Electric Vehicles (EVs): Transforming World Mobility at Electrifying Pace

سجل بريدك الالكتروني للحصول على احدث المقالات والتقارير

- EV sales have been rising in the past few years driven by strong policy support across various countries to decarbonize mobility

- European countries lead the pack with greater share of electric car sales in total car sales, driven by strong policy impetus.

- Global penetration of electric cars in total car sales is expected to rise from ~9% in 2021 to above 20%. by 2030.

- Financial markets have amply rewarded EV makers and battery stocks leading to huge jump in their valuations.

- Investors need to be cautious in vetting opportunities for EV investments with respect to soundness of business models and use of proven technology.

Electric Vehicles as Key Enablers to Decarbonize Transportation

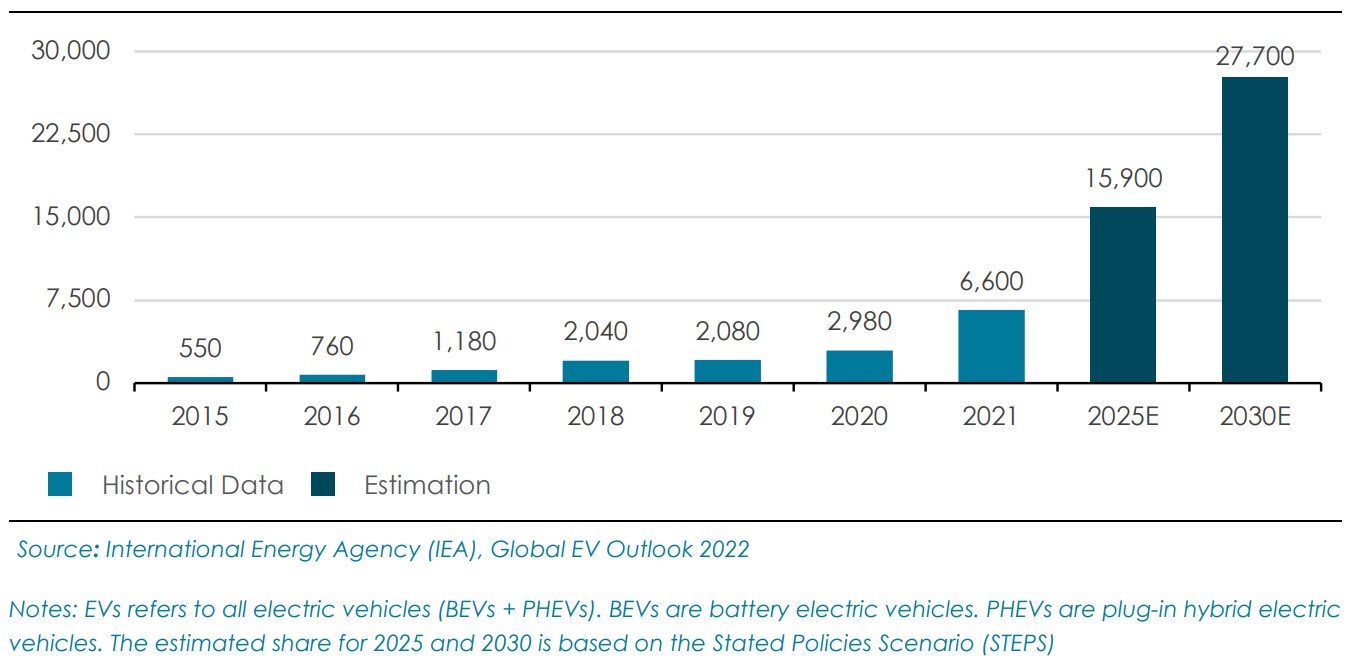

Globally, the transportation sector contributes to around a fifth of greenhouse gas (GHG) emissions with road transportation accounting for about 75% of this share. Amid growing concerns over climate change especially in the past decade, various countries have instituted ambitious policy initiatives and incentives to decarbonize transportation via electrification of mobility. In response to this, the global EV sales have been rising persistently. To put this in perspective, the global EV car sales has jumped from 120,000 units in 2012 to 6.6 million units in 2021, with annual sales having tripled since 2019.

The EVs have faced a slew of barriers to adoption in the past – high purchase costs due to higher battery pack costs, limited driving range, inadequate charging infrastructure and lengthy charging time. In the past decade, there has been huge improvement in the battery performance and significant reduction in the battery cost, which has vastly improved the value proposition of EVs. Despite this, EVs are stil not cost competitive as compared to the conventional vehicles. Furthermore, inadequate charging infrastructure. in most countries creates a significant barrier to adoption. As per a recent Bloomberg (BNEF) report, there were only 2.7 million public charging points globally in 2022, which must increase to 59 million by 2040 to. be on track for 2050 net-zero emissions.

According to 2022 EY Mobility Consumer Index study, about 52% of car buyers prefer an EV for their next purchase, a significant rise compared to 2020 when 30% of buyers were interested in purchasing EV. The International Energy Agency (IEA) forecasts the global electric car sales to increase from nearly 6.6 million. units in 2021 to ~28 million units in 2030, registering a four-fold rise over the nine-year period.

EV Car Sales in World (in thousands)

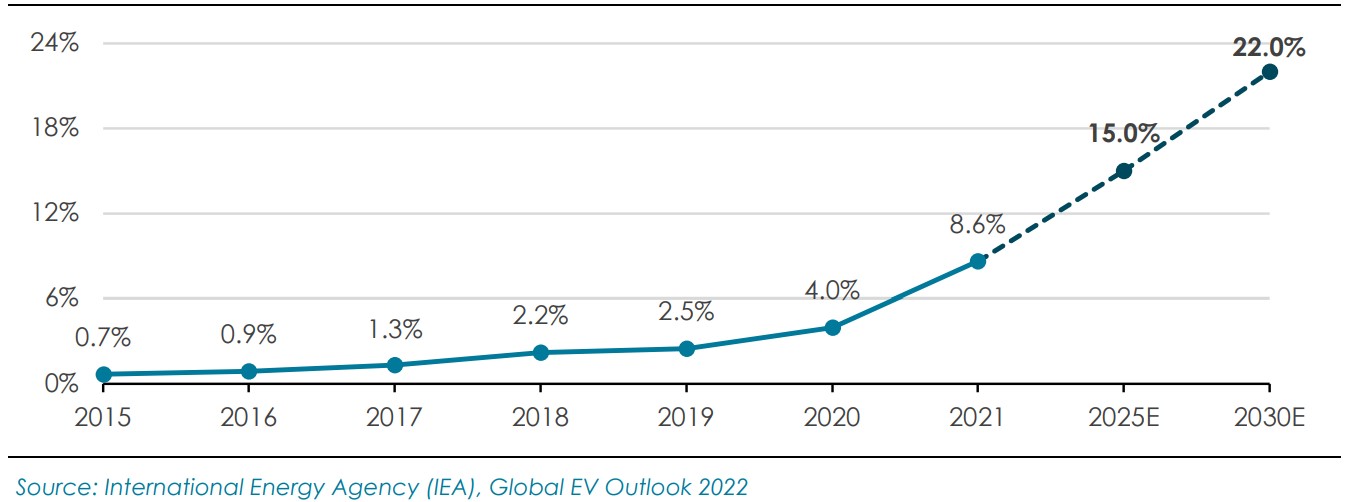

According to International Energy Agency (IEA), the public spending on subsidies and incentives almost doubled in 2021 to USD 30 billion. Electric cars accounted for about 9% of global car sales in 2021, compared to their share of below 2% in 2017. The IEA’s Stated Policies Scenario (STEPS), which considers stated current EV policy plans of various countries, forecasts share of EV cars to reach over 20% of car sales in 2030, raising the global stock 11-fold from today’s levels to 200 million vehicles.

Share of Electric Vehicles (EV) in Total Car Sales (%)

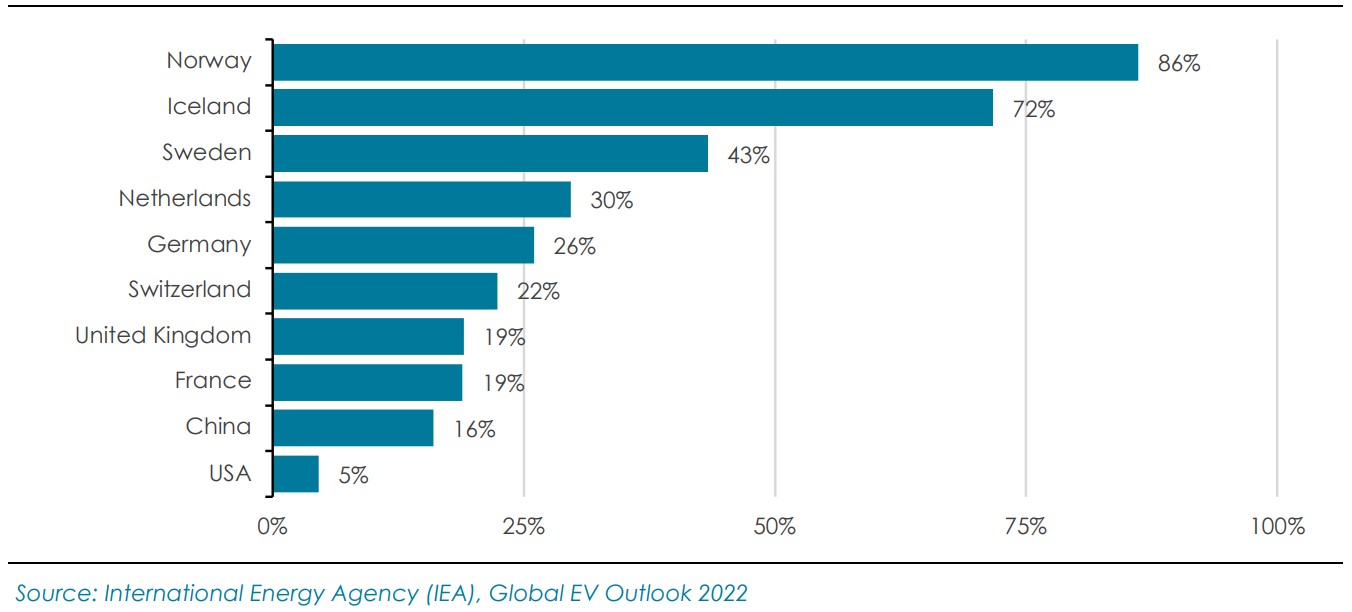

Electric Car Sales Penetration Varies Significantly by Country/Region

European countries count among heavy users of electric cars with highest market share in terms of new electric car sales, which is particularly underpinned by tightening CO2 emissions implemented in 2020 and 2021. Notably, Norway and Iceland each registered electric car sales market share of above 70% in 2021. Overall, the share of electric cars stood at 17% of Europe’s auto sales in 2021. Outside Europe, China remains the second largest adopter of electric cars with about 16% share in total car sales. This is followed by United States with a share of 4.5% in 2021.

Share of EV Cars Sales in Total Car Sales (2021)

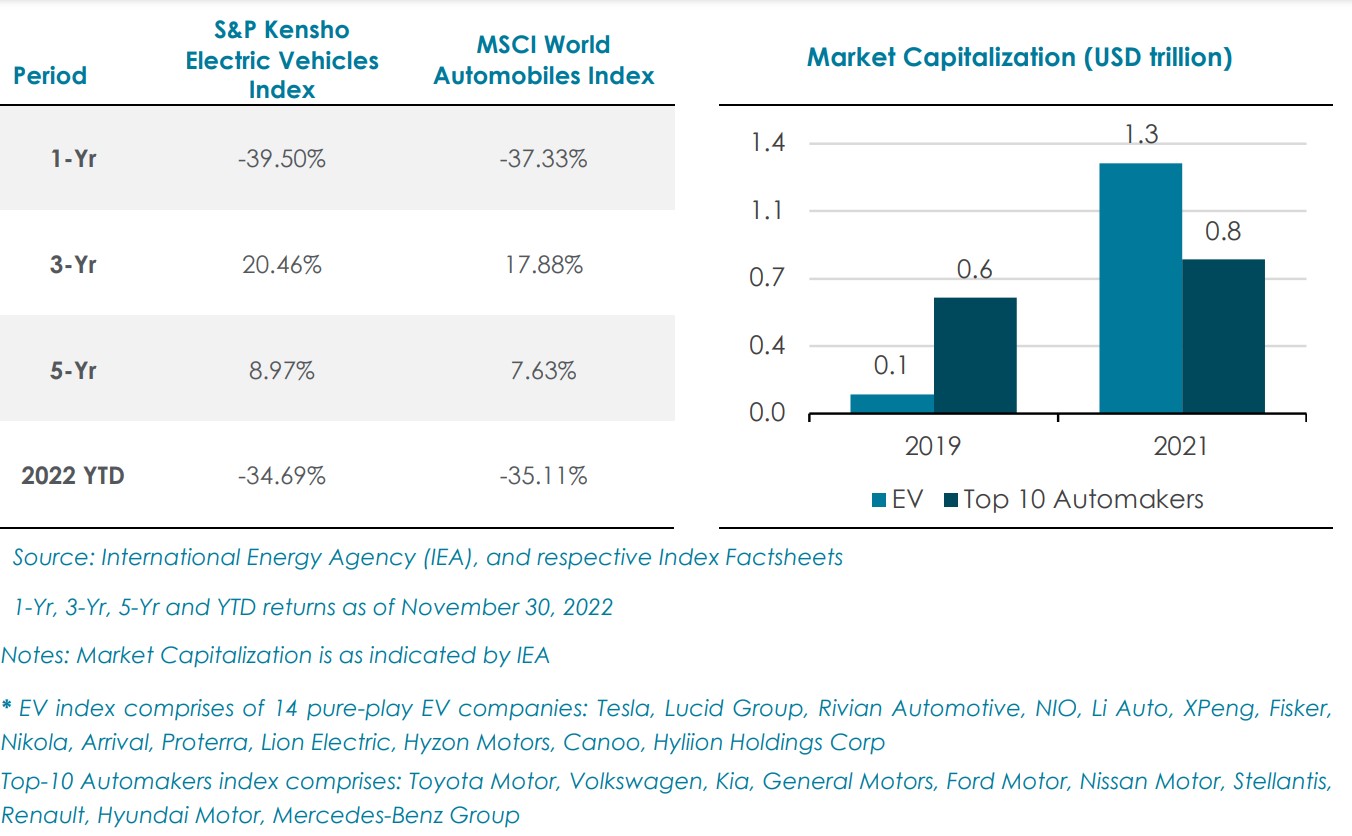

EV-related Firms Outperform Incumbent Automakers

The S&P Kensho Electric Vehicles index, designed to reflect the performance of companies involved in the electric vehicle sector and the ecosystems supporting it, has handily outperformed MSCI World Automobiles index over the past few years. This is also evident in the significant increase in the market capitalization of EV companies, indicating financial markets have liberally rewarded EV and battery companies. The aggregate market capitalization of EV index* was 13% of the total market cap of top-ten automobile companies at the end of 2019. Interestingly, the tables had turned by the end of 2021 with aggregate market capitalization of EV index 60% higher than that of top-ten automakers combined.

Outlook

The continued surge in EV car sales and the rising EV penetration confirms that incentives and policy changes to drive zero-emission EV adoption are starting to pay off. The strong policy support by various countries coupled with growth in EV charging network and the larger electrified model range available to consumers, is expected to drive EV sales in 2023 and thereafter. However, it would be crucial to build up charging infrastructure to sufficiently cater to the accelerated EV rollouts. Besides, it would be a huge deterrent to pull back policy support under the contention that the transition to EVs will proceed fast enough to stabilize the climate. To the contrary, the success of EVs hitherto is even more a reason for countries to continue with their incentives and policy support.

Market leadership in the auto sector is going to be scrambled, as incumbent players are forced to adapt or lose share, and new players emerge. Tesla, which debuted its first electric car more than a decade ago, has emerged as global leader in electric car sales ahead of traditional automakers. Though most of autorelated investments are in legacy automakers and established auto parts suppliers, the tremendous buzz surrounding EVs has resulted in the sector attracting big-ticket investments to the tune of billions of dollars. However, investors need to thoroughly vet investment opportunities and exercise due prudence, especially when considering ‘pre-revenue’ EV companies with untested business technologies or business models.

DISCLAIMER

This document is strictly private, confidential and personal to its recipients and should not be copied, distributed or reproduced in whole or in part, nor passed to any third party.

The information provided in this report is for general guidance and information purposes only. Under no circumstances the information contained in the report is to be used or considered as a formal financial, investment advice or any other advice, or an offer or solicitation of an offer to buy or sell, or as recommendation or endorsement of any security or other form of financial asset. The report is not to be. considered as investment research or an objective or independent explanation of the matters contained herein.

The information in the report is obtained from various sources per dating of the report. Sidra Capital have taken reasonable care to ensure that the material information contained herein is in accordance with the facts and contains no omission likely to affect its understanding.

Sidra Capital makes no representations or warranties whatsoever, as to the accuracy or completeness of this report and Sidra Capital expressly disclaims any liability of whatever nature whether (direct or indirect), or responsibility for the accuracy of the information contained in the report.

The information contained herein may be subject to changes without prior notice. Sidra Capital does not accept any form of liability, neither legally nor financially, for loss (direct or indirect) caused by the understanding and/or use of this report or its content. This report is only intended for the recipients, and should not be copied or otherwise distributed, in whole or in part, to any other person without the prior written approval of Sidra Capital.