Impact of EVs on Commodities Market Report

سجل بريدك الالكتروني للحصول على احدث المقالات والتقارير

Key Highlights

- The surge in demand for Electric vehicles (EVs) means demand for the key commodities that go into batteries and EVs is also expected to rise.

- An electric car requires six times more minerals than a conventional car, leading to increased demand for critical battery minerals like lithium, nickel, graphite, and cobalt.

- The unprecedented EV demand and supply chain disruptions due to Russia-Ukraine war resulted in huge increase in prices of critical minerals during the first half of 2022. However, prices declined in the subsequent quarters on account of uncertain economic prospects.

- One pressing concern for EV adoption is the question of supply of critical minerals matching the future demand as there is geographical concentration of supply, long lead times in mining production, and environmental/social vulnerabilities in the procurement.

- The widespread EV adoption is predicated on stakeholders’ taking necessary steps, making substantial investments in securing adequate supply of critical minerals and ensuring their price stability.

Boom in EVs to have Implications on Demand for Key Commodities

The Paris Agreement sets a long-term goal of reducing the global temperature rise to well below 2 degrees Celsius and achieving climate neutrality by reducing greenhouse gas (GHG) emissions. This goal is set in motion by decarbonizing mobility and shifting to clean energy transitions. As the transportation sector contributes around one-fifth of GHG emissions, with road transportation accounting for about 75% of this share, various countries have instituted ambitious policy initiatives and incentives to electrify the road ahead. This shift to cleaner energy is set to drive a huge increase in the requirement for the ‘commodities of the future’ – minerals used to manufacture EVs, batteries, and renewable infrastructure.

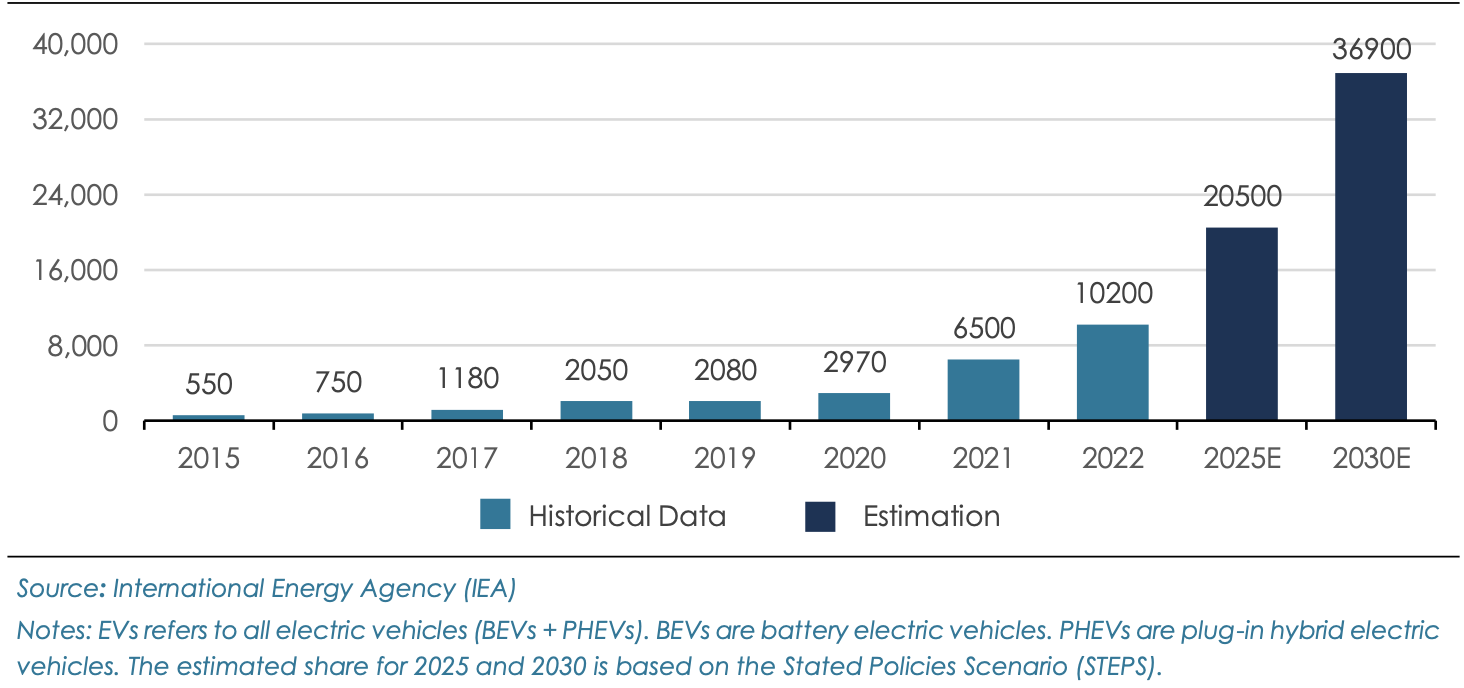

Global EV Car Sales (in thousands)

EV sales have been surging in recent years driven by concerns over climate change and strong policy impetus to decarbonize the mobility sector. According to the International Energy Agency (IEA), the global EV car sales jumped from about 120,000 units in 2012 to a milestone of 10 million units in 2022 and are estimated to reach ~37 million units in 2030. An EV calls for the use of the commodities comprising a slew of critical minerals such as lithium, nickel, copper, manganese, etc. The acceleration toward EVs will lead to humongous increase in demand, necessitating adequate supply of these key commodities.

Higher Usage of Critical Minerals in EV Cars

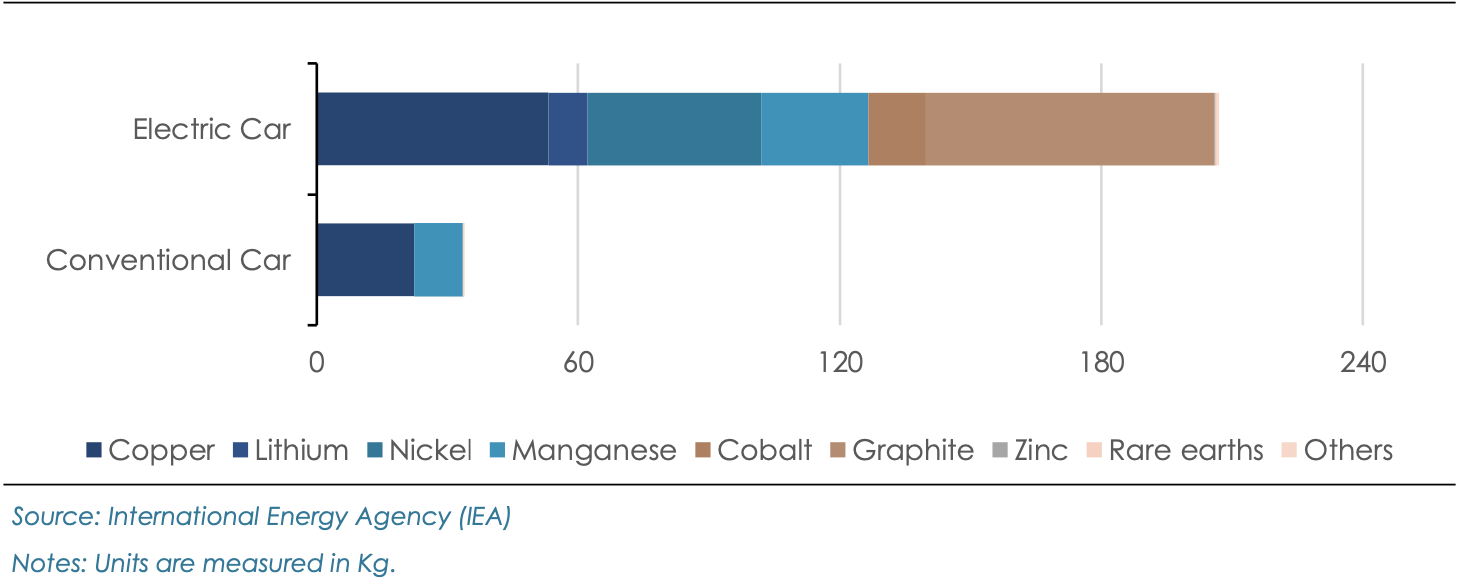

Minerals Used in Electric Cars Compared to Conventional Cars

According to IEA, a typical electric car uses six times more minerals than a conventional car. Conventional cars mainly use copper and manganese, while electric cars rely on critical minerals such as lithium, nickel, cobalt, graphite, copper, and manganese for their performance, longevity, and energy density. Rare earth elements are crucial for the permanent magnets that are essential for EV motors. Estimates from IEA show that EVs and battery storage have already ousted consumer electronics to become the largest consumer of lithium. They are also poised to overtake from stainless steel as the largest end-users of nickel by 2040.

Dramatic Rise in Prices of Key Battery Metals Pose a Significant Challenge

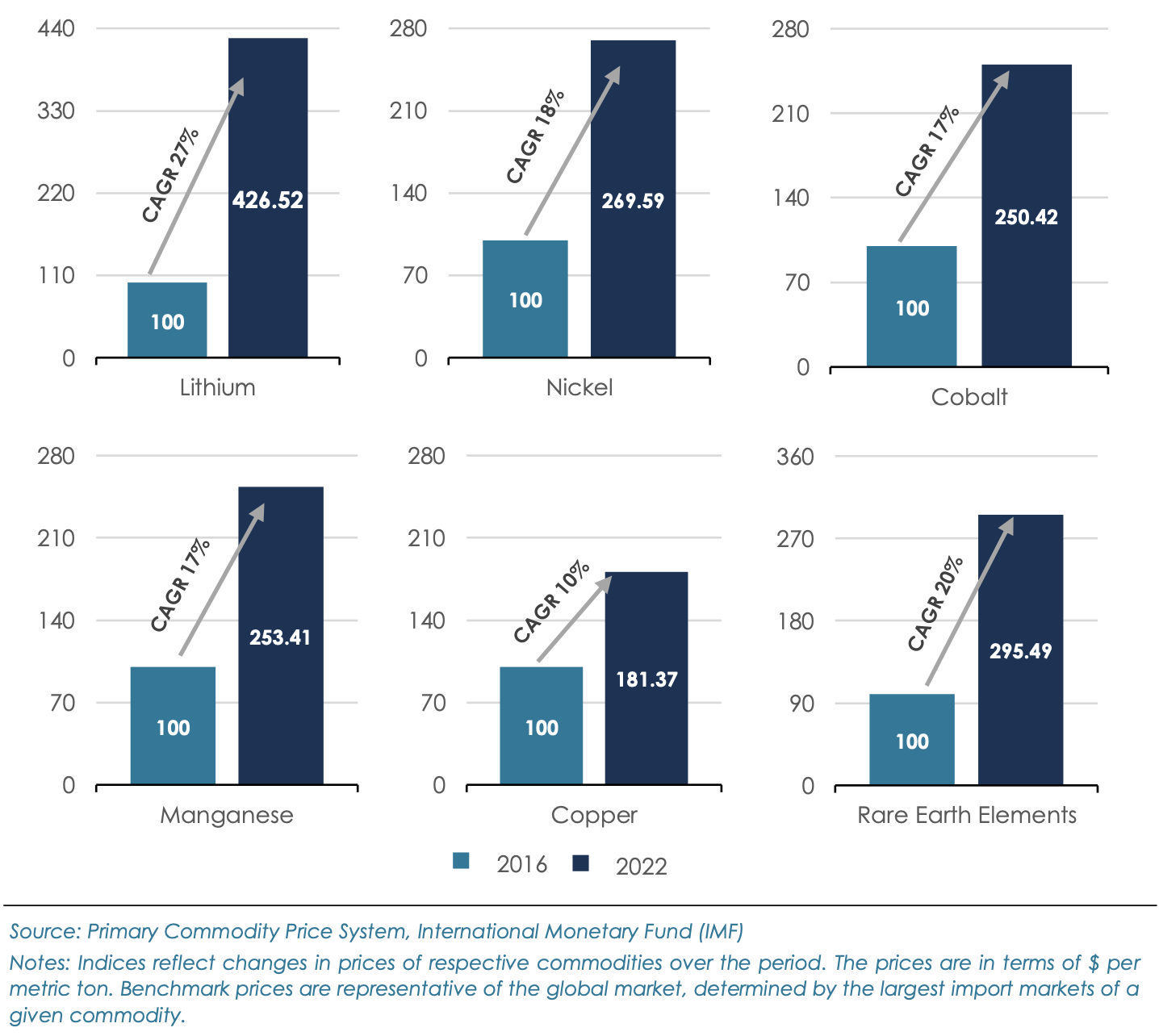

Metals Price Indices CAGR Growth (2016-2022)

The prices of metals surged in early 2022 due to the unprecedented rise in EV sales and concerns over supply chain disruptions amid Russia-Ukraine war. For instance, in March 2022, nickel prices surged to a record high of more than $100,000 per tonne causing the reputed London Metal Exchange (LME) to halt trading nickel. This was reflective of market’s concern that Russia is the world’s largest supplier of Class 1 battery grade nickel. As of early 2023, lithium prices were six times higher than their average over the 2015- 2020 period. According to the International Monetary Fund’s commodity prices index, the lithium price index has grown at the highest pace registering CAGR of 27% from 2016 to 2022, followed by annualized price growth of 18% for nickel and 17% for both cobalt and manganese. The IEA warns of the potential implications of the rise in raw material costs in the long-term. For instance, a doubling of lithium or nickel prices would lead to a 6% rise in battery costs, offsetting much of the anticipated unit cost reductions associated with significant scale up of battey production capacity. However, the prices of critical minerals 9.3x are expected to see a huge rise going ahead considering the anticipated future demand for EVs and batteries.

Surge in Demand of Critical Minerals in EVs to Rise Multifold

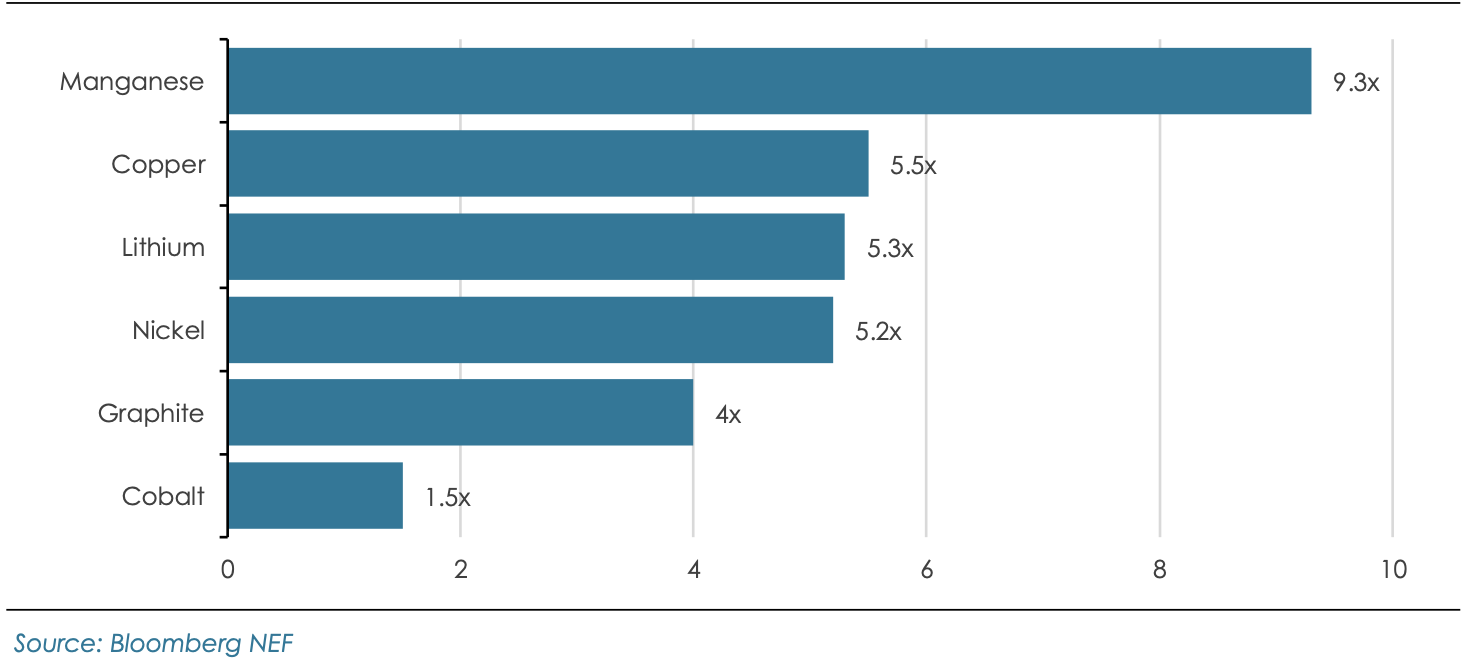

Demand Growth of Critical Minerals by 2030 (in times compared to 2021)

EV makers will consume a rising share of the world’s lithium, nickel, manganese, and other minerals needed to make batteries as EV sales are expected to surge. In 2022, EV batteries accounted for about 60% of lithium demand, 30% of cobalt, and 10% of nickel (per IEA). Bloomberg NEF forecasts the demand for manganese will increase over ninefold between 2021 and 2030, while demand for copper, lithium, and nickel demand will increase fivefold over the same period. The trend of battery chemistries towards lower cobalt usage is curbing the demand for cobalt while the demand for nickel is growing. These demand fluctuations rely on the uncertainty around the stringency of climate policies. According to IEA, the demand for minerals used in EVs and battery storage grows about ten times in the Stated Policies Scenario (STEPS) and nearly 30 times in the Sustainable Development Scenario (SDS) by 2040. As an essential component of battery chemistries, lithium is expected to record the fastest growth, with demand increasing over 40 times in the SDS by 2040, followed by graphite, cobalt and nickel growing around 20 times. In terms of weight, copper and graphite dominate mineral demand, followed by nickel.

Rising EV Sales Challenge Adequate Supply of Critical Minerals

The rapid rise in demand for the critical minerals used in EV batteries and other EV infrastructure will exert upward pressure on the adequate supply as the world progresses towards its net-zero ambitions. However, the current mineral supply and investment strategies are inefficient and pose a risk of delayed or more expensive energy transitions. The supply of critical minerals faces several bottlenecks, including the high geographical concentration of production, long-lead times for mining projects, and environmental and social concerns associated with production. More than half of the supply of lithium, nickel, and cobalt comes from the top three producing nations. For instance, Australia and Chile accounts for about 70% of global lithium and the Democratic Republic of the Congo (DRC) supplies over 70% of world’s cobalt. Similarly, Indonesia is the world’s largest producer of nickel accounting for about 40% of global production and an important source of cobalt and copper. According to an estimate by the International Energy Agency (IEA), mining projects require over 16 years to deliver their initial production, highlighting the pressing need for channeling required investments in the mining of critical minerals to ensure their sufficient availability in the medium- to long-term. This will be key to meeting the surging demand for EVs, avoiding prolonged periods of market tightness, and mitigating price volatility.

EV Stakeholders’ Intensifying their Efforts in Securing Mineral Inputs

The diversification of supply chains in procuring critical minerals will be crucial in paving the way for a greener future. The governments and private players are making considerable investments in the critical minerals supply chain to meet the future challenges regarding adequate availability. Governments around the world are attempting to diversify their supply chains and reduce their reliance on China for EV batteries. For instance, the Inflation Reduction Act (IRA) passed in the US, along with recent agreements between the US and the European Union, as well as the US and Japan, represent Washington’s efforts to strengthen and diversify their supply chain. According to the International Council on Clean Transportation, the Indonesian government has signed deals worth over US$15 billion with international companies for nickel mining, refining, and battery manufacturing in the last three years. In their drive to ensure sufficient availability of critical minerals, some of the leading Auto OEMs (original equipment manufacturers) have entered partnerships and joint ventures with mining companies to secure critical minerals. Recently, General Motors invested $650 million to build a lithium mine in Nevada, and Tesla broke ground on a metal refinery in Texas. These actions highlight the OEMs’ concerns and mitigation efforts about controlling their supply chain and ensuring their market competitiveness.

Evolving Battery Chemistries to Determine the Demand Mix of Critical Minerals

The evolution of battery chemistries will determine the demand trajectories for critical minerals given their long lead times. Currently, lithium-ion batteries for EVs are categorised into two types: nickel-based (such as nickel manganese cobalt oxide [NMC] and nickel cobalt aluminium oxide [NCA]) and lithium iron phosphate (LFP) batteries. In 2022, NMC remained the dominant battery chemistry with a market share of 60%, followed by LFP and NCA with a share of nearly 30% and 8%, respectively. Due to the lower cost, there has been a major uptake of LFP battery chemistry over the last few years especially in China. The future of battery chemistries is not predetermined, but sustained higher prices of commodities could lead to a development of new chemistries that rely on less critical minerals such as the manganese-rich cathode chemistry (lithium nickel manganese oxide [LNMO]) and even alternative lithium-free battery chemistries, such as sodium-ion batteries.

Outlook

While policy measures by various governments’ and the overall rise in EV adoption thus far is laudable, the lack of sufficient availability of critical minerals may become a big impediment to a greener future. According to current projections of supply, some critical minerals are expected to reach deficits by 2030. Besides, price volatility of critical minerals could severely thwart the outlook for EV adoption as it is partly predicated on anticipated reduction in battery costs in the future.

Some countries with biggest EV sales currently, such as the Germany and the United States, are also the countries with most vulnerable supply chains owing to their heavy reliance on imports for EV batteries and critical minerals. To keep up with the growing demand of critical minerals, it is imperative for EV stakeholders to make adequate investments in the mining of key materials. It is only with the right prioritisations on securing key raw materials availability and price stability that the world can accelerate into an EV future.