KSA Housing: Strong Fundamentals Led by Vibrant Economy and Govt’s Transformational Projects

سجل بريدك الالكتروني للحصول على احدث المقالات والتقارير

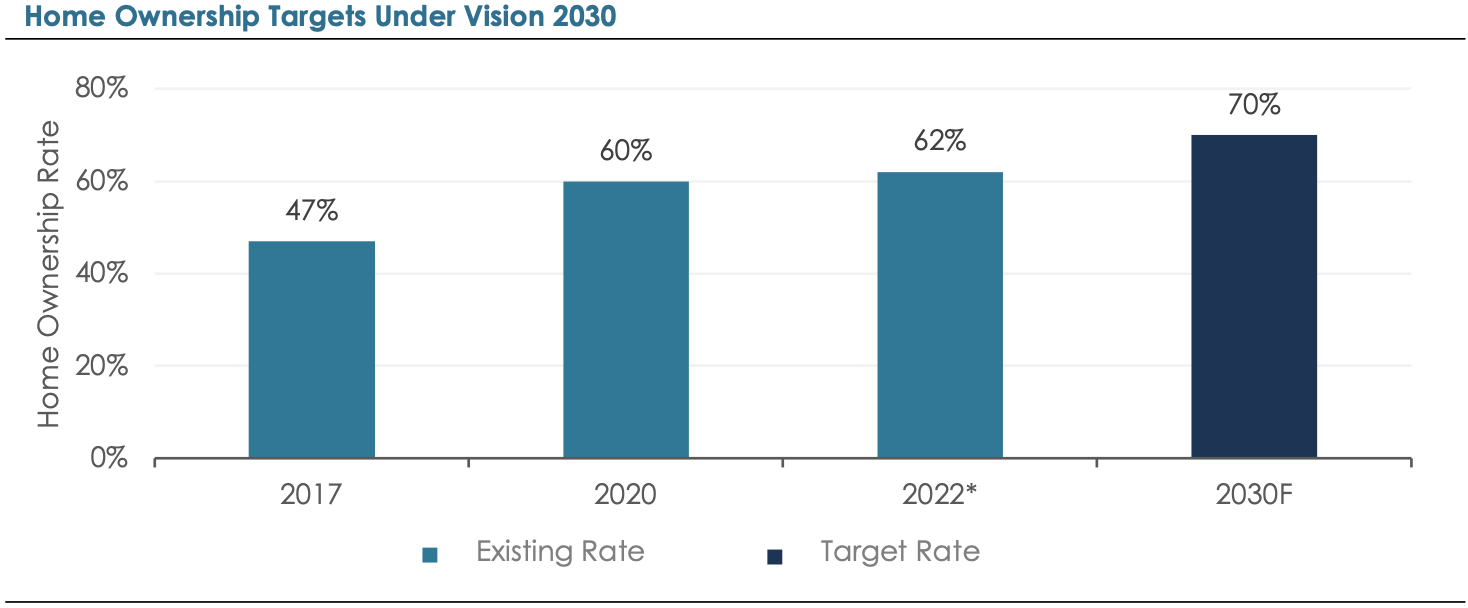

- The KSA government’s strong impetus to develop residential sector has helped in raising the home ownership rate from 47% in 2017 to ~62% in Q3 2022

- The implementation of conducive measures under Vision 2030 such as Sakani program and improved accessibility to financing have boosted home ownership rates

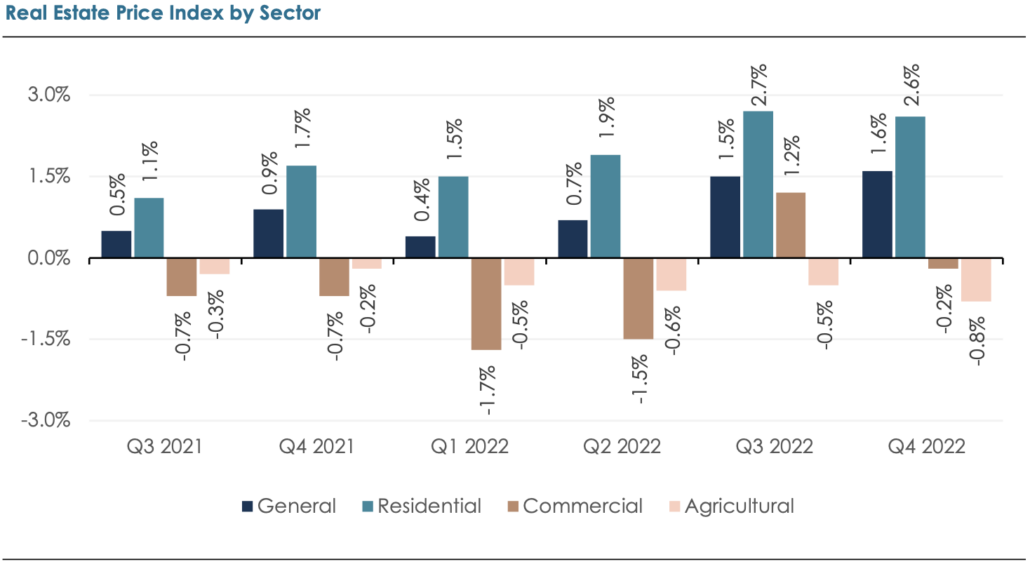

- Residential real estate was the only sector registering positive price growth in 2022, compared to decline for commercial and agricultural sector

- Surge in interest rates, rise in development costs and the lack of suitable supply for lower and middle- income segment led to tepid demand, resulting in decline in residential real estate transactions during 2022

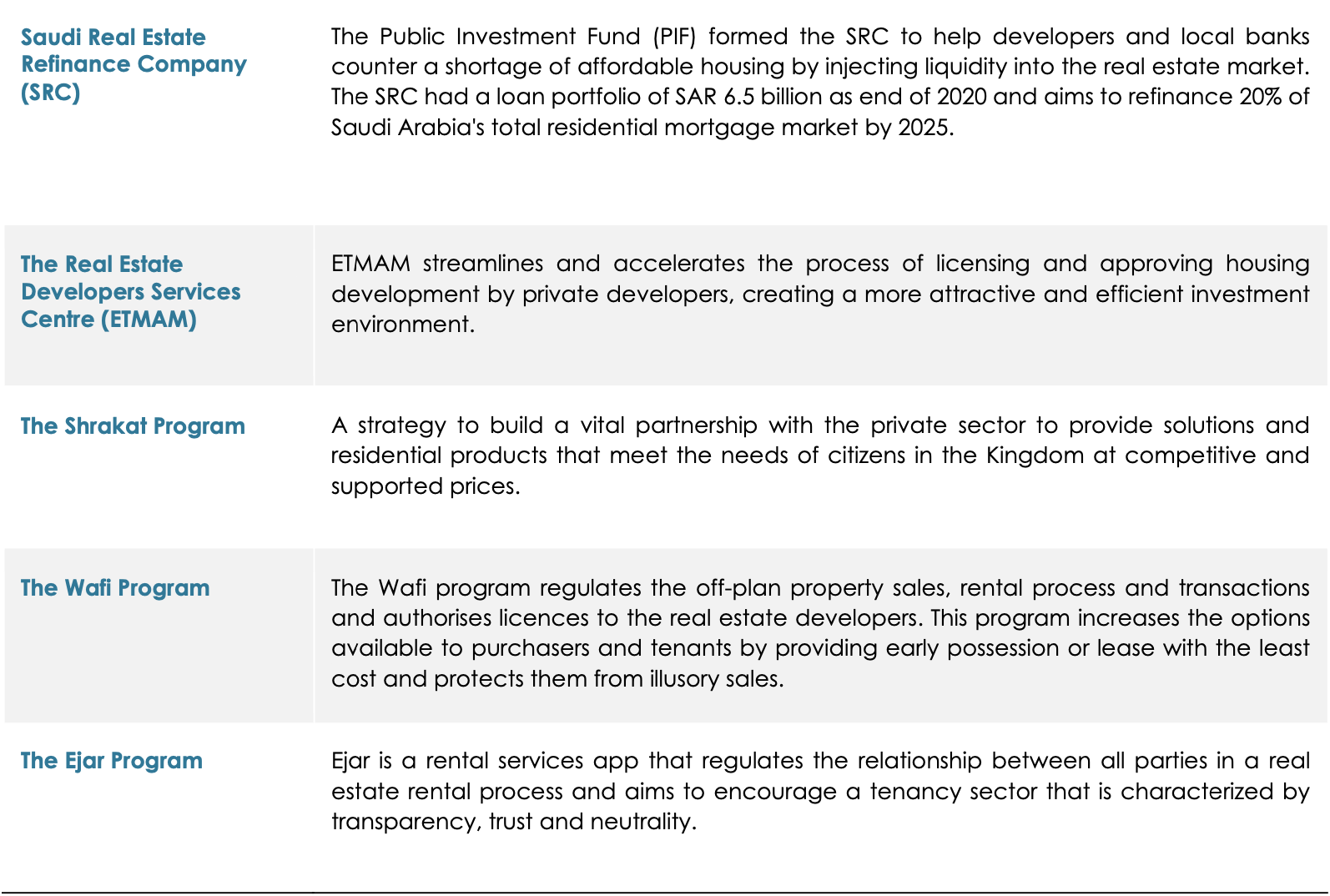

- The prospects for residential sector remain buoyant driven by increasing demand for housing and apt implementation of several giga and mega projects by the government catering to the socioeconomic transformation underway

Strong Economic Momentum, Demographic Trends and Slew of Initiatives Under Vision 2030 Bode Well for the Kingdom’s Housing Market

Saudi Arabia, one of the fastest growing economies among G20 countries, witnessed a strong GDP growth of 8.7% in 2022. This increase in GDP was a result of the upsurge in the oil activities by 15.4% and the non-oil activities by 5.4%. The Real Estate sector is one of the crucial elements in the KSA economy – contributed around 7% to the GDP and generated about 40,000 jobs in 2021. Saudi Arabia’s non-oil private sector PMI rose from 56.9 in December to 58.2 points in January 2023, recording 29th straight month of expansion in the non-oil private sector economy. The Kingdom has raised its fiscal surplus estimates for 2022 and 2023, reflecting confidence in its economic reform program that has been bolstered by higher oil prices. It’s worth mentioning that the Kingdom’s government has implemented several initiatives and reforms, in line with Vision 2030 framework, to transform the country’s housing sector. A key goal is to raise the home ownership rates from 60% in 2020 to 70% by 2030. About $1 trillion of real estate and infrastructure developments are underway and at least eight new cities are being planned. These initiatives along with favorable demographic factors, would transform the Saudi Arabia’s residential real estate landscape.

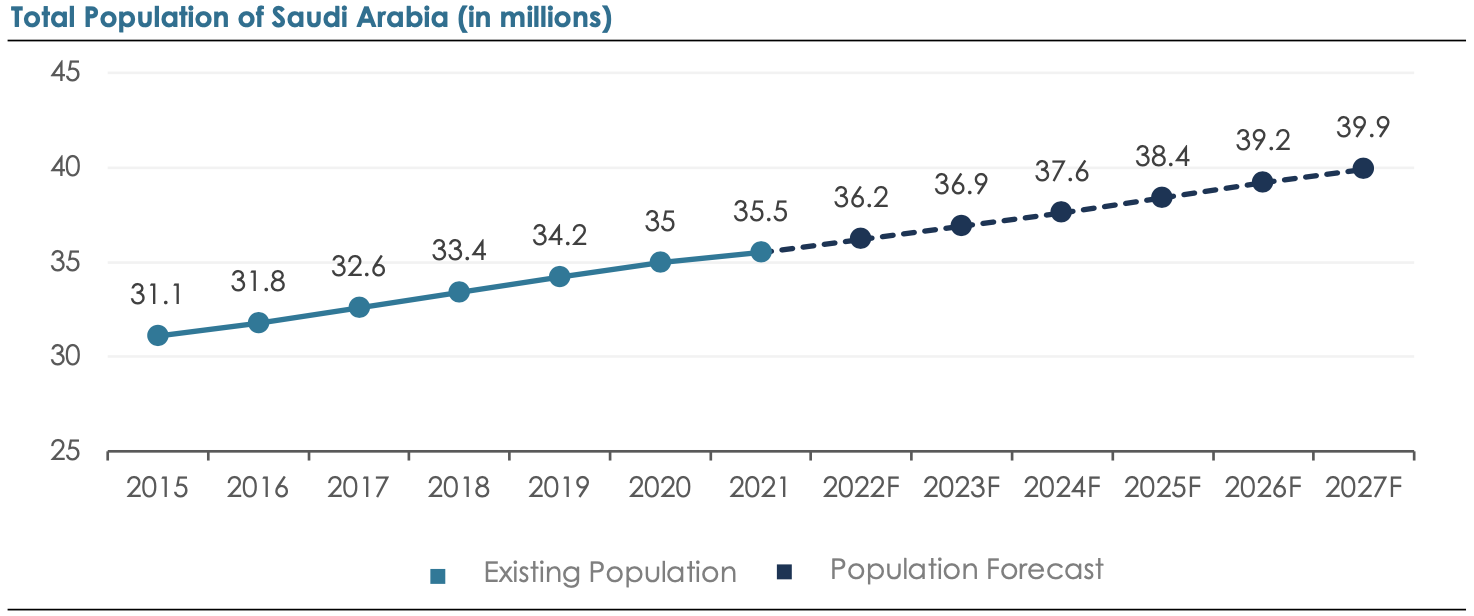

The Kingdom of Saudi Arabia accounts for over 50% of the total population of the GCC and is the most populous country across the GCC. According to IMF forecasts, the Kingdom’s population is estimated to grow at a CAGR of about 2.0% between 2020 to 2027 to reach ~40 million. A large and growing population would result in rise in the number of households, fueling significant surge in demand for housing units.

Residential Real Estate Has Outperformed Other Sectors

According to General Authority for Statistics (GASTAT) data, the residential real estate price index increased by 2.6% YoY in the fourth quarter of 2022, compared to a decline of 0.2% and 0.8% for the commercial and agricultural sector indices, respectively. During 2022, the average prices in the residential sector grew 2.1% YoY, while the commercial and agricultural sector declined 0.9% and 0.6% respectively. Residential real estate price index grew particularly high in the second half of 2022, with an increase of 2.74% in Q3 and 2.63% in Q4. Among residential property types, plots grew 2.67%, followed by apartments, villas, buildings and houses with 2.21%, 1.70%, 0.05% and -0.43% respectively.

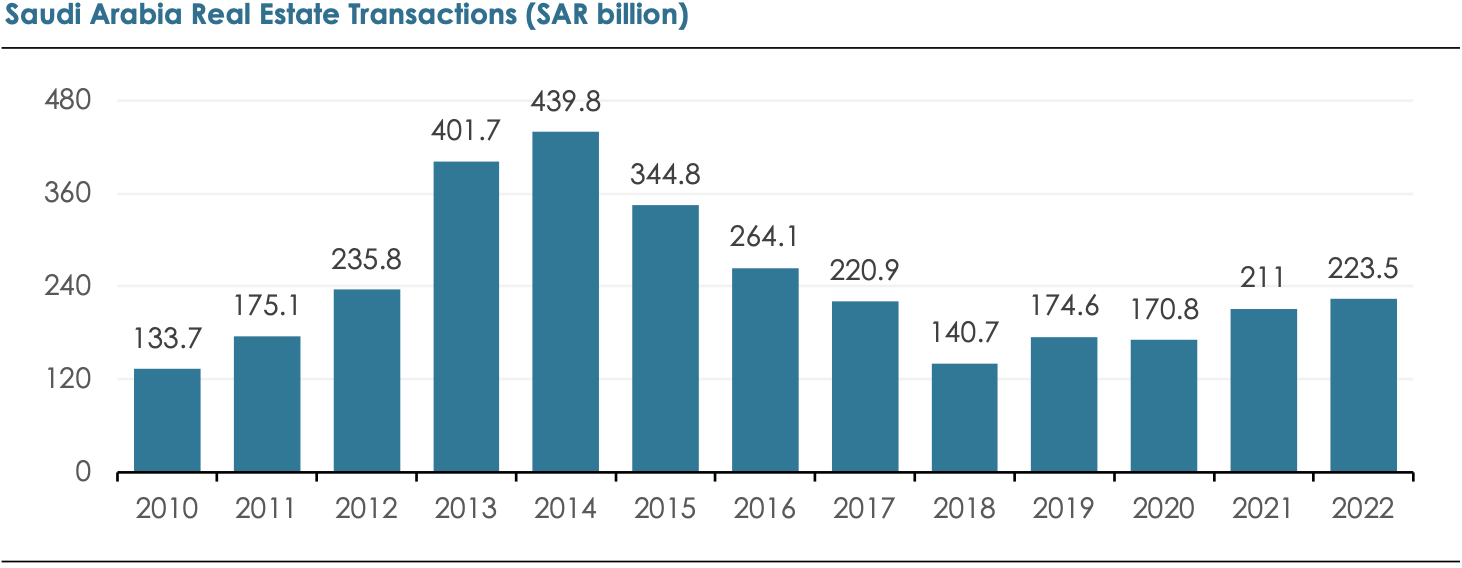

2022 Witnessed Continued Momentum in Overall Real Estate Transactions

The value of Kingdom’s real estate transactions rose 6% YoY, or SAR 12.5 billion, to SAR 223.5 billion in 2022, as per Ministry of Justice data. Of the total real estate deals registered in 2022, land sale transactions accounted for the major chunk at nearly 87%, or ~SAR 194 billion, followed by apartments valued at ~SAR 19 billion. The value of real estate deals registered in 2022 was the highest in last six years. Riyadh represented 40% of total real estate deal values, while Jeddah represented only 18%. Notably, the value of real estate deals retreated in the second half of 2022, with July deal value declining by 24% YoY.

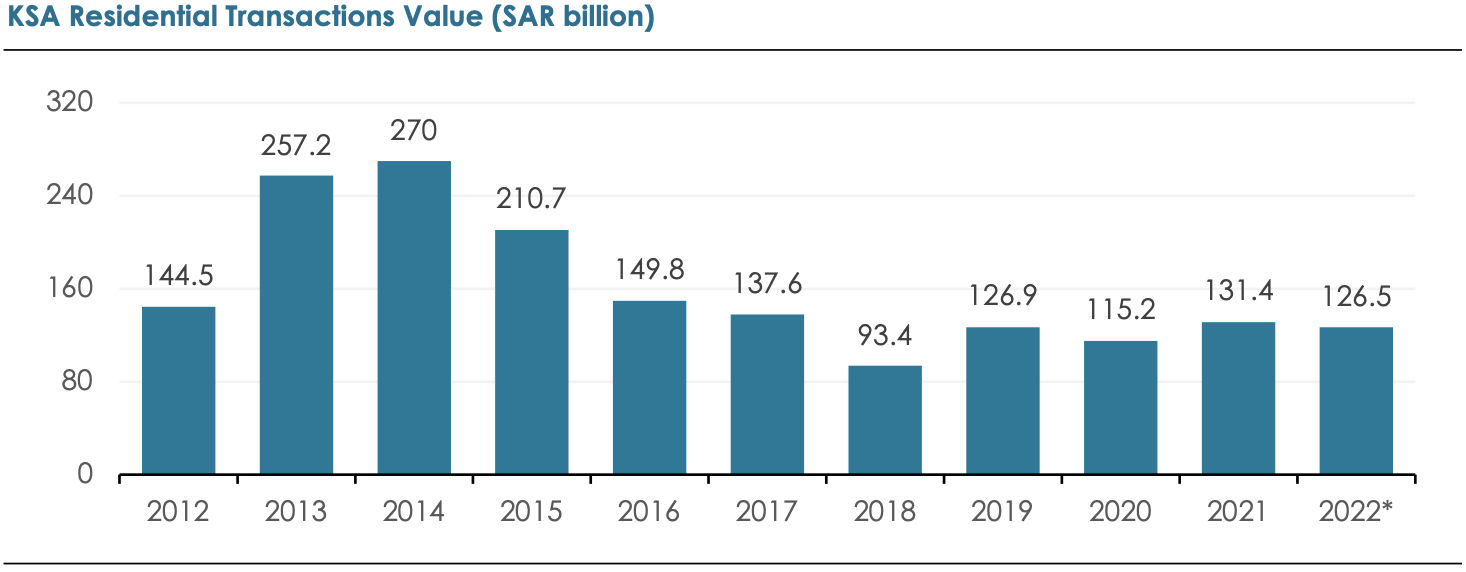

Though Value of Residential Transactions Dropped Slightly in 2022

The total value of residential real estate transactions during 2022 declined marginally by 3.7% YoY to SAR 126.5 billion. Yet, the decline in the total number of residential transactions was considerably higher, falling by 24.5% YoY during 2022 to 175,067. The marked jump in interest rates and rise in development costs resulted in housing demand remaining relatively steady in 2022. On a regional level, transaction volumes fell across the three major regions during 2022 – Riyadh, Jeddah and Dammam – with volumes decreasing by 33.9%, 16.2% and 20.9%, respectively, according to CBRE. Besides, the rising affordability concerns combined with a lack of suitable supply for middle and lower-income segment also added to the decline in sales activity. For instance, villas in Jeddah can cost about 12 times the average annual earnings, while in Riyadh it is closer to 8.5 times.

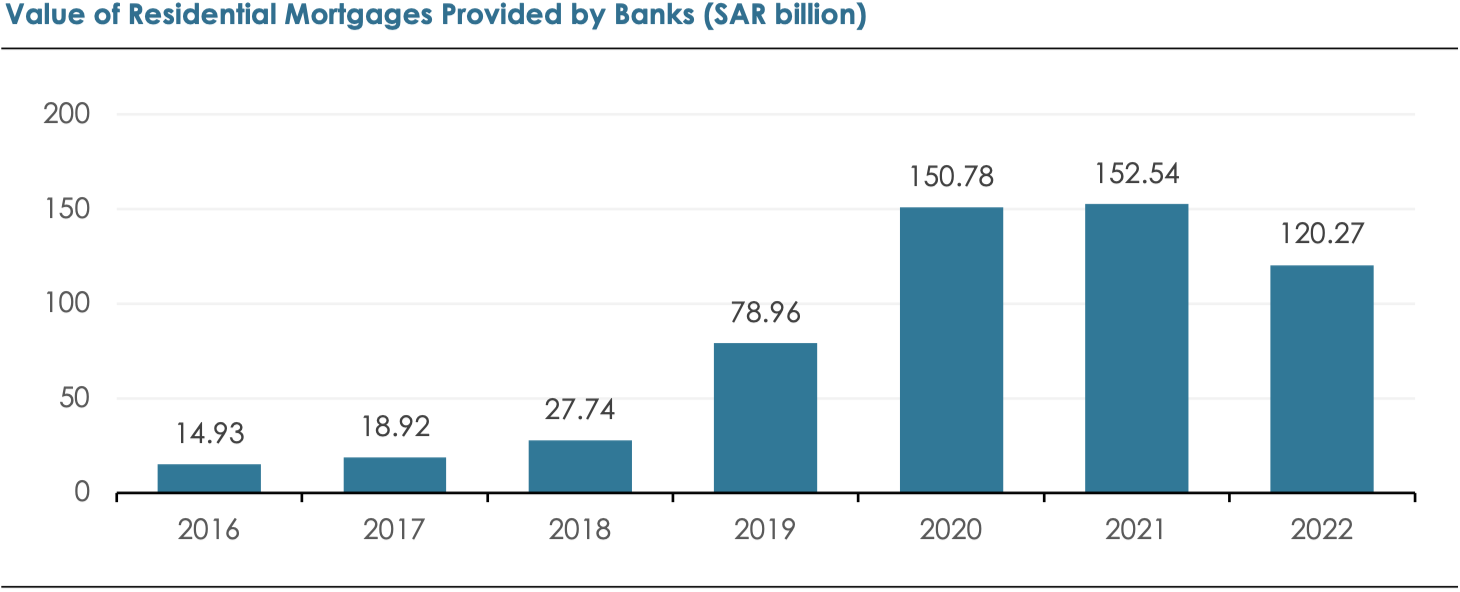

Volume of Mortgage Contracts Mirrored the Decline in Residential Transactions

For the same period, the total number of mortgage contracts issued by banks declined to 154,392 in 2022, a decline of 23.4% (YoY). The total value of these contracts added up to SAR 120.27 billion. Among the property types, houses continue to dominate the list with 83.97 billion constituting for nearly 70% share. Apartments and land mortgages follow with the value of 27.24 billion and 9.06 billion with the shares of 22.65% and 7.5% respectively (as per SAMA). Even though, the mortgage contracts are lower than in 2020 and 2021, the figures are way above the pre-pandemic levels, considering both the number of contracts and the size of the loan value. This is a strong indicator reflecting the enabled access to home financing through the continued efforts of the government of Saudi Arabia like raising the maximum loan-to-value ratio, licensing the Saudi Real Estate Refinance Company (SRC) to inject liquidity into the market and the Sakani program.

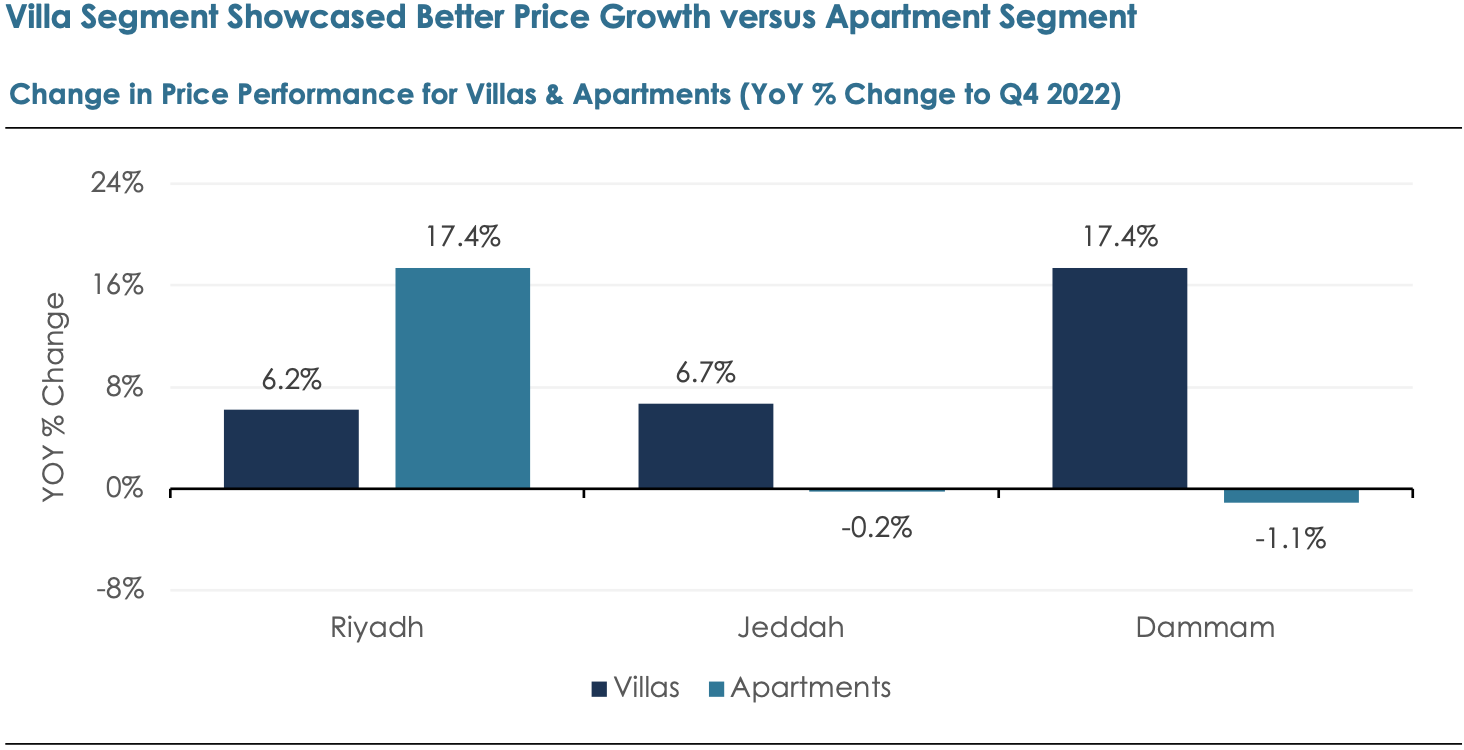

Villa Segment Showcased Better Price Growth versus Apartment Segment

In terms of price performance within the residential sector, villas have performed better than the apartments. According to CBRE, the average villa prices in Riyadh, Jeddah and Dammam rose by 6.2%, 6.7% and 17.4% in 2022, respectively. The apartment segment displayed fragmented performance over various regions. For instance, the apartments in Riyadh saw a price increase of 17.4%, while the prices in Jeddah and Dammam contracted by 0.2% and 1.1%, respectively. The influx of Saudi youths and expats to take advantage of the capital city’s buoyant labour market adds up to the price hike in Riyadh, especially for apartments. In Jeddah and Dammam, people increasingly prefer villas over apartments which leads to the sustained demand and comparatively higher price rise for villas.

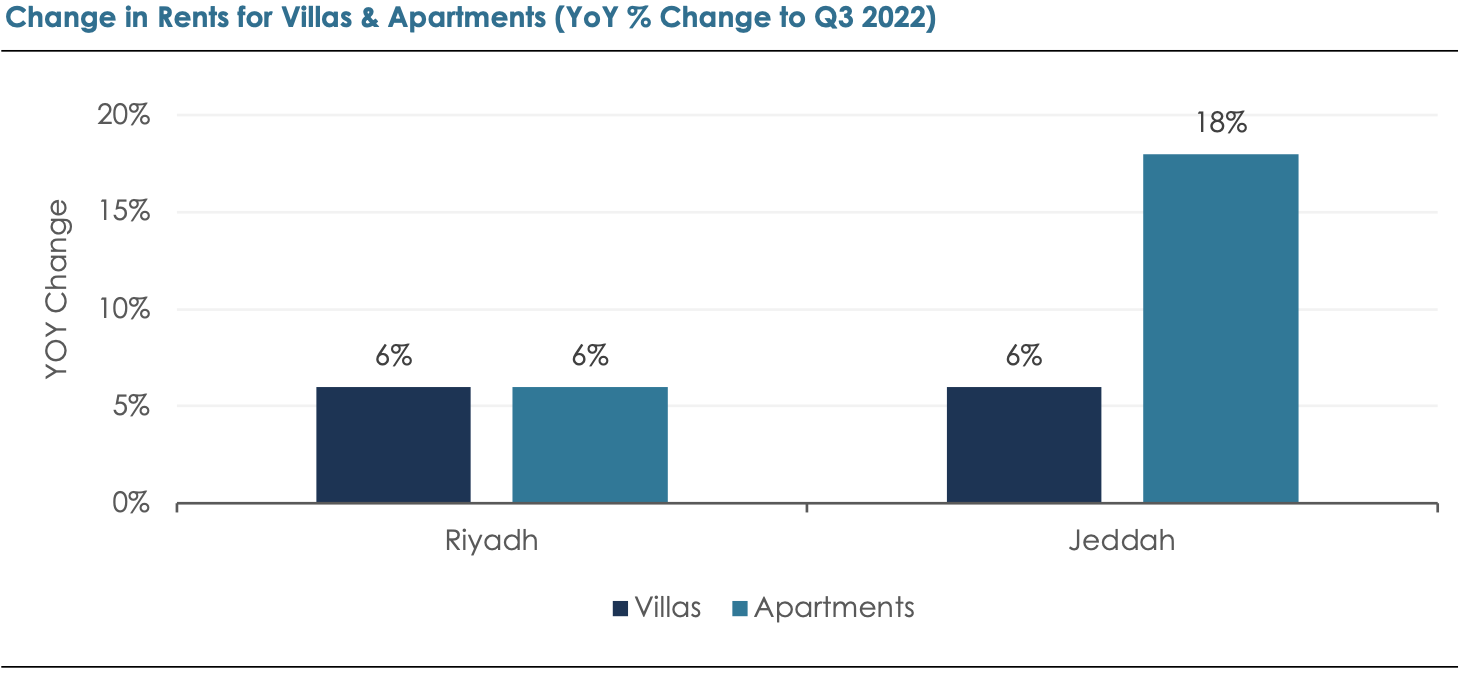

Decent Growth in Rents across Riyadh and Jeddah

The rents of villas in both Riyadh and Jeddah saw a moderate increase of 6% (YoY) through Q3 2022, while rents in Dammam declined by 6%. The apartment segment helped by the relative affordability, saw a surge in rental rates. The rents of the apartments rose in all three major regions: Riyadh, Jeddah, and Dammam recording a rise of 6%, 18% and 18%, respectively, as per Deloitte. Riyadh’s strong job creation and the redevelopment of Jeddah is driving a spike in rental demand, as households explore their options.

Strong Government Initiatives set to Transform the Housing Sector

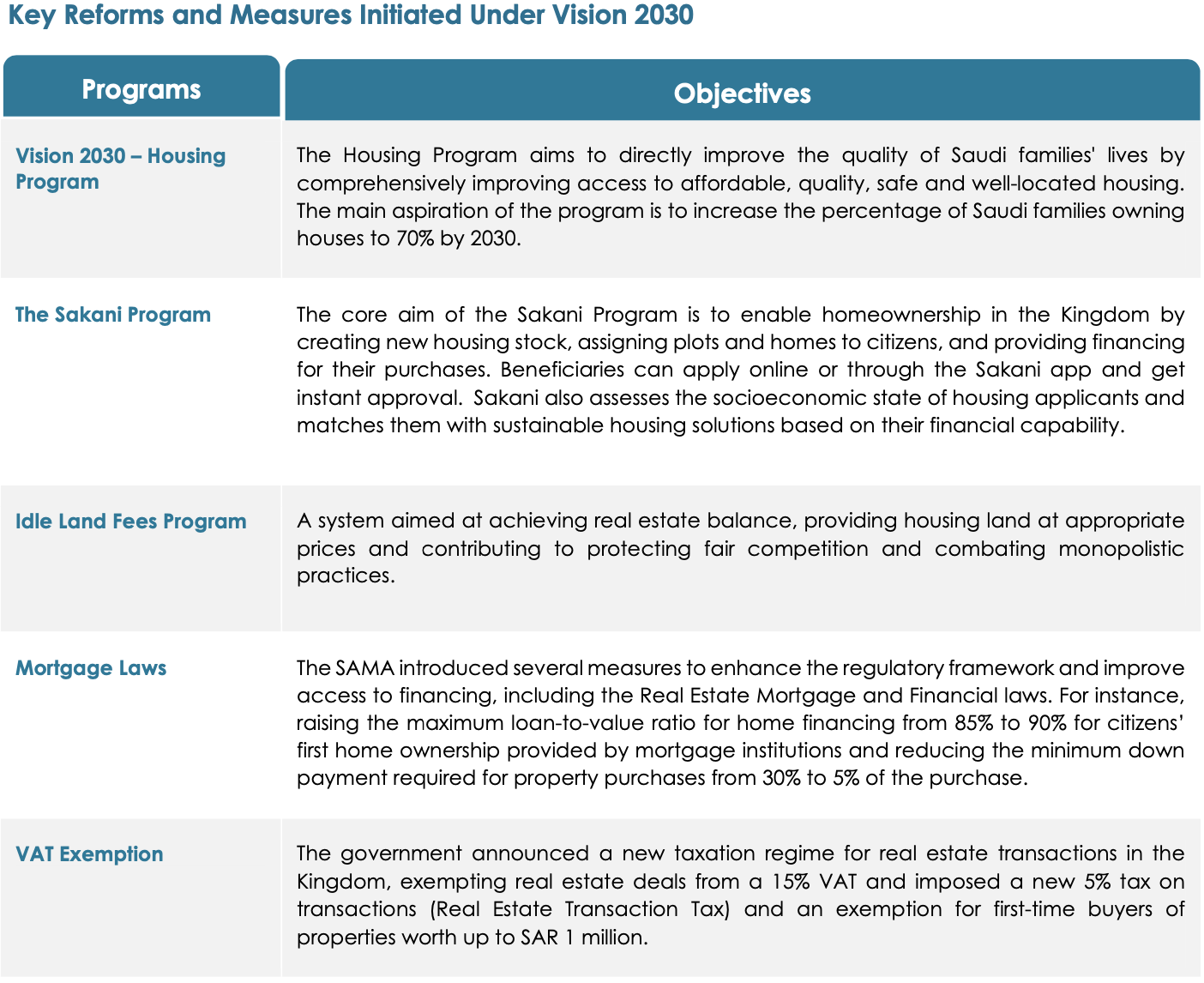

The Saudi Housing Program, in line with the Vision 2030 framework, replaced the prior system that suffered from long processing times and low citizen satisfaction levels. Over the past few years, the Ministry of Municipal and Rural Affairs and Housing (MoMRAH) has created a new housing ecosystem that includes formation of more than 16 separate entities that oversee the implementation of key initiatives and reforms of the housing market.

The government’s strong policies and initiatives like the enhanced access to finance, tax reforms, digitally enabled support, other initiatives in collaboration with the private sector and the regulatory authorities have helped making a huge transformation in the housing sector in Saudi Arabia.

Jeddah Spotlight

Jeddah to See a Real Estate Upswing

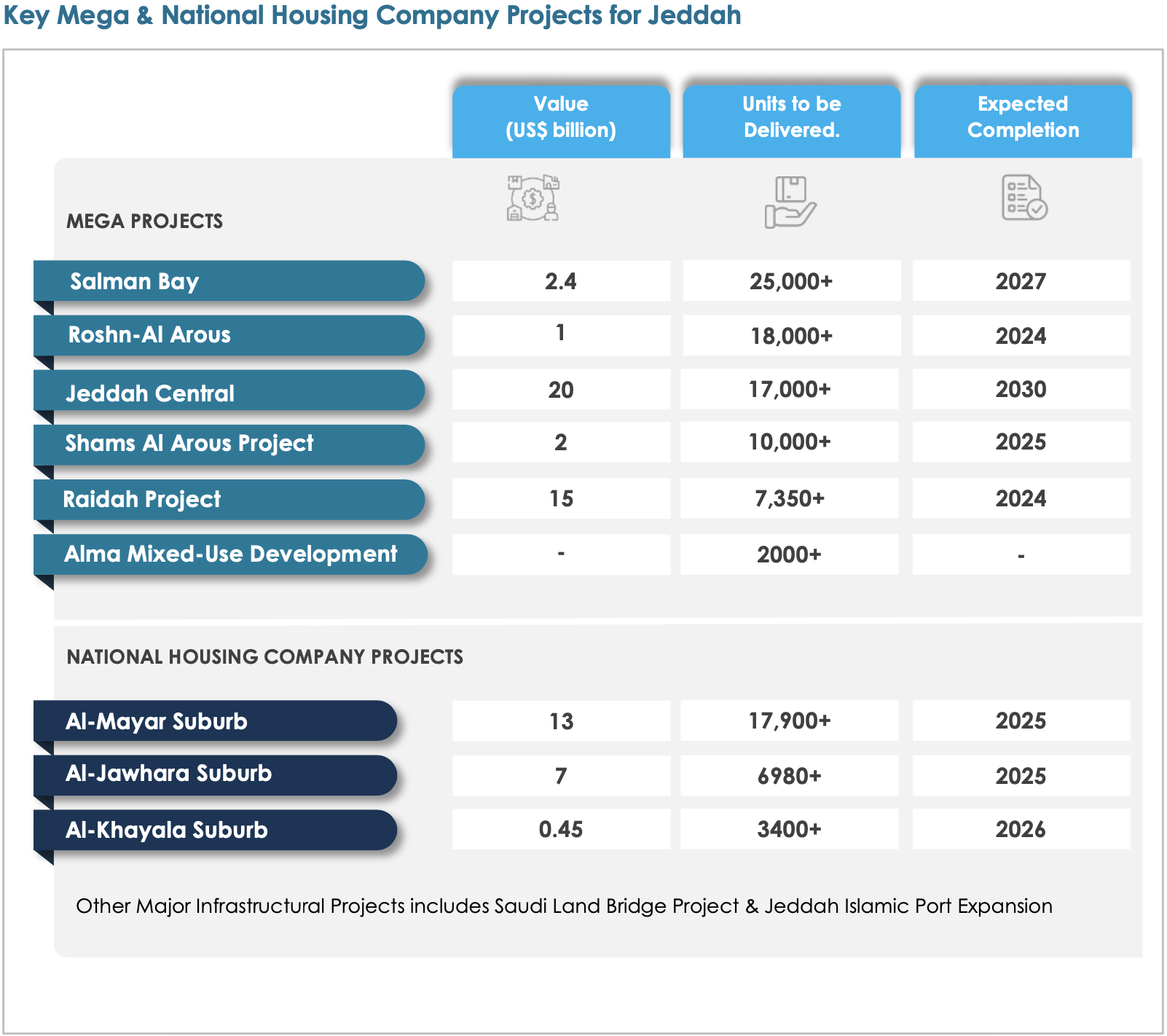

The residential real estate sector in Jeddah is expected to be revitalized by the dramatic wave of goverment projects set for the transformation of the city. The upcoming supply is based on the large housing plans launched by the MoMRAH under the Sakani program which is focused more on middle-income housing in North Jeddah seeing most of the development activity. Jeddah is undergoing the regeneration of the city’s slums. Notably, 64 districts out of 210 districts are to be demolished and redeveloped. The committee has already begun demolition work in 26 districts covering an area of 18.5 million square meters (Arab News, June 2022). The redevelopment of the city and the urban regeneration of some districts in the south are driving a shift in the population to the north and the north-eastern districts. Landlords are trying to capitalise on the growing demand and residential rents in Jeddah have been rising. As households explore their options, it is a lucrative opportunity for developers to cater to the specific supply of residential units in Jeddah region.

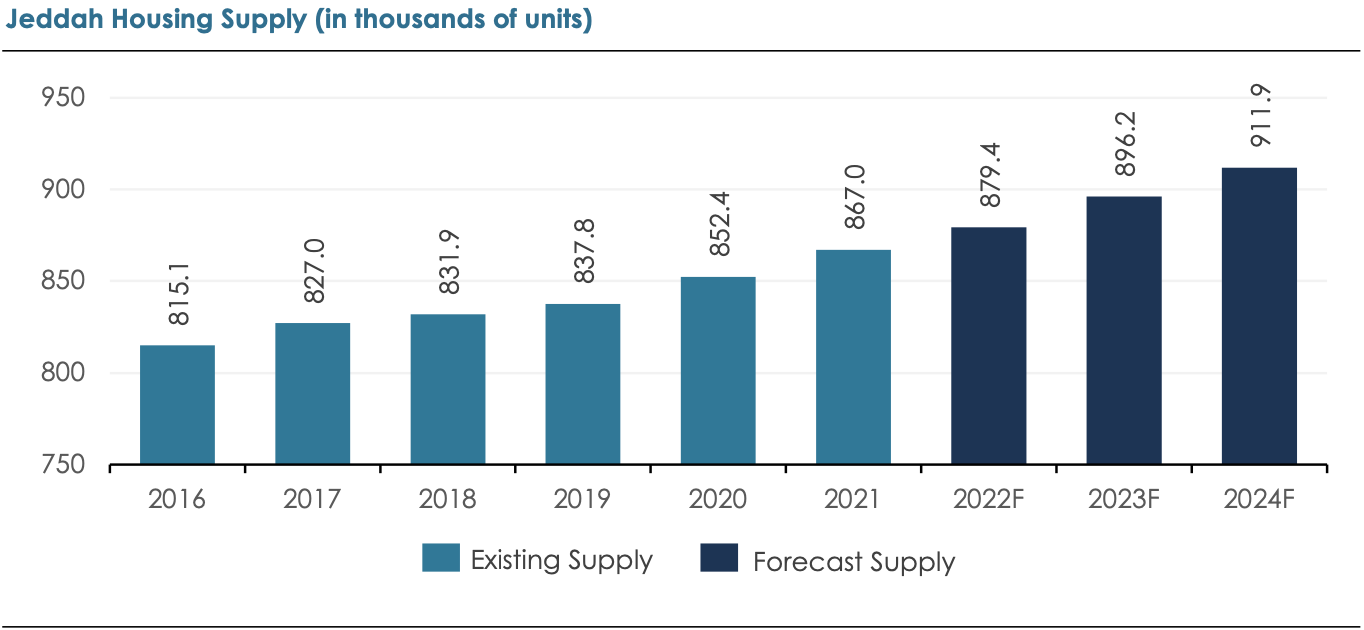

According to population statistic, Jeddah’s population is expected to rise from 5.1 million residents in 2020 to about 6.1 million in 2030, growing at a CAGR of 1.9%. With an average household size of 4.5, this roughly translates into a demand of about 1.3 million housing units by 2030. The housing supply in Jeddah has seen a steady growth in recent years and according to a recent Knight Frank report the 2022 supply is expected at around ~880K units. By 2030, the housing supply is expected to reach about 987.7K units, which suggests a market gap of about 383.3K units. According to Retal Urban Development Company’s IPO prospectus, villas are the most aspirational housing typology in the Jeddah region, and the significant rise in capital values of villas over apartments mirrors this demand trend. The average villa sales price rose by 6.7% YoY in 2022, while the apartment sales price fell by 0.2% YoY, as per CBRE. However, the apartment segment is becoming increasingly popular among the young generations as well. To address the affordability challenge and to capitalise on the demand for community apartment living, developers have been including more apartments in their residential developments. As a result, the average rent for apartments rose by 18% (YoY through Q3, 2022), way above the 6% rise in average rent for villas, as per Deloitte.

Outlook

The positive demographic trends in the Kingdom set the stage for robust housing demand in the long run. Nearly 60% of Saudi population is below the age of 30 and increasingly prefers independent and modern living spaces, which is expected to boost the demand for apartment segment particularly. To cater the growing demand, the government has implemented several ambitious projects and robust reforms to ensure the apt supply of residential units. With healthy demand supply dynamics, the sector is expected to see a record boom and presents attractive investment opportunities for investors looking to benefit from the socioeconomic transformation theme currently underway in the Kingdom.