Saudi Arabia Residential Real Estate Market

سجل بريدك الالكتروني للحصول على احدث المقالات والتقارير

Saudi Arabia’s Residential Market Set For Continued Growth Amid Rising Housing Demand

Saudi Arabia’s residential real estate market, which is majorly concentrated across major cities such as Riyadh, Jeddah, Makkah, and Dammam Metropolitan Area (DMA), is expected to grow further in the coming years, on the back of rising demand for housing units. Support is expected to majorly come from growth in the young population, rising income levels coupled with the introduction of recent government reforms aimed at boosting access to mortgage finance. In addition to this, the government is undertaking various initiatives to increase the role of the private sector in fulfilling the demand for residential units. The Saudi residential market is set to benefit in the longer term on account of the government’s recent decision to exempt real estate deals from 15% Value Added Tax (VAT), implementation of large-scale housing programs, and continued efforts to expand the mortgage market. We have discussed the various drivers supporting our outlook for the Saudi housing market in the forthcoming sections.

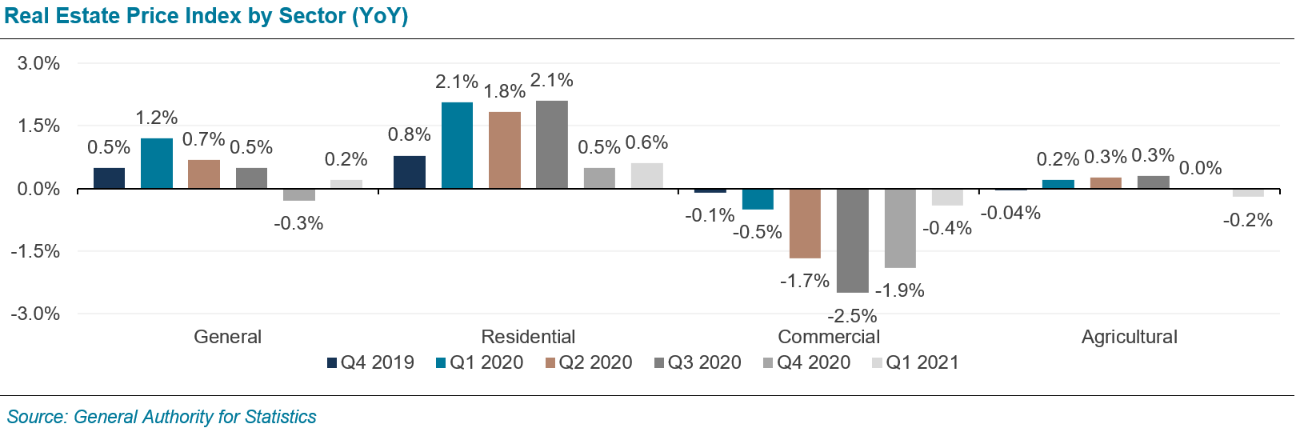

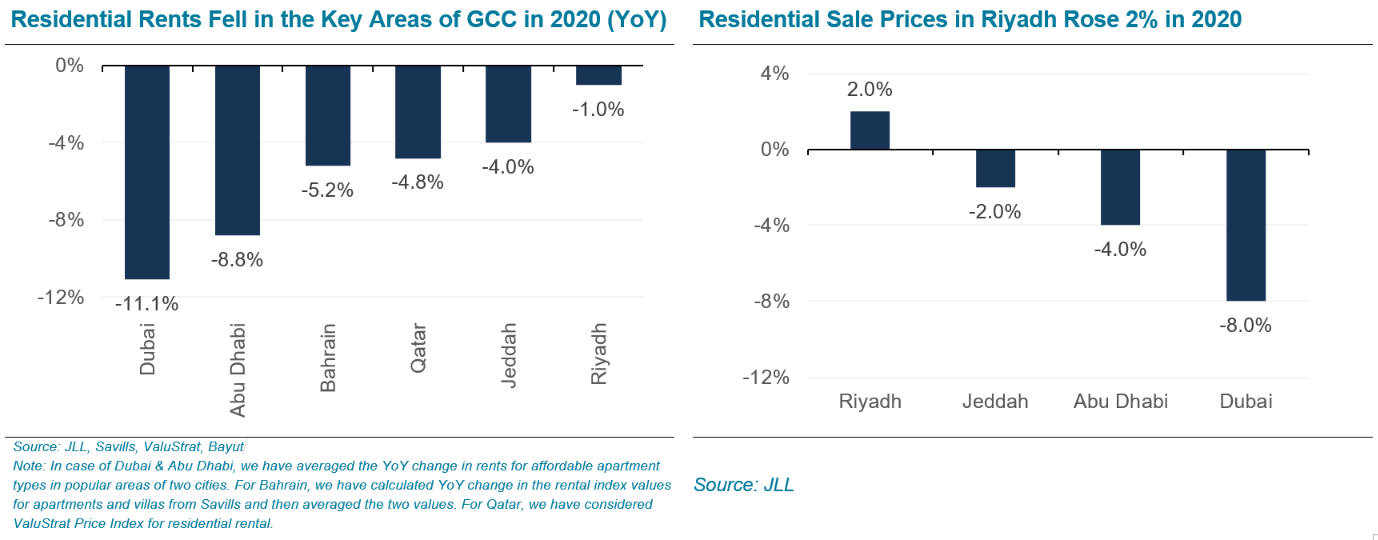

Residential Real Estate Sector Remained Resilient Amidst COVID-19 Pandemic

The prices of residential real estate rose in 2020 despite the coronavirus pandemic, as demand for housing units remained elevated. The residential property market performed better than the commercial sector even during the ongoing pandemic, with the price index for the residential sector rising over the past one-year period till Q1 2021. For 2021, the outlook for the residential sector remains positive amid continued government support for the real estate industry under Saudi Vision 2030 goals.

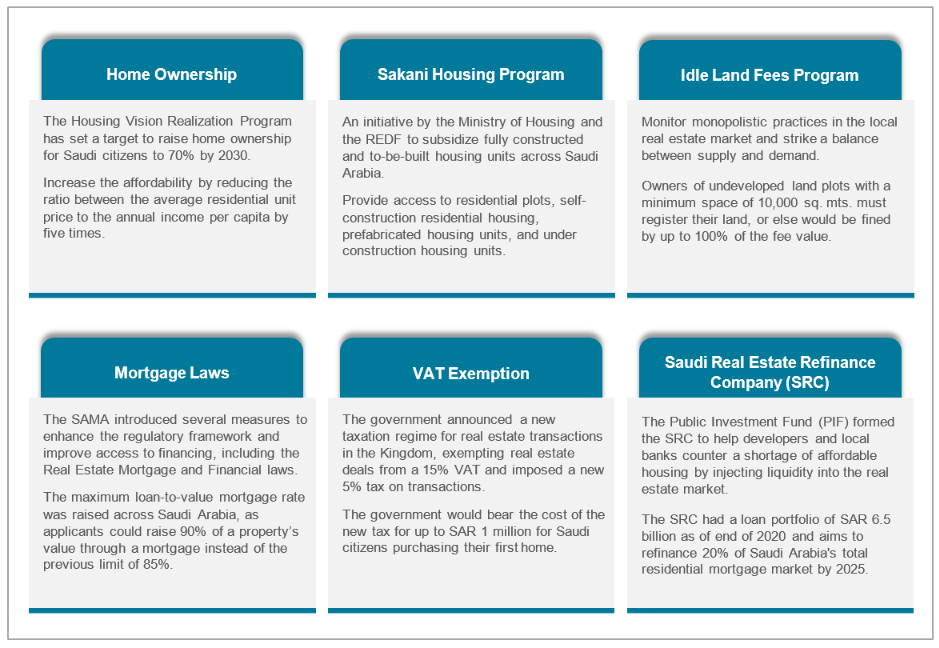

Government Reforms Will Provide a Further Boost to the KSA Housing Market

Saudi Arabia’s Real Estate Development Fund (REDF) has been a key factor which has driven growth in the Kingdom’s housing sector development based on the Vision 2030 framework. The REDF along with the Ministry of Housing and other government entities have announced several initiatives to propel residential real estate demand in the Kingdom and provide affordable housing to Saudi citizens.

We believe these intiatives will go a long way in propelling the sector by addressing the key challenges faced by the housing market.

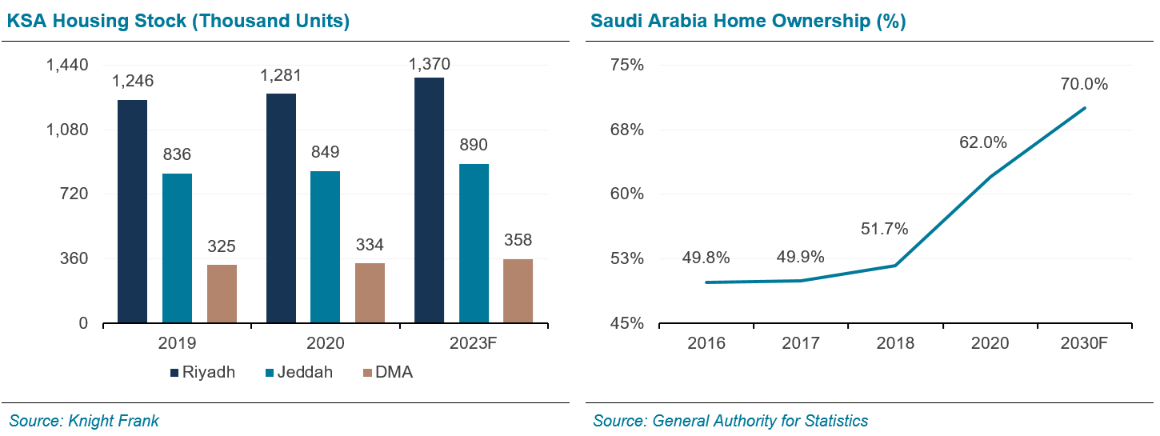

Lower Home Ownership Rates Offer Strong Potential for Growth

Under the Vision 2030 initiative, the Saudi government is pushing towards increasing home ownership in the Kingdom to 70% by 2030. The home ownership rate has witnessed a steady growth over the last few years, climbing from 51.7% in 2018 to about 62% in 2020, following the government-led initiatives through the Ministry of Housing. With rapid growth in urbanization and rising number of citizens entering the workforce, the demand for new housing units is expected to remain high over the coming years. Among residential properties, we expect demand for smaller and more affordable housing units in the form of apartments to remain strong amid increasing popularity of nuclear families. Moreover, the introduction of 5% tax on real estate transactions in place of VAT coupled with the government’s decision to bear the cost of the transaction tax for first-time home buyers of properties worth up to SAR 1 million would drive demand for mortgage loans in the housing market.

The demand for residential properties remained positive during 2020, following strong support from the government for the sector. This was also reflected in the new residential mortgage loans data by the Saudi Central Bank (SAMA) for 2020, where 295,590 contracts worth SAR 140.7 billion were provided to Saudi families, thereby equaling the combined data for the prior four years (2016 to 2019). The growth in mortgage financing despite the current coronavirus pandemic clearly indicate that demand for housing remains healthy among Saudis.

Increasing Affordable Housing Supply to Address Huge Demand

Saudi government has been undertaking a slew of measures to step up housing construction and boost lending activities to help close the supply-demand gap and raise the mortgage penetration rate in the Kingdom which is currently one of the lowest in the world. It is estimated that the Kingdom will require an additional 1.2 million homes over the next 10 years to reach a total housing stock of 4.96 million units by 2030. Housing demand is anticipated to grow from 99,600 units in 2021 to 153,000 units by 2030 with an average of 124,000 units over the period. The housing market is also witnessing an increase in public-private partnerships (PPPs) as part of the government’s plan to attract more private sector investment in the sector. Meanwhile, the government is making huge investments in new housing projects across the Kingdom in order to meet pent-up demand following the ease in lockdown restrictions. Keeping these developments in view, we believe Saudi Arabia’s booming housing market offers promising investment opportunities for investors looking for long-term returns.

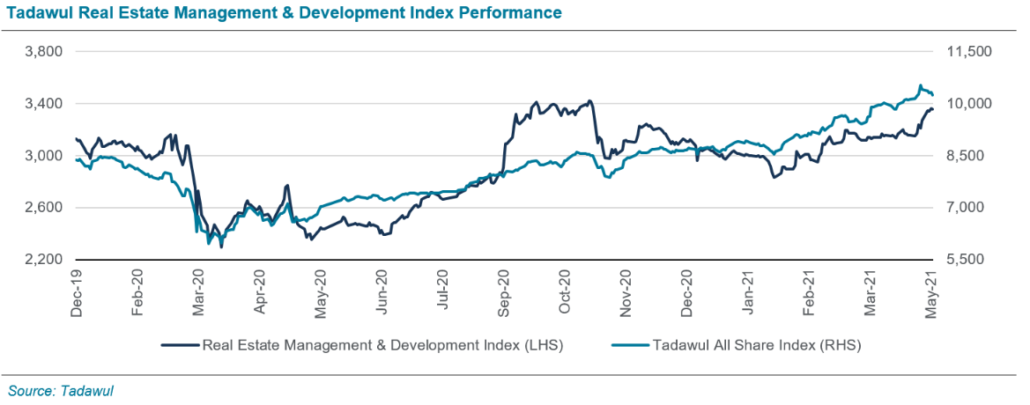

Saudi Arabia’s Real Estate Equities Have Rebounded to Pre-Pandemic Levels

Listed real estate companies in Saudi Arabia, represented by the Tadawul Real Estate Management & Development Index, witnessed a faster recovery at the end of 2020 and have managed to bounce back to their pre-pandemic level as of Q1 2021. The Index has already gained ~11% in the year to May 5, 2021 and has surged ~33% over the last one year (as of May 5, 2021), reinforcing the investor’s confidence in the Saudi real estate sector. We expect business conditions in the residential market to improve in the post-Covid environment as the economy emerges out of the current crisis and the construction activity resumes at full speed, which will boost market sentiment.

DISCLAIMER

This document is strictly private, confidential, and personal to its recipients and should not be copied, distributed, or reproduced in whole or in part, nor passed to any third party.

The information provided in this report is for general guidance and information purposes only. Under no circumstances the information contained in the report is to be used or considered as a formal financial, investment advice or any other advice, or an offer or solicitation of an offer to buy or sell, or as recommendation or endorsement of any security or other form of a financial asset. The report is not to be considered as investment research or an objective or independent explanation of the matters contained herein.

The information in the report is obtained from various sources per dating of the report. Sidra Capital have taken reasonable care to ensure that the material information contained herein is in accordance with the facts and contains no omission likely to affect its understanding.

Sidra Capital makes no representations or warranties whatsoever, as to the accuracy or completeness of this report and Sidra Capital expressly disclaims any liability of whatever nature whether (direct or indirect), or responsibility for the accuracy of the information contained in the report.

The information contained herein may be subject to changes without prior notice. Sidra Capital does not accept any form of liability, neither legally nor financially, for loss (direct or indirect) caused by the understanding and/or use of this report or its content. This report is only intended for the recipients, and should not be copied or otherwise distributed, in whole or in part, to any other person without the prior written approval of Sidra Capital.