Economic Themes 2023

Subscribe to our Insights Leave your email address to be the first to hear about insights.

Key highlights

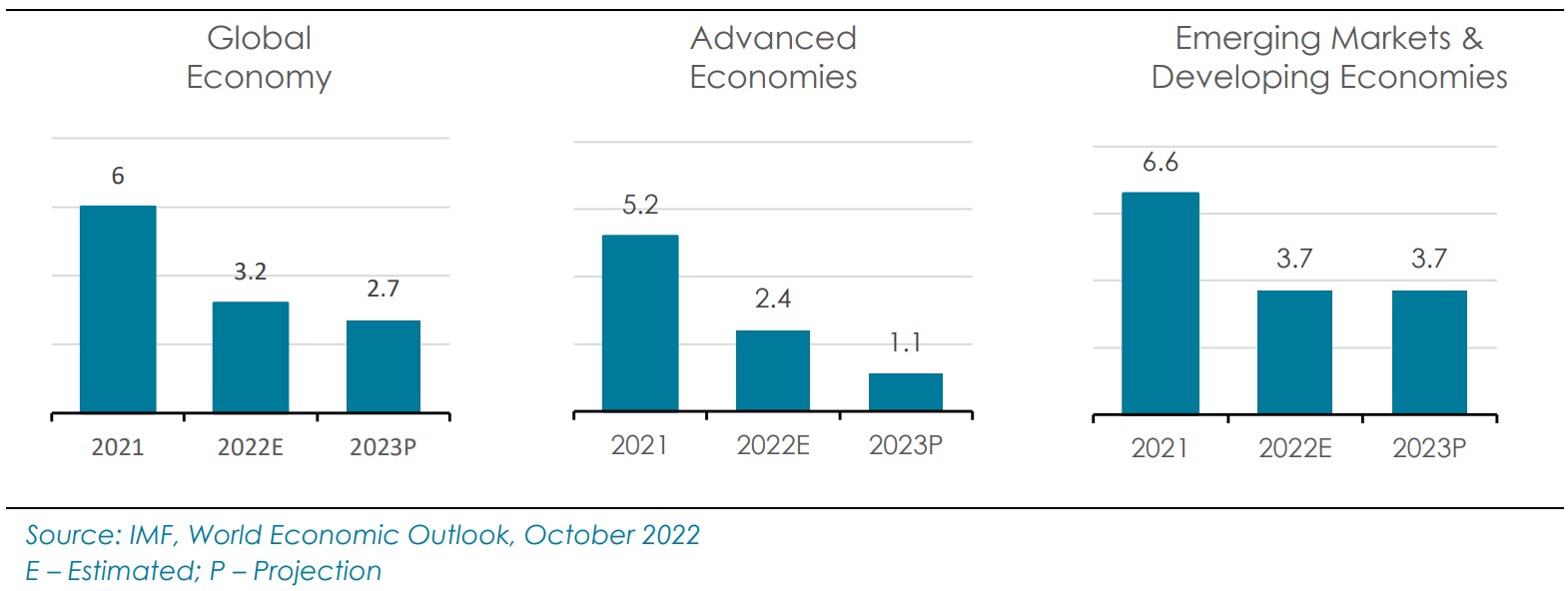

- Global growth projections are historically low as economies are on the verge of falling into recession.

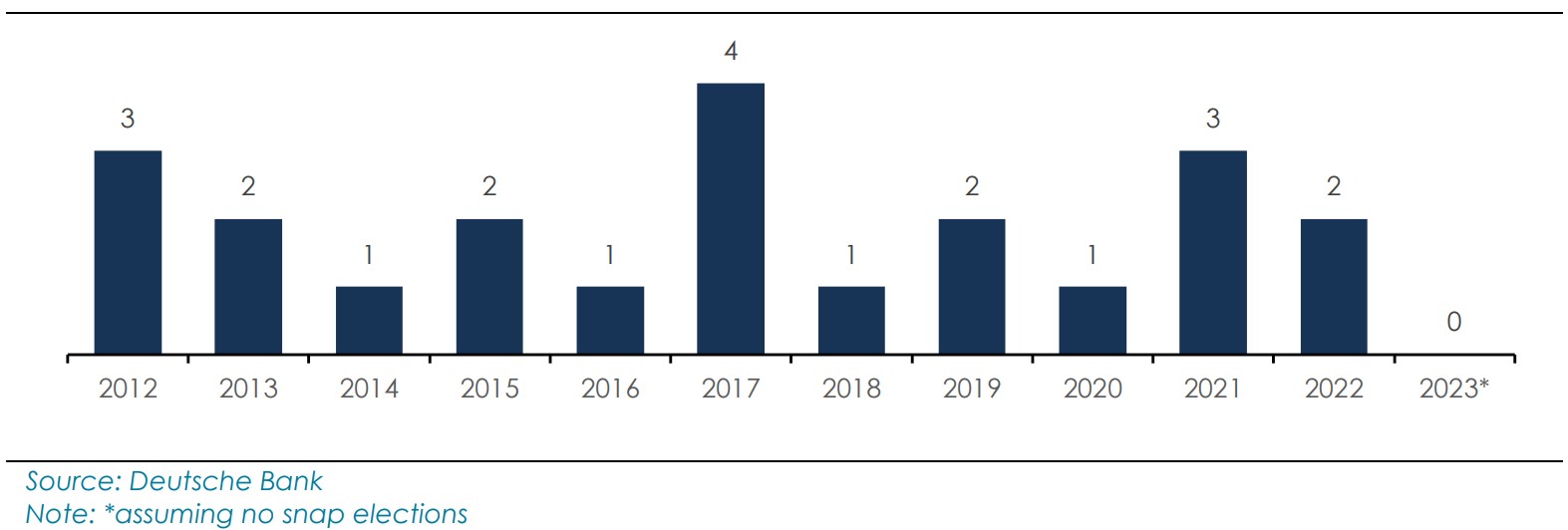

- With no major elections in G7 countries, 2023 is expected to be the year of relative political stability

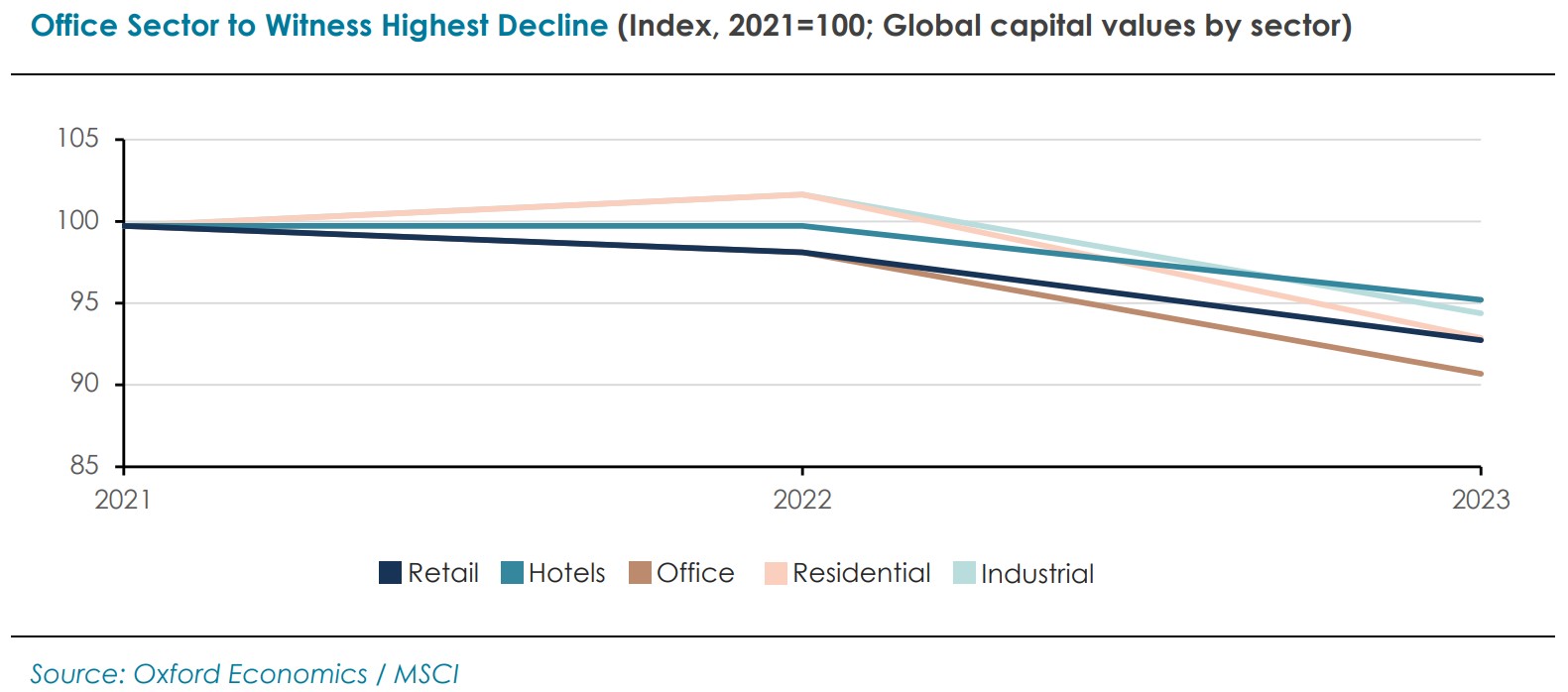

- The real estate capital values are expected to see some correction in 2023, with the office sub-asset

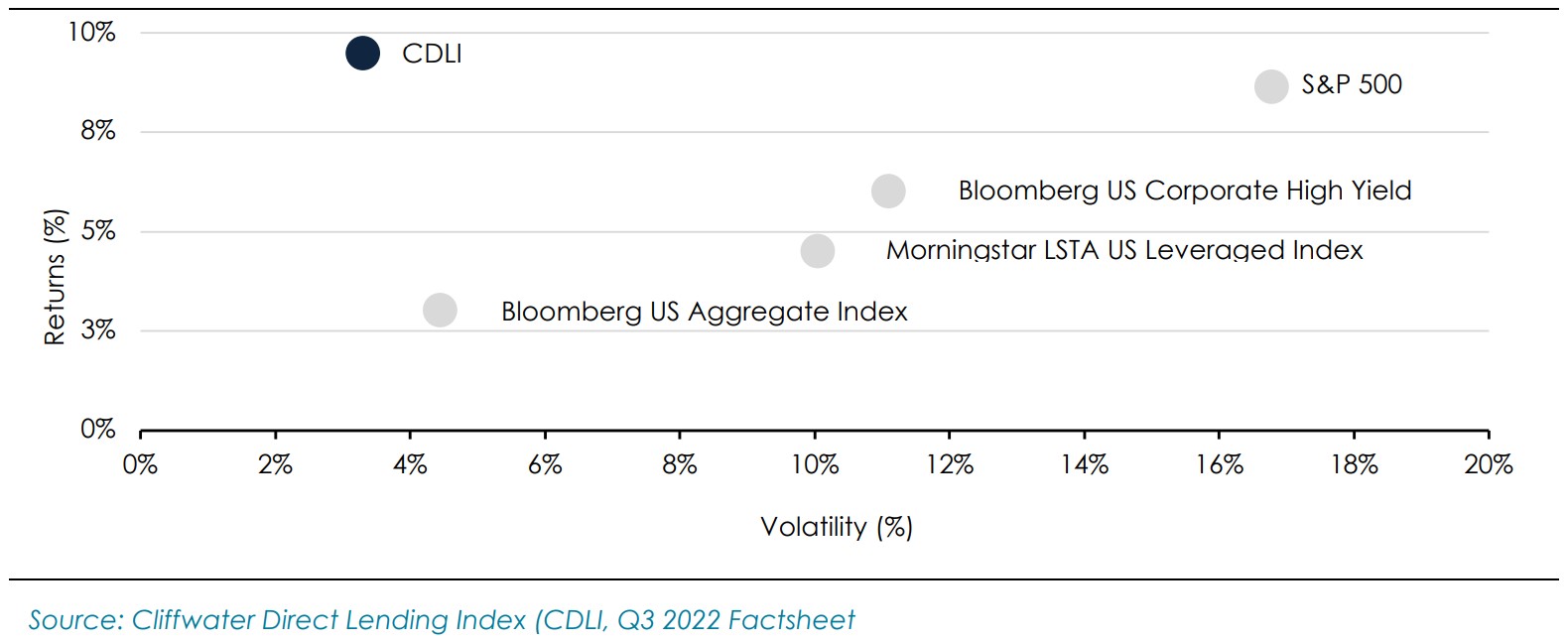

class expected to be the most negatively affected in the short term. - Private debt will continue to be an attractive alternative asset class in 2023, especially direct lending

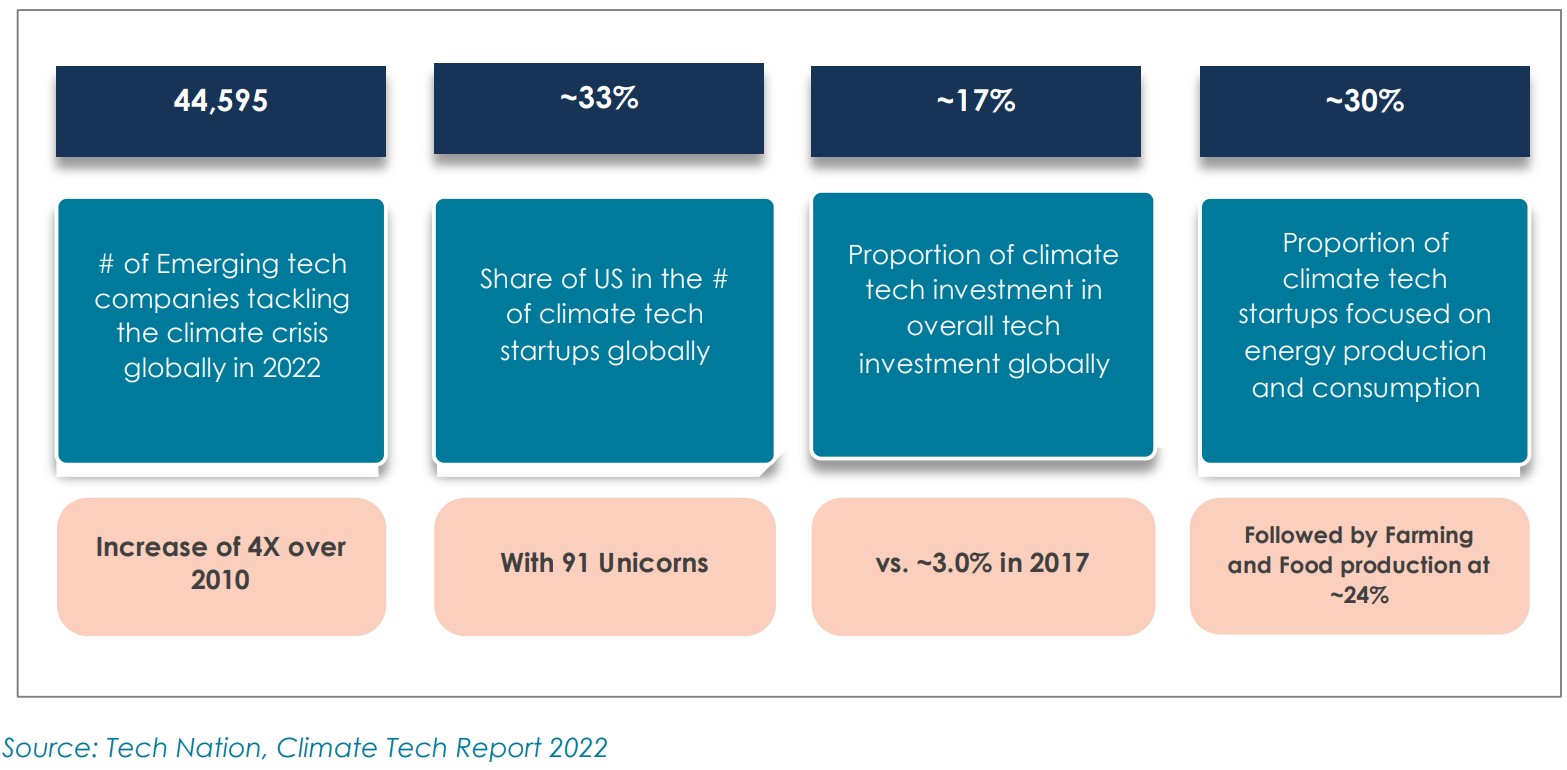

strategies owing to their floating rate exposure amid rising interest rates. - Climate tech investments will gain further momentum and are expected to provide compelling

investment opportunities.

The Russia-Ukraine war and central banks’ tightening to control inflation in 2022 intensified the economic challenges in most countries, negating the gradual economic recovery from COVID-19. Overall, the year 2023 will continue to be challenging from a macroeconomic perspective due to the imminent threat of recession coupled with stubborn inflation and China’s Covid chaos and energy crisis in Europe.

Below we discuss some key themes for 2023.

Recession Looms Large

2023 is expected to be the third worst year for global economic growth after the start of this millenium,behind 2009 when the global financial crisis caused the Great Recession and 2020 when Covid-19 lockdowns brought economic activity to an unimaginable halt. The International Monetary Fund (IMF), in its latest World Economic Outlook report of October 2022, has cut its global growth outlook for 2023 and warned that inflationary pressures, geopolitical instabilities, and rising interest rates could steer the global economy into the verge of recession. IMF projects global GDP growth of 2.7% in 2023, the weakest growth estimate since 2001 excluding the period of the Global Financial crisis and the Covid-19 pandemic.

GDP Growth (%) Set to Shrink

The economic growth of the world’s three largest economies – the United States, the Euro area, and China – has been slowing. There is a consensus that the Eurozone and the UK may have entered a recession in Q4 2022. In addition, China’s economy is also slowing down. These economies may face the worst by mid-2023 and thereafter begin a weak, tentative recovery, meanwhile the United States may or may not be able to avoid a recession. The US recession, however, is expected to be less severe compared to other economies, as aside from inflation concerns, household and corporate balance sheets are largely in good shape. In Europe, a war-induced recession is expected, based on the crises created by the prolonged Russia-Ukraine war, though fuel subsidies and a light winter should help reduce the impact of the recession.

Perhaps the largest apprehension is around the impact of Covid-19 on China and its knock-on impact on the rest of the world. China has abandoned its stringent zero-Covid policy, becoming closest to fully reemerging from government imposed Covid isolation and reintegrating with the rest of the world. The process of reopening could be erratic and as China battles large-scale outbreaks of Covid-19 into 2023, the shortterm impact is expected to affect domestic demand and further supply chain disruptions. China’s historic real estate downturn and the potential global recession could add to the surmounting problems in the Chinese economy. Overall, 2023 is expected to be another slow year for global economies.

2023 will likely be a Year of Relative Political Stability

The improved tone of global cooperation as seen in the G20 and COP27 meetings in late 2022 and the recent bilateral meetings between China and European leaders indicate easing geopolitical tensions. Interestingly, 2023 will be the first year of the 21st century without a general or presidential election in G7 countries. As a result, global leaders are likely to be more focused on addressing the current challenges with no leadership changes and transition periods.

Number of G7 Countries with major Election that year

The economic damage caused by the Russia-Ukraine conflict echoed far beyond their borders. It triggered global supply chain disruptions, impacted global trade, spiked energy prices globally, and the international sanctions imposed on Russia have highly undermined the efforts taken by the rest of the economies to recover from Covid-19. The economies which relied heavily on exports from Russia & Ukraine have been impacted as the war has caused volatility and price surges in key commodities. Also, various economies. faced food crises in 2022. The intent to promote stability is clear among the global leaders based on their reaction to Russia’s invasion of Ukraine, where even countries with strong diplomatic ties to Russia have expressed discomfort with regard to the ongoing conflict and a desire for peace.

Meanwhile, China is more likely to concentrate on domestic stability amid Covid-19 outbreaks. Furthermore, China is not expected to risk its internal stability by escalating matters with Taiwan.

Capital Values in the Global Real Estate Expected to see Correction

The real estate sector is expected to witness value correction in 2023. Elevated construction costs, higher. financing costs, uncertain exit values, and the recent downturn in housing markets coupled with the expectation of a recession might further exacerbate the headwinds of the real estate sector.

The general surge in e-commerce will continue to serve as a tailwind for the logistics and industrial warehouse space for the forseeable future. The short-term returns for industrial properties, specifically classA assets, is expected to be challenged by rising inflation rates. This is primarily due to long-term leases, which typically only factor in 2%-3% inflation. Meanwhile, the demand for space in office sector is undergoing a structural shift. Reduced occupier demand owing to more flexibility regarding working from home and a rise in demand for Class A/prime assets has resulted in an increase in vacancy rates and a decline in rental values. According to Oxford Economics, the office sector is anticipated to underperform in comparison to. other real estate sectors.

Private Debt Continues to be an Attractive Asset Class

The pandemic-induced market collapse in 2020 provided data points that demonstrated the durability of the asset class in terms of returns and defaults. This became a further selling point for the asset class, particularly during the market volatility in early 2022. As a result, Private Debt took market share from other sources of financing because of their relatively better yields. In March 2022, extreme market volatility caused a surge in loan prices, leaving no incentives for new issuance. In the absence of syndicated. financing options, private debt providers stepped in to fill this void in the market.

The Cliffwater Direct Lending Index (CDLI) is a good proxy for private debt returns as it measures the unlevered, gross-of-fee performance of US middle market corporate loans, including both exchangetraded and unlisted Business Development Companies. The annualized returns comparison from Q4 2004 to Q3 2022 between CDLI and other proxy indices of selective asset classes reveals that CDLI has outperformed other segments of loan markets like aggregate bonds, leveraged loans, high-yield corporates, and S&P 500, with much lower volatility.

According to Preqin, there is positive investor sentiment towards private debt holdings and it sees direct lending strategies to be particularly appealing in 2023 owing to their floating rate exposure as interest rates increase.

Comparing Risk & Return Across Selected Asset Classes (Q4 2004 through Q3 2022 Annualized)

Despite macroeconomic challenges, the demand for top managers that have scale, unique competitive advantages, and proven track record is expected to remain strong in 2023.

Climate Tech to Emerge as a Promising Sector

Over the last decade, climate tech began to be an integral future of investment. The share of climate tech investment in overall tech investments has risen significantly in the last few years. Furthermore, China and the EU have strengthened policies and guidelines on e-waste. Recently the US also passed a bill specifically on recycling EV batteries. Efforts to mine secondary metals from e-waste are expected to reduce dependency on mining and boost access to metals critical for clean-energy technologies, with far lower emissions.

As governments worldwide are setting regulations for a net-zero future, there is ample incentive to adopt sustainable technologies. The long-term regulatory tailwinds will encourage greater use of renewables and. put them at the spearhead of the fossil-fuel agenda. The inescapable impacts of climate change and the various governments’ policies to keep up net-zero targets will continue to attract significant investments in the space. Hence, sustainability and climate tech will likely be at the front and center in 2023.

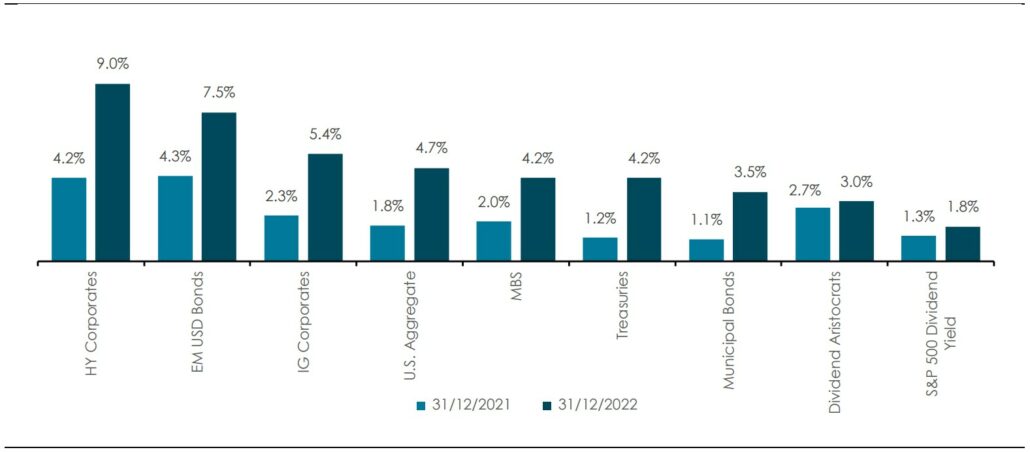

Fixed Income will Make a Comeback in 2023 with their Enticing Yields

After the bond market went through interest rate resetting, the performance of fixed-income markets in 2022 was rather dismal and an anomaly, as historically during periods of sharply rising interest rates bonds have generally delivered positive returns. The missing cushion of high coupon income in 2022 resulted in relatively weak returns. However, looking forward to 2023 the returns from fixed income are set for a rebound given that current yields and valuations seem to be more attractive. The favorable expectations are predicated on factors: starting yields are highest in years – both in nominal and real terms, the bulk of. US Fed tightening is over, and inflation is likely to decline to go into 2023.

Yields in Fixed Income Investments are higher than Dividend Yields

Note: Indices represented are Bloomberg U.S. Corporate High-Yield Bond Index (HY Corporates), Bloomberg Emerging Market USD

Aggregate Index (EM USD Bonds), Bloomberg U.S. Corporate Bond Index (IG Corporates), Bloomberg U.S. Aggregate Bond Index (U.S.

Aggregate), Bloomberg U.S. MBS Index (MBS), Bloomberg U.S. Treasury Index (Treasuries), the S&P 500 Dividend Aristocrats Index (Dividend

Aristocrats) and S&P 500 Dividend Yield. Yields shown are the average yield-to-worst except for the Dividend Aristocrats, for which the

difference of Total Return and Price Return was taken.

Yields in various segments of the fixed income market: like high-yield corporate bonds, emerging market bonds, investment grade bonds, municipal bonds, etc. have exceeded the S&P 500 dividend yields towards the end of 2022. According to Morgan Stanley, the slowing inflation in 2023 is likely to force central banks to reverse the course of aggressive rate hikes, which will make bonds investable and more attractive.

DISCLAIMER

This document is strictly private, confidential and personal to its recipients and should not be copied, distributed or reproduced in whole or in part, nor passed to any third party

The information provided in this report is for general guidance and information purposes only. Under no circumstances the information contained in the report is to be used or considered as a formal financial, investment advice or any other advice, or an offer or solicitation of an offer to buy or sell, or as recommendation or endorsement of any security or other form of financial asset. The report is not to be considered as investment research or an objective or independent explanation of the matters contained herein.

The information in the report is obtained from various sources per dating of the report. Sidra Capital have. taken reasonable care to ensure that the material information contained herein is in accordance with the facts and contains no omission likely to affect its understanding.

Sidra Capital makes no representations or warranties whatsoever, as to the accuracy or completeness of this report and Sidra Capital expressly disclaims any liability of whatever nature whether (direct or indirect), or responsibility for the accuracy of the information contained in the report.

The information contained herein may be subject to changes without prior notice. Sidra Capital does not accept any form of liability, neither legally nor financially, for loss (direct or indirect) caused by the understanding and/or use of this report or its content. This report is only intended for the recipients, and should not be copied or otherwise distributed, in whole or in part, to any other person without the prior written approval of Sidra Capital.