Global Private Equity: Macro Concerns Blur Near Term, But Patience will be Rewarding in the Long Term

April 28, 2023

Subscribe to our Insights Leave your email address to be the first to hear about insights.

Key Highlights

- Global private equity (PE) fundraising, PE-backed M&A deals and exits slowed in 2022 amid volatile financial markets and geopolitical unrest.

- Decline in public equities has caused most institutional portfolios to be over-allocated to PEs, affecting the prospects for fundraising activity in 2023.

- There is considerable empirical evidence that PE outperforms public equities in the long-run and has delivered excess returns over equities during inflationary periods.

- Investors who can exercise patience in the current market environment will be well placed to take benefit of attractive opportunities as the markets recover.

The massive stimulus from governments to revive the economies during the pandemic fuelled a rally in markets and served private equity well in 2021. However, 2022 brought a different set of economic challenges – Russia’s invasion of Ukraine, soaring energy costs and rising inflation – triggering an unprecedented rate-hike cycle by central banks to tackle the spiraling inflation. This, coupled with subdued economic growth prospects in 2022, made investors more cautious affecting all aspects of PE market – fundraising activity slowed, deal flow tumbled and consequently valuations started to reflect the uncertainty After delivering a stellar performance in 2021, private equity remains subdued in 2022. Yet, private equity proved resilient compared to public markets, given the markdowns in portfolio valuations were quite lower as compared to public markets.

Given the sector sits on a substantial dry powder, the General Partners (GPs) will be keen to put it to work as soon as possible. However, the concerns around where GDP is headed and how much rate-hike central banks will resort to impede the contours of dealmaking among all – buyers, sellers and lenders.

Private Equity Fundraising Has Had a Slow End to 2022 Amid Challenging Macro Backdrop

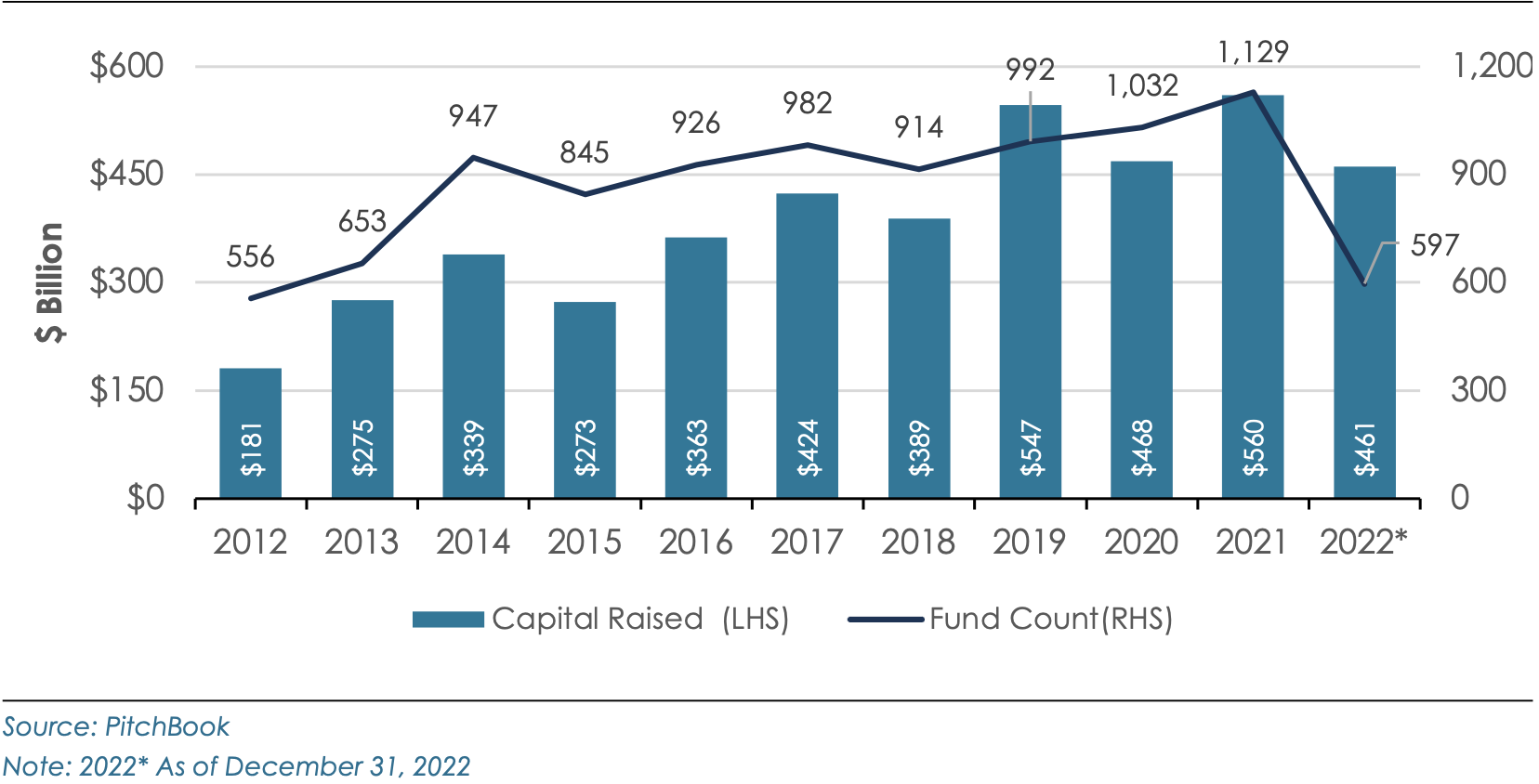

The global PE fundraising activity declined about 18% YoY in 2022 to $461.2 billion, according to data from PitchBook. The decline is not sharp though considering the challenging market environment. However, the decline in the number of funds raised was more steep decreasing by 47% YoY from 1129 funds in 2021 to 597 in 2022. Interestingly, mega funds (funds of over $5 billion) witnessed their second-best year in 2022 – collectively raising $219.2 billion and accounted for ~47% of the total PE funds raised in 2022. North America accounted for 78% of the total fund value in 2022, recording its highest share in total fundraising to date. Out of the top 10 largest funds raised, nine funds were from the US. Europe came in second representing 12% of the total fund value, followed by Asia region with a share of 8.5%.

PE Fundraising Activity ($Billion)

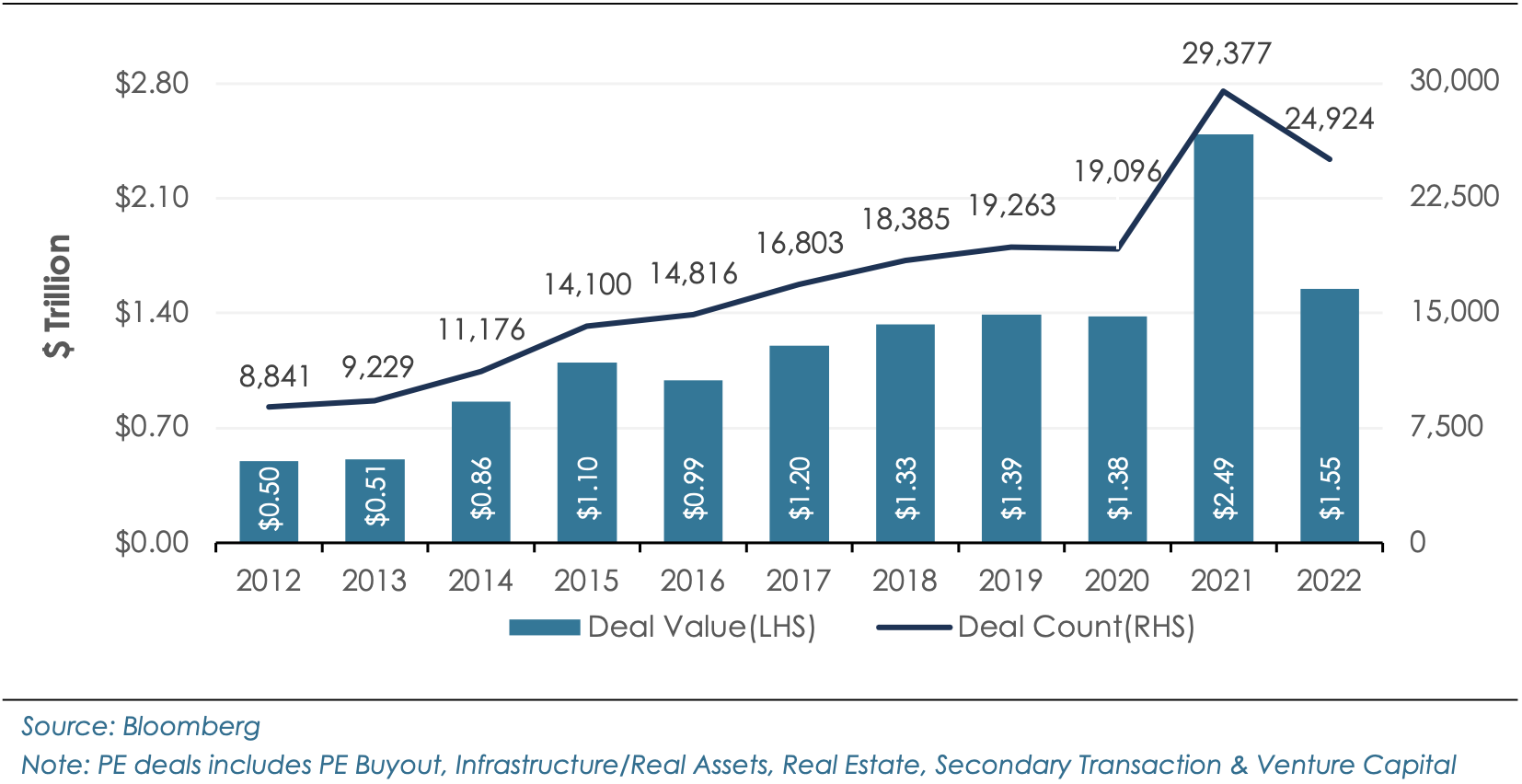

M&A Deal Activity Involving PE Slowed in 2022 Mirroring Subdued Fundraising Environment

PE Deal Flows ($Trillion)

The higher interest rates raised the cost of capital leading to a decline in the leverage during 2022. This coupled with limited exit opportunities had a detrimental effect on PE deals in 2022. Aggregate mergers and acquisitions involving private equity declined by more than a third in 2022. According to Bloomberg data, the private equity deals dropped nearly 38% YoY from $2.49 trillion in 2021 to $1.55 trillion in 2022. However, the deal value still came in at second-best performance in the past decade. The number of deals in 2022 reduced to 24,924, a decline of 15% YoY. According to Bain & Company, the average deal size declined by ~23% YoY from $1.25 billion in 2021 to $964 million in 2022.

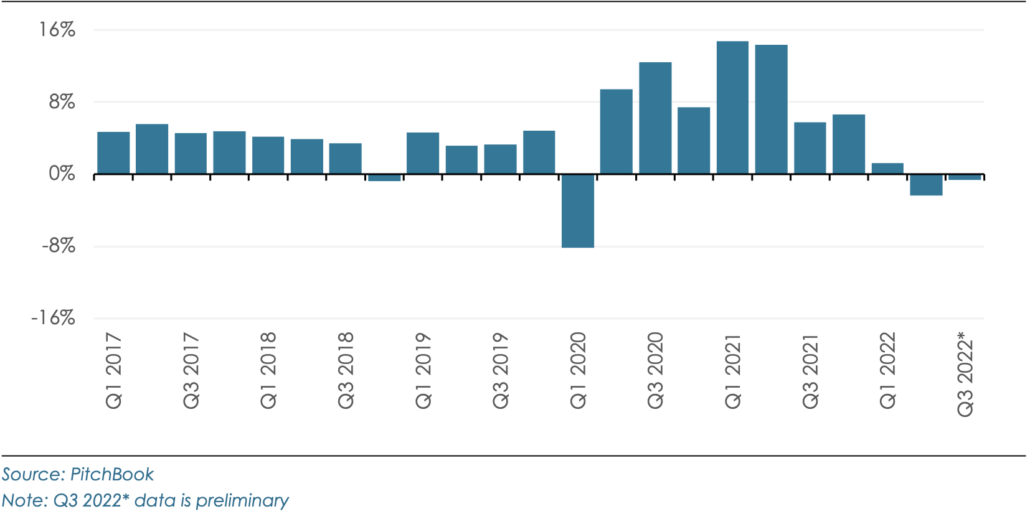

Relatively Flat Returns in 2022, But Resilient Compared to Public Markets

Global PE Funds Quarterly IRR from Q1 2017 to Q3 2022*

After posting a strong performance in 2021, PE funds delivered muted returns in 2022, as investors grappled with a drastically different macro environment – Russia Ukraine war, surging energy costs, rising inflation and aggressive interest rate hikes by various central banks. PE funds globally delivered returns of -0.6% for Q3 2022 (preliminary estimates from Pitchbook), following -2.4% returns clocked in Q2 2022 – both quarters registering sharp drop-offs from the quarterly figures seen in the last three years, except for Q1 2020 due to the pandemic, which was a one-off. Compared to public markets, private equity still proved relatively resilient given the sharp drop-off in most public markets with the US S&P 500 index posting a decline of 19.4% in 2022.

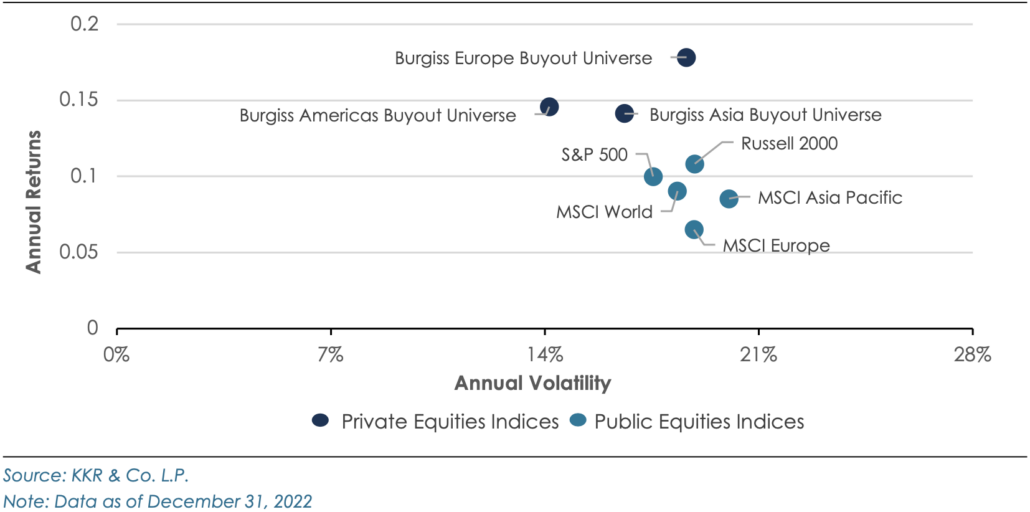

Empirical Evidence Suggests that PE’s Role is quite Additive in an Investment Portfolio

Historic Return vs Risk of Private Equities Over Public Equities

A recent research piece from KKR (The Role of Private Equity in the ‘Traditional’ Portfolio), which examines the asset class returns over the past two decades, demonstrates that private equity has delivered higher risk-adjusted returns than public equities. Notably, the Burgiss Buyout Index for all major regions – America, Europe and Asia Pacific, has generated higher returns with lower volatility than S&P 500 Index, Russell 2000 Index and MSCI regional indices. Importantly, private equity has consistently outperformed public equities in all inflationary regimes, except the ‘low inflation/low growth’ environment. During high inflation periods, private equity has generated ~ 6% excess return versus public equities.

APAC PE Spotlight

APAC Deals Fall on US Pullback from Chinese Investments

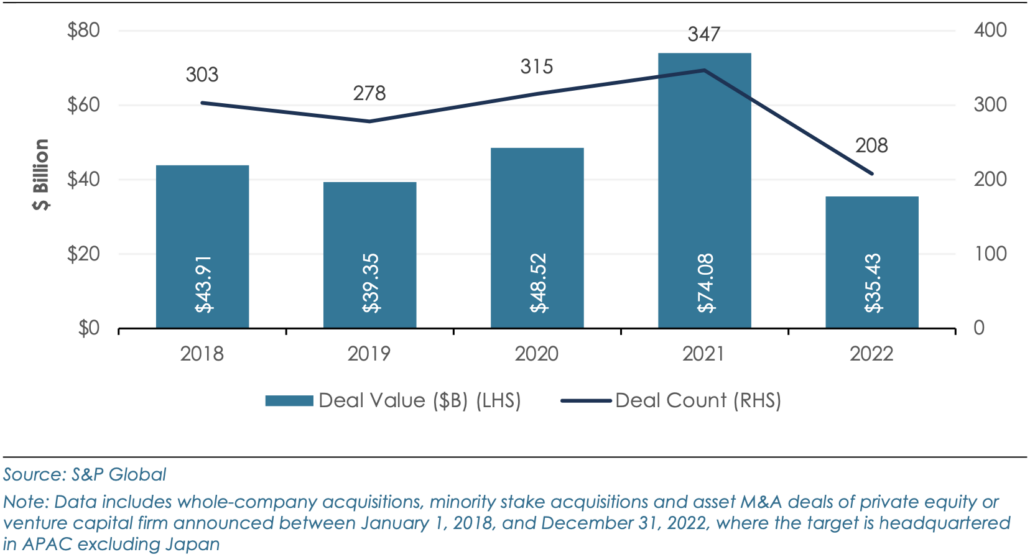

PE/VC-backed M&A in APAC Excluding Japan

Private equity and venture capital investments in APAC excluding Japan declined considerably in 2022, according to S&P Global. The aggregate transaction value and the total number of deals dropped to their lowest levels in the last five years. Deal value dipped by more than a half from about $74 billion in 2021 to $35.4 billion in 2022.

The Global Private Capital Association attributes the 2022 slowdown in APAC deals to a sharp decline in investment driven by a pullback of US institutional investors in China. Acquisitions of Chinese companies fell 76% YoY in 2022 as major US PE funds diversified their investments away from China into other regions like India, Japan, South Korea and Australia, primarily driven by investor concerns over Beijing’s worsening relations with the US and restrictive pandemic countermeasures. On the other hand, US investments in Japan rose in 2022 as the rising value of the US dollar against the Japanese yen made PE firms scout for attractive acquisition opportunities.

APAC PE Funds Delivered Better Returns Compared to Public Markets

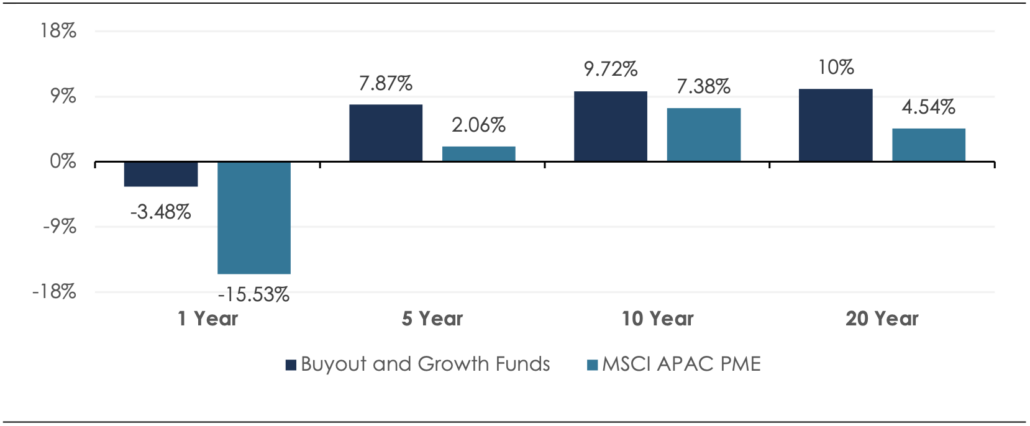

APAC End-to-end Pooled Net IRR (as of Q3 2022)

APAC buyout funds outperformed public markets in 2022. According to Bain & Company, the end-to-end pooled net IRR generated by APAC buyout and growth funds have always been higher than MSCI APAC PME funds during various investment horizons ranging from 1-year to 20-years. In the 1-year period through Q3 2022, buyout and growth funds returned -3.5% as private valuations held up relatively better, whereas MSCI APAC PME declined 15.5% during the same period.

Outlook

The prevailing risk-off environment coupled with the rising cost of debt and lower valuations suggests the prospects for global PE fundraising and AUM growth to remain challenging in 2023. Furthermore, a major chunk of institutional investors are now fully or over-allocated to private equity driven by the denominator effect – as the proportion of portfolio invested in public equities and bonds has declined considerably in 2022. This further constrains Limited Partners’ (LPs) appetite for new capital commitments. Yet, the long-term outlook for PE AUM growth looks promising as per forward AUM projections by Preqin and PitchBook. Importantly, there is ample historical evidence that, on average, PE has empirically delivered excess returns over public equities on a net annualized basis and the relative performance has tended to be better in times of geopolitical unrest and economic turmoil. This is suggestive of PE’s additive role in a well-diversified investment portfolio. Investors exercising patience will be well-positioned to leverage attractive investment opportunities as the market recovers.