Global Themes 2021

Subscribe to our Insights Leave your email address to be the first to hear about insights.

Key Highlights

- Global economy to heal from Covid-19-led wounds.

- Rapid progress in vaccine development points towards the beginning of the end of Covid-19, however, few obstacles remain

- US to embark new journey under Joe Biden’s Presidency.

- Oil outlook remains optimistic but Covid-19 uncertainty to decide actual course.

- Global funds will stress on ESG projects as sustainable investment gathers pace.

- Cryptocurrencies to receive attention from investors as an investment alternative.

- Increased instances of cyberattacks will prompt higher focus on digital security infrastructure.

2020 – A Year to Remember

2020 will be a year to remember as the world witnessed an unprecedented event in the form of COVID-19 pandemic, which led to severe global economic disruption. All the major developed as well as developing economies faced unprecedented damage due to Coronavirus-induced lockdowns, leading to prolonged furlough of workers or even mass layoffs across industries. According to the World Bank, the global economy is expected to contract by 5.2% in 2020, the deepest global recession since World War II, with China being the only country expected to generate a positive GDP growth rate. Apart from the Coronavirus crisis, which overshadowed most of the other events in the year gone by, the other highlights of the year included Joe Biden’s victory in the US Presidential Elections, post-Brexit trade deal between the UK and the EU, and the Regional Comprehensive Economic Partnership (RCEP) was signed by 15 countries from the Asia-Pacific region to form the world’s largest trading bloc, aimed at lowering tariffs and counter protectionism. As we close out a tumultuous 2020, we focus on the themes that we believe are likely to drive the global economy and financial markets going forward.

Global Economy to Witness Recovery in 2021

Global economy is expected to recover from the shock led by the Covid-19 pandemic and return to growth phase in 2021, as countries across the globe are attempting to get back on their feet. There are early green shoots of recovery, with a recent surge in Chinese exports as well as fresh economic activity in Europe and east Asia. The OECD expects world GDP growth to reach pre-pandemic levels by the end of 2021, on the back of progress in Coronavirus vaccines along with measures taken by global governments and central banks to lessen the economic impact of the crisis. We expect financial conditions to remain loose until sustained economic recovery is on the way.

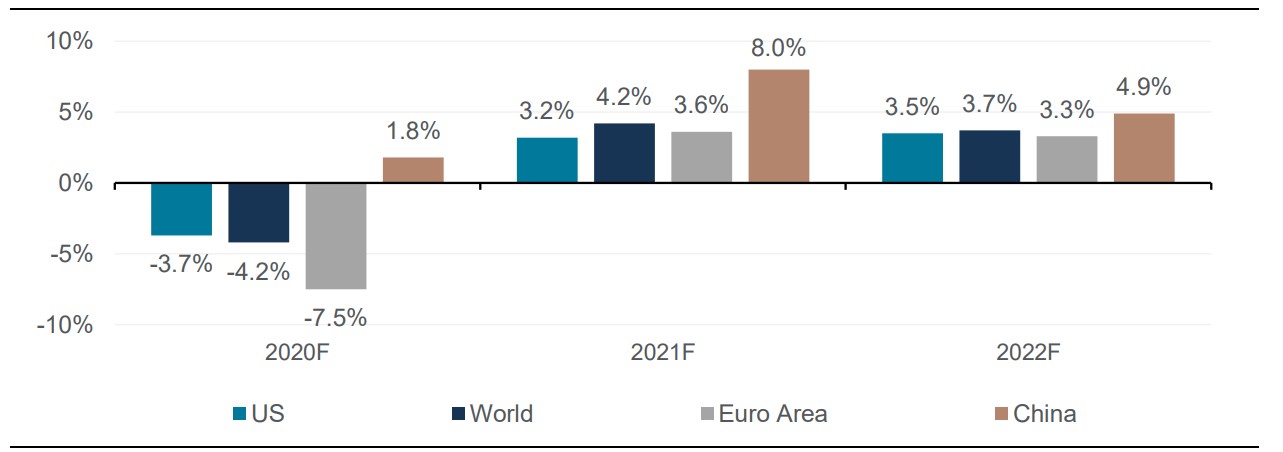

Global Economic Growth is Expected to Rebound in 2021 and Stabilize in 2022

Source: OECD

The OECD has projected the global real GDP growth to hit 4.2% in 2021 and 3.7% in 2022, with China expected to serve as a global growth engine and would contribute over one-third of world economic growth, with an estimated real GDP growth of 8% in 2021 and 4.9% in 2022. However, the OECD

has warned that considerable risks related to Coronavirus remains and urged global policymakers to keep supporting businesses to counter the Covid-19 pandemic. In our opinion, global economy should return to normalcy by the first half of 2022, as the uncertainty over the Coronavirus pandemic would recede in 2021, with the increasing number of countries launching the vaccination programs.

Vaccine Development – Is it the End of COVID-19?

Major global pharmaceutical firms, in collaboration with other private and government agencies, have worked tirelessly to develop COVID-19 vaccines in record-breaking time. The recent approval of Pfizer-BioNTech and Moderna vaccines has raised hopes of turning a corner in the fight to limit the spread of the virus and containing the pandemic. This has further strengthened the expectations of global economic recovery in the coming year. However, nearly 60% of global population would be needed to get vaccinated in order to achieve herd immunity, according to the World Health Organization (WHO). And although several countries, including the UK and the US, have already embarked on the vaccination campaign or are in process, it would take several months to vaccinate the majority of the population across the globe.

Firstly, there is a limited supply of doses available as the combined production capacity of vaccine makers will fall short to vaccinate even one-fourth of the world population by 2021-end. Secondly, different vaccine candidates require different type of storage and delivery method, which poses a huge logistical challenge. Thirdly, even though there is not yet known major side effect from any Covid-19 vaccines, any potential incident involving serious side effect would cause a huge issue. Fourth, there is no conclusive evidence regarding the long-term efficacy of the vaccines and question would remain as to how long the immunity lasts. Lastly, the newly discovered Coronavirus mutant, which is believed to be more infectious, puts the year-long efforts of scientists and researchers under jeopardy.

In our opinion, it is a long road ahead until the war with the Coronavirus is won, as several major countries recently witnessing a second wave of infections clearly indicate that the pandemic situation will stay for some time.

America under Joe Biden’s Presidency

With Joe Biden set to take over the reigns as the 46th US President, his predecessor Donald Trump leaves over a legacy of economic and foreign policies that he would like to mull over during his term of presidency. Biden’s several campaign speeches indicate that his priorities would be a combination of reversing Trump administration actions, while simultaneously expanding and advocating former President Barack Obama’s initiatives including investing in green jobs. As far as competing with China is concerned, Biden has urged on building alliances with like-minded partners to be in a stronger position to hold Chinese government responsible for its abuses on trade, technology, human rights and other fronts. He has also pledged to reverse Trump’s efforts to curb immigration and limit protections for both legal and illegal immigrants. Biden would expand the affordable healthcare scheme, Obamacare, aimed for the middle-class American families. In terms of foreign policy, Biden will try to revive the Iran nuclear deal and restore Obama-era changes to the US-Cuba relationship, and resume full US participation in multilateral organizations including NATO and UN. However, the most important agenda in Biden’s campaign was the proposal of investing $2 trillion in a massive green-jobs program to build renewable energy infrastructure and re-join the Paris Climate Accord to restore environmental protections undone by the Trump administration.

With regards to Biden’s economic policy, first thing on his agenda is another fiscal rescue package to keep the economy afloat until the end of the pandemic. Moreover, Biden plans to create 5 million new jobs through his “Buy American” plan, wherein the government would buy $400 billion worth of American products and services and a further $300 billion would be spent towards R&D. Biden is planning to increase Federal revenue by more than $3 trillion over 10 years by raising taxes for corporations and high-income filers. In addition, Biden would more than double the Federal minimum wage to $15 an hour, to spur economic growth by giving workers more to spend, increasing both demand and business revenue. We reckon that Joe Biden would first prioritize on combating the Coronavirus pandemic and the deal with aftermath once things go back to normal. Also, investors would keep an eye on how Biden builds his foreign relationships, especially with China and Russia.

What Next for Oil Markets?

Coronavirus pandemic caused a significant amount of volatility in crude oil prices in 2020, as oil demand was subdued due to the halt in global economic activity, while the recovery in prices was during the fag end of the year was led by continued production cuts from the Organization of the Petroleum Exporting Countries and its allies (OPEC+) as well as optimism surrounding the developments in the Coronavirus vaccines. For 2021, the OPEC expects global oil demand to rise just by 5.9 million barrels per day (bpd) at 95.9 million bpd, amid threat of demand drop from the second wave of Covid-19 infections. The OPEC+ group has agreed to increase crude oil output by 0.5 million bpd from January, bringing the production cuts at 7.2 million bpd. In our opinion, oil markets would remain optimistic in 2021, as the beginning of vaccination programs from major countries has brighten the economic recovery and oil demand outlook. However, uncertainties surrounding the Covid-19 developments would decide the actual trajectory of the commodity.

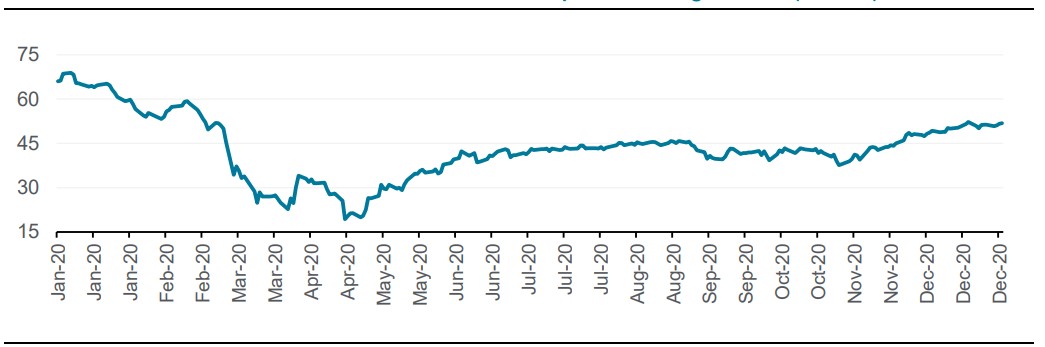

Oil Prices Steadied from Middle of the Last Year and is Expected to Surge in 2021 ($/barrel)

Source: Bloomberg

The US Energy Information Administration (EIA) has forecasted Brent crude prices to average $49 per barrel in 2021, on the back of rising global crude oil demand and subdued OPEC+ oil output. EIA expects oil prices to get support from the combined effect of lower supply expectations from OPEC+ countries and strong market expectations for a recovery in global oil demand. Goldman Sachs has projected Brent crude prices to average $65 per barrel in 2021, citing mass vaccinations and the limited rise in production from OPEC+ as factors driving the upward trend. Looking ahead, we believe oil prices will stabilize in 2021, in line with the global economy.

Going Green Globally – A Call to Embrace Sustainable Investing/Business Practices

The severe impact of COVID-19 on global economy in such a short span of time led policymakers and investors to draw parallels between a pandemic and climate change. The Coronavirus pandemic serves as nature’s warning against climate change, as it increases the likelihood of COVID-type pandemics through changes in the habitats of disease vectors or increased inter-species contact resulting from deforestation. Further, with the increasing occurrences of wildfires, glacier meltdowns, coral bleaching and other such catastrophic events, climate change is clearly taking place in front of our eyes.

On the bright side, steep decline in transportation and industrial activity, as a result of the lockdowns around the world to control COVID-19, resulted in a drop in daily global carbon emissions.

The pandemic calls for global investment funds to emphasize their priorities on investing in projects that are sustainable in nature and addresses the environmental, social and governance (ESG) risks. ESG investing seeks to generate positive returns while delivering a long-term positive impact on the society and the environment. Economists, investors and asset managers have been urging their community to integrate ESG factors into their investment strategies and to make it a defining factor while considering investments. Larry Fink, the CEO of BlackRock, has indicated that 100% of BlackRock’s portfolios will integrate ESG metrics by the end of 2020, up from 70% at the end of April 2020. According to the Global Sustainable Investment Alliance, global socially responsible investments reached $30.7 trillion in 2018 and is expected to jump exponentially in the coming years.

Where is Cryptocurrency Headed?

Cryptocurrency, especially Bitcoin, has garnered immense popularity over the past few years owing to their decentralized and regulation-free nature. Bitcoin has surpassed $34,000 for the first time as it notched record after record, indicating a growing acceptance of crypto as an asset class of its own. A Deutsche Bank survey found a majority see Bitcoin ending 2021 higher, with 41% of participants projecting a target between $20,000-$49,999 and 12% seeing it crossing above $100,000. Likewise, Ripple, Ethereum, Litecoin, Stellar, Cosmos, etc. are currently amongst the most traded cryptocurrencies across the globe and could possibly attract further investor support in the coming years as the industry moves into the mainstream.

Going forward, 2021 would witness major developments in the field of cryptocurrency as, according to the Bank for International Settlements, 80% of the world’s central banks are working on various forms of digital currency, as they would be operated and regulated by a centralized authority. Bank of Japan has revealed that it will launch the first of numerous testing phases for its own Central Bank Digital Currency (CBDC) in 2021, including the development of a test environment for the currency. Meanwhile, Facebook-led cryptocurrency project, Diem (formerly Libra), is also expected to be launched in 2021 and will form part of the social media firm’s own payment ecosystem.

However, new regulatory restrictions from federal governments will emerge as the biggest challenge for cryptocurrencies in the near term. The US Treasury Department proposed a new regulation requiring banks and other intermediaries to keep records and submit reports to verify customer identities for transactions involving convertible virtual currencies. The EU Parliament highlighted the supervisory and regulatory gaps in the cryptocurrency space and urged lawmakers to prepare a framework to regulate crypto assets.

We believe that cryptocurrencies would continue to shine in 2021 and act as an alternative investment asset that will be hard to ignore by investors, institutions, and governments.

Growing Importance of Cybersecurity

The onslaught of Covid-19 led to a surge in remote working, making cybersecurity an important aspect to consider for the corporates. Ever since the pandemic-dictated lockdown was imposed, there has been an unprecedented jump in cyberattacks carried out on the network and systems of companies across the globe. Cybersecurity firm McAfee’s report revealed that global losses from cybercrime are projected to hit nearly a record $1 trillion for 2020, as the Coronavirus pandemic gave new opportunities for hackers to target consumers and businesses. Companies which rely on online service delivery are threatened by increased instances of cyberattacks including data theft, ransomware, malware, etc. In 2020, multinational companies like Marriott International and EasyJet suffered cyberattack incidents which compromised on the personal information of their customers. The New Zealand stock exchange was hit with several cyberattacks in August and September, forcing the exchange to even halt trading at times. However, the biggest of them perhaps was when the US government confirmed that dozens of email accounts at the US Treasury Department were compromised while hackers gained access to the networks of the US Energy Department.

Even though most companies had planned to add cybersecurity on to its agenda for the last few years, the onslaught of Covid-19 has only accelerated that process. According to a Cisco study, more than 70% of the organizations in India experienced a 25% or more rise in cyber threats or alarms since the pandemic broke out. UAE Government Cyber Security Head revealed that the emirate witnessed a whopping 250% surge in cyberattacks, citing the situation as a cyber pandemic. In our opinion, companies would ramp up their spend on the multi-level security of their systems in the coming years, since a significant part of their workforce would be permanently working remotely, where home networks are susceptible to attacks. Even government agencies would be keen on upgrading their digital security infrastructure capabilities to avoid incidents that poses threat to national security.

DISCLAIMER

This document is strictly private, confidential and personal to its recipients and should not be copied, distributed or reproduced in whole or in part, nor passed to any third party.

The information provided in this report is for general guidance and information purposes only. Under no circumstances the information contained in the report is to be used or considered as a formal financial, investment advice or any other advice, or an offer or solicitation of an offer to buy or sell, or as recommendation or endorsement of any security or other form of financial asset. The report is not to be considered as investment research or an objective or independent explanation of the matters contained herein.

The information in the report is obtained from various sources per dating of the report. Sidra Capital have taken reasonable care to ensure that the material information contained herein is in accordance with the facts and contains no omission likely to affect its understanding.

Sidra Capital makes no representations or warranties whatsoever, as to the accuracy or completeness of this report and Sidra Capital expressly disclaims any liability of whatever nature whether (direct or indirect), or responsibility for the accuracy of the information contained in the report.

The information contained herein may be subject to changes without prior notice. Sidra Capital does not accept any form of liability, neither legally nor financially, for loss (direct or indirect) caused by the understanding and/or use of this report or its content. This report is only intended for the recipients, and should not be copied or otherwise distributed, in whole or in part, to any other person without the prior written approval of Sidra Capital.