Private Equity Trends & Opportunities

Subscribe to our Insights Leave your email address to be the first to hear about insights.

- Despite the COVID-19 pandemic, value of Private Equity (PE) deals jumped 8.5% to $533 billion in 2020.

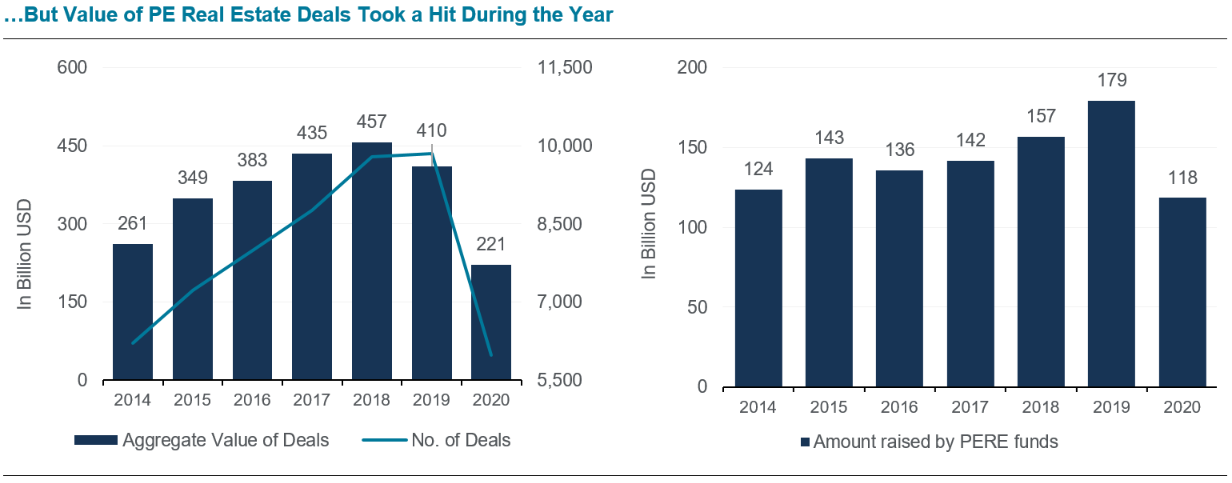

- Value of real estate deals by PE funds nearly halved to $221 billion in 2020.

- Demand for industrial portfolios remained high from PE funds as e-commerce boom propelled warehousing space demand.

- Deal-making by PE funds into the real estate sector has witnessed a rebound since the third quarter of 2020.

- Global real estate funds have accumulated $300 billion in dry powder.

- Commercial real estate properties worth $146 billion have been forced into distress or bankruptcy.

- PE funds poised to exploit grab this opportunity to acquire real estate portfolios as global economy rebounds in 2021.

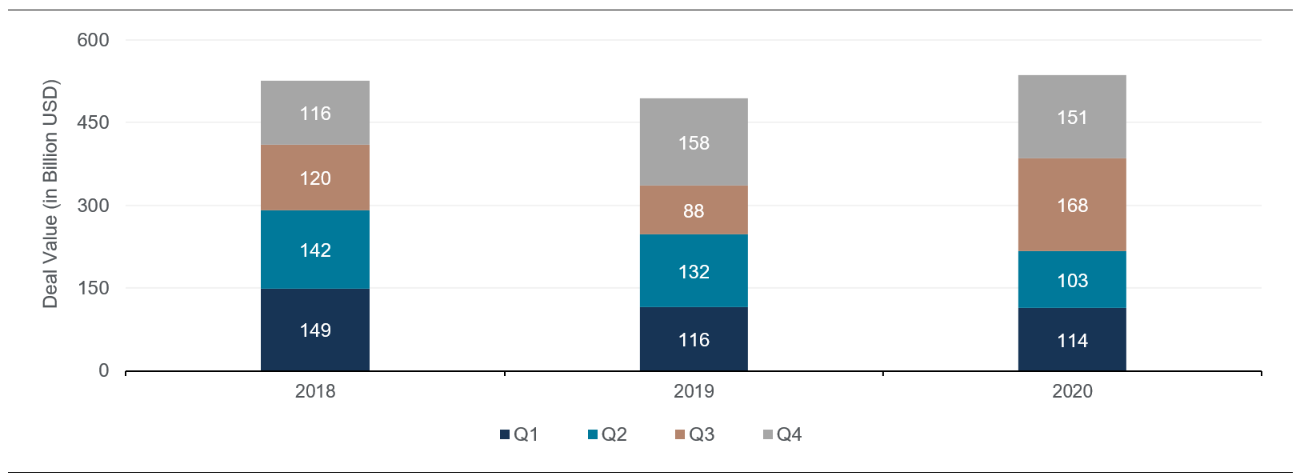

Despite the challenging environment of 2020 the global PE industry showed resilience and adapted to the new business environment. In the immediate aftermath of the pandemic at the end of Q1, the PE market saw a significant slowdown in deal-making which continued until Q2. As economic conditions stabilized in Q3, PE investors turned their attention back to executing and closing deals, pushing the sector into a rebound in the second half of the year. According to S&P Global, total quarterly transaction volumes in Q3 touched a 3-year high, recording a 90% year-on-year jump to $168 billion. Although deal count fell slightly in Q4, capital deployment stood at $150 billion, nearly at par with Q4 2019’s level of $158 billion, bringing the total amount invested in H2 2020 to nearly $320 billion, compared to $246 billion in H2 2019. Overall, annual PE transaction volumes rose 8.5% to $533 billion in 2020 compared to $494 billion in 2019.

Value of PE Deals Globally Rose in 2020 Despite Pandemic-Led Impact…

Saudi Arabia Residential Real

Source: S&P Global

Real estate has been a key sector for PE funds investing in alternative asset classes. PE funds have supported high net worth individuals, as well as institutions like endowments and pension funds, invest in equity and debt holdings related to real estate assets. PE funds have poured investment in real estate as the sector can offer a mix of high current income as well as capital gains due to price appreciation over the longer term, despite lower liquidity.

Source: Preqin, Bloomberg

According to Preqin, the number of deals completed by global private equity real estate (PERE) funds plummeted to 5,979 in 2020 from 9,848 in 2019, while the total aggregate value of real estate deals fell to $221 billion from $410 billion in 2019. Moreover, the total capital raised by PERE funds plunged more than a third to $118.4 billion in 2020, as the global economy was battered due to the pandemic. However, within the sector, there are clear clear winners and losers. The industrial real estate market was the most sought-after segment, with PE funds including Blackstone Real Estate Income Trust, KKR, Hines Global Income Trust, competing to acquire industrial portfolios. This demand was driven by the COVID-19 e-commerce boom which led to higher demand for warehousing space as well resiliance demonstrated by the segment during the pandemic.

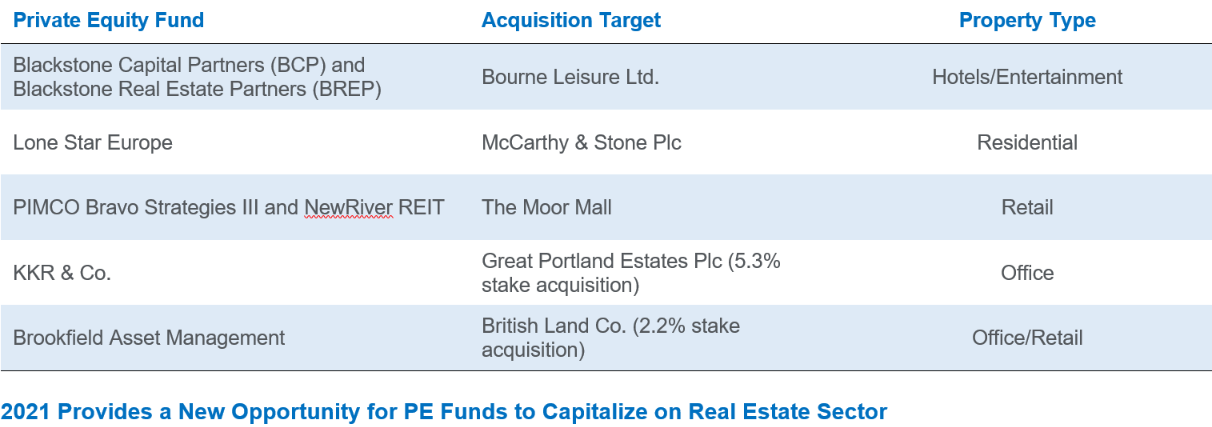

Recent Jump in Activity from PE Funds is Stirring Real Estate Sector Back to Life

Since the third quarter of 2020, there has been a strong uptick in the deal-making activity by PE funds in the real estate space, which is raising investor hopes that the sector could recover faster than expected in the near term. Below are few deals made by top PE firms recently in the real estate market:

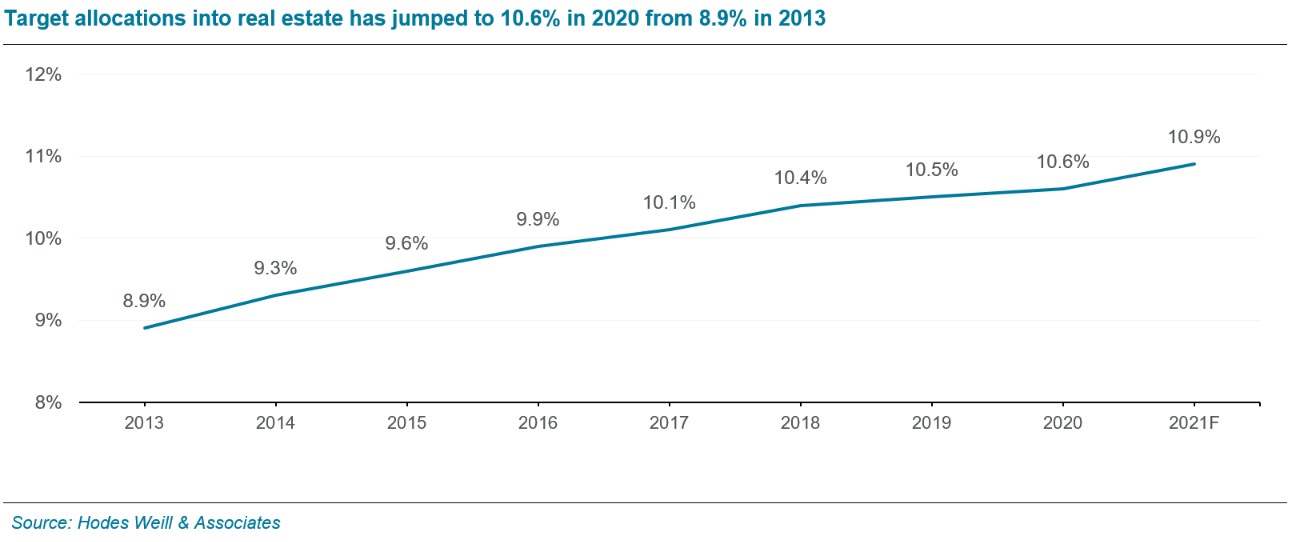

The rollout of vaccines has given rise to cautious optimism that the global economy will improve in the second half of the year as lockdowns can be lifted, despite the real estate investment activity remaining below pre-pandemic levels. According to Preqin, buyout firms’ global real estate funds have accumulated more than $300 billion of dry powder, indicating of the opportunity for the real estate sector to capitalize on the ongoing economic rebound. Moreover, the availability of debt at low-interest rates will continue to lend support to real estate funds, while investors will continue to be attracted to the sector because of its ability to generate income. According to the Hodes Weill & Associates’ 2020 Institutional Real Estate Allocations Monitor, globally investors targeted a 10.6% allocation to real estate in 2020, which was 8.9% in 2013 and is expected to rise to 10.9% in 2021.

Lockdowns pushed nearly $146 billion of commercial real estate into distress, serious risk of bankruptcy or default by the end of last year as incomes of hotels, leisure parks, and malls dried up due to restrictions put in place to combat COVID-19. However, government support and bank forbearance, which saw banks offer breaks of up to 18 months, helped keep delinquency rates low and distressed assets temporarily out of the market.

That said, with nearly $430 billion of commercial real estate debt coming due this year and fading government support, we expect to see attractive real estate opportunities arise throughout the year and increased investment activity by PE funds in 2021 and beyond. In particular, and directly as a result of global vaccine rollouts gathering steam, we anticipate hotels, student accommodation, and other travel and entertainment assets to be transacted in a significant way during the latter half of this year.

Additionally, the global economic recovery, along with low prevailing interest rates, will prompt asset managers and capital allocators to contemplate their investment strategies and reconsider allocations to the real estate sector. The Industrial real estate segment, in particular, will continue to grow in attraction driven significantly by the ever-increasing demand for warehouse space as the structural behavioral shift from buying offline to online gathers pace.

Notwithstanding our optimism in the medium to longer term, we see the resurgence of COVID-19 infections and emergence of new virus variants as near-term headwinds.

DISCLAIMER

This document is strictly private, confidential, and personal to its recipients and should not be copied, distributed, or reproduced in whole or in part, nor passed to any third party.

The information provided in this report is for general guidance and information purposes only. Under no circumstances the information contained in the report is to be used or considered as a formal financial, investment advice or any other advice, or an offer or solicitation of an offer to buy or sell, or as recommendation or endorsement of any security or other form of a financial asset. The report is not to be considered as investment research or an objective or independent explanation of the matters contained herein.

The information in the report is obtained from various sources per dating of the report. Sidra Capital have taken reasonable care to ensure that the material information contained herein is in accordance with the facts and contains no omission likely to affect its understanding.

Sidra Capital makes no representations or warranties whatsoever, as to the accuracy or completeness of this report and Sidra Capital expressly disclaims any liability of whatever nature whether (direct or indirect), or responsibility for the accuracy of the information contained in the report.

The information contained herein may be subject to changes without prior notice. Sidra Capital does not accept any form of liability, neither legally nor financially, for loss (direct or indirect) caused by the understanding and/or use of this report or its content. This report is only intended for the recipients, and should not be copied or otherwise distributed, in whole or in part, to any other person without the prior written approval of Sidra Capital.