UK Office Property Market Characterized by Continued Flight to Quality

Subscribe to our Insights Leave your email address to be the first to hear about insights.

- The third quarter was rather subdued as evidenced by QoQ rise in Central London office vacancy rate and decline in take-up.

- The separation of the office market into best and the rest is gaining momentum, with Grade B space staying on the market for longer periods and Grade A stock that meets stipulated EPC ratings seeing lower vacancy

- The flight to quality continues to intensify underpinned by the significant year-to-date take-up of Grade A space in London City

- The increased investor caution due to the rising cost of debt and expansion of yields could dampen transaction activity in the next 12 to 18 months

Deteriorating Economy Begins to Weigh on Office Market

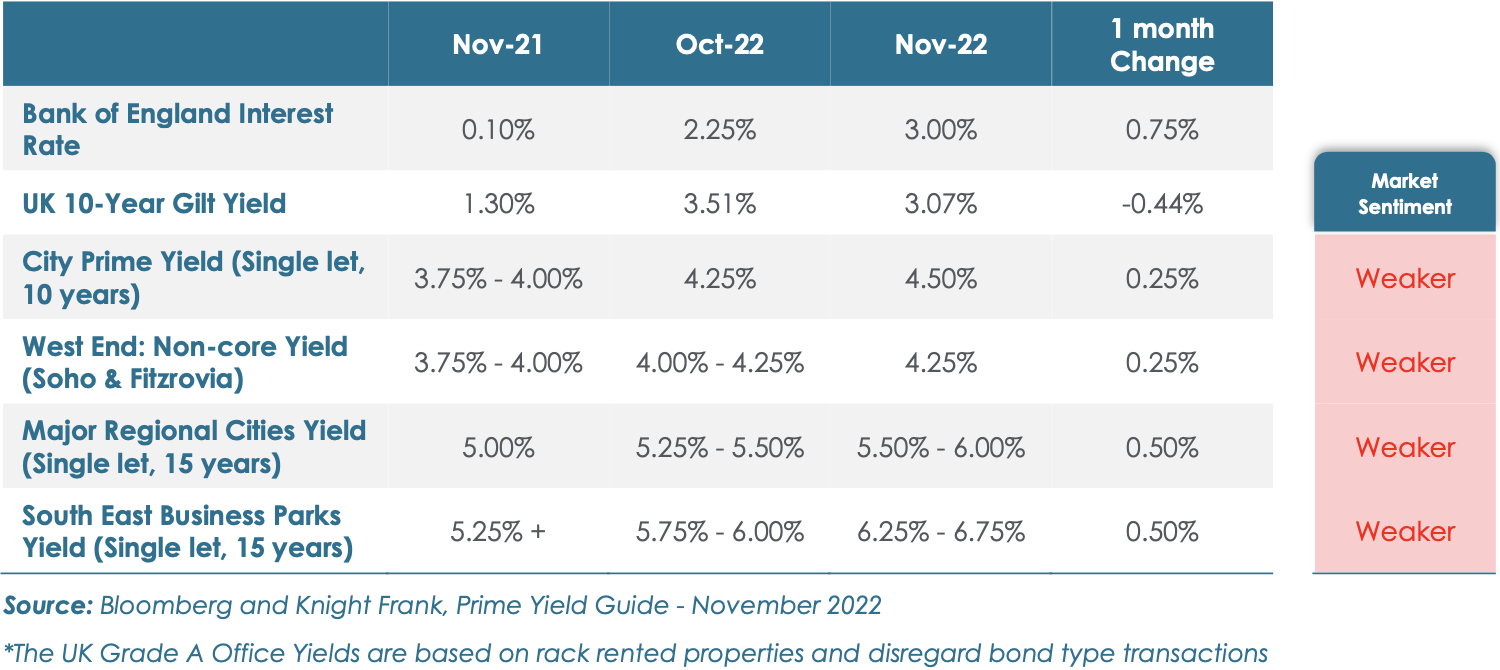

The UK economy is battered by recession concerns and runaway inflation. The rise in vacant office space in the UK, normalization of hybrid mode, and firms resorting to cost-cutting strategies, coupled with the double whammy of rising interest rates and gilt yields have created an uncertain outlook for the office sector. This has triggered the expansion of yields and dramatic price corrections.

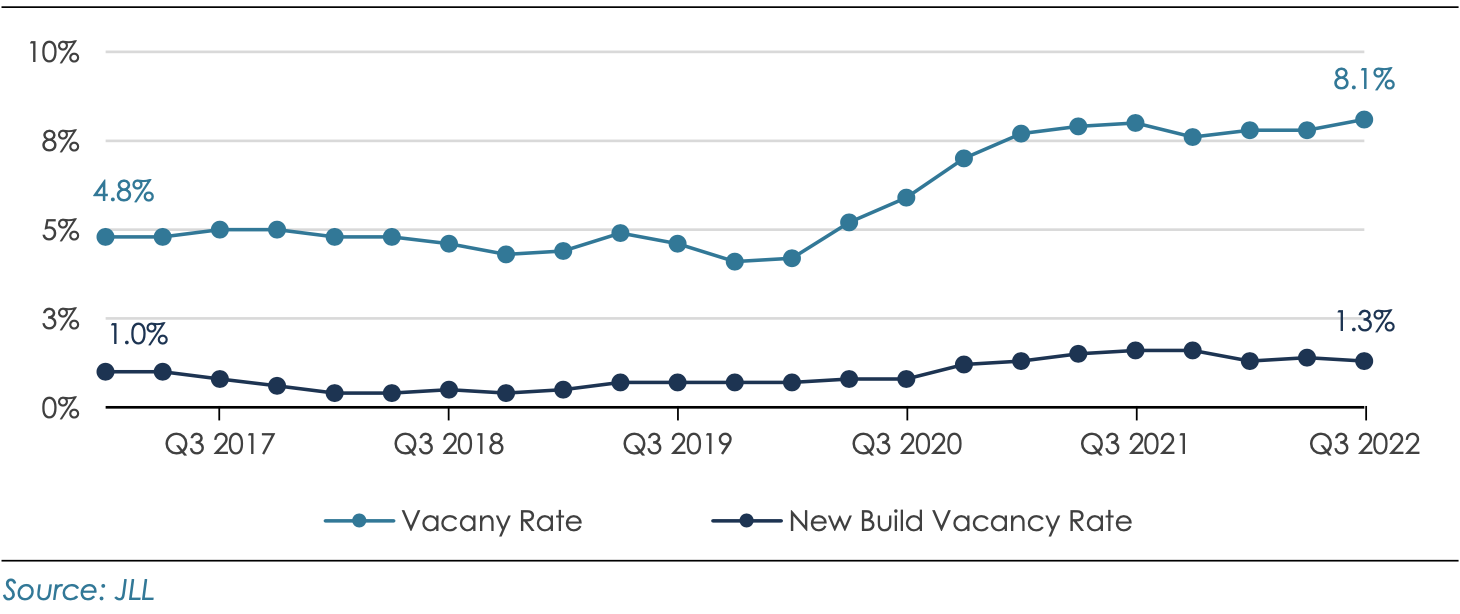

Following a strong first half of the year, the third quarter of 2022 was quite subdued as Central London take- up declined 6% quarter-on-quarter, and the vacancy rate ticked up. The overall vacancy rate in Central London reached a high of 8.1% in Q3, a major chunk of which is accounted by second-hand space. Nevertheless, the occupier demand remains strong as workers have started returning to offices with flexibility under the hybrid working model. As tenants increasingly seek best-in-class quality prime space, there is a continued shortage of new build space, especially that complies with the minimum standards on energy performance certificates (EPCs). As a result, the new build vacancy rate declined by 0.1% QoQ to 1.3% in Q3.

Though vacancy rates have inched up, the investment volumes buck the sentiment in the space. Investments across Central London stood at £3.2 billion in Q3, recording a rise of 16% on second-quarter volumes but remained below the 10-year quarterly average of £3.8 billion. In the West End region, the largest share of investment volume came from UK investors, which was followed by Malaysian investors. The Q3 Central London leasing volume declined marginally versus Q2. By sector, the tenant demand was dominated by TMT and Professional services, which accounted for 19% and 17% of the take-up respectively. The space continues to witness polarisation of demand – with the market’s appetite gravitating towards best-in-class Grade A stock.

The Exodus from Grade B Stock to Grade A Stock

The tenant demand is increasingly tilted towards best-in-class sustainable office space catalyzed by the requirements under Minimum Energy Efficiency Standards (MEES) regulation to meet standard minimum EPC ratings. The demand has further intensified with the normalization of hybrid working, increased emphasis on ESG compliance, and the need to create collaborative workspaces. The firms in their bid to draw the workforce back to the office and simultaneously reduce their operational costs are now increasingly opting for smaller office spaces with state-of-the-art facilities.

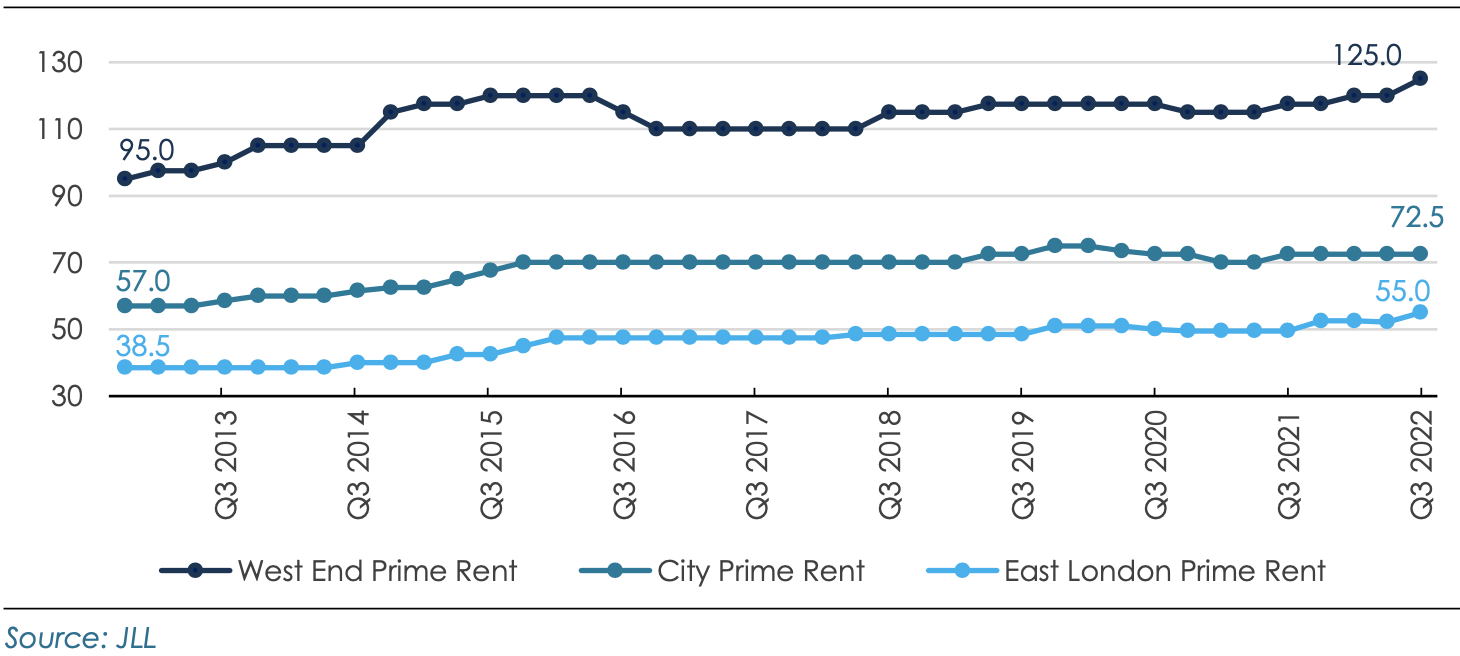

The continued shortage of high quality office space across Central London has supported growth in rents. Prime offices and Grade A stock has enjoyed stable rental growth. In addition the rental uplifts for Prime/Grade A offices are further supported by the tight supply conditions, with new and newly refurbished space supply getting constrained, partly on account of the inflation-induced disruptions.

Price Discovery Continues to be Challenging

Since the pandemic, the interest rates and UK 10-year gilt yields were comparatively low which made investments in the office sector an attractive alternative. The availability of capital at pretty low interest rates provided a cushion to leveraged buyers. However, the onset of Russia-Ukraine war started an inflationary spiral. Consequently, the Bank of England shifted to the hawkish mode raising interest rates at a pace never seen before. The higher cost funding and expansion of yields is reflected in real estate deals usually with a lag. This could trigger a fall in capital vaues by as much as 20%.

This dynamic could pull leveraged investors back out of the market and reduce investments in the sector. The market has now tilted in favour of buyers with assets being sold either at a discount or at moderated prices. In terms of investments, the third quarter was the dullest Q3 on record in the West End market (excluding the pandemic period), with assets worth only £1.0 billion being transacted and 25 transactions being concluded. Year to data through Q3 transactions amounted to £4.4 billion, below the pre-pandemic five-year average of £5.3 billion.

Outlook

The prevailing concerns over the UK economy heading into a recession means employment levels are expected to decline. Given hybrid work is here to stay, the office becomes a collaborative destination for employees and will assume greater role in retaining and attracting talent. This bodes well for occupancy levels going forward. However, the economic uncertainty could impact office space take-up in the near to medium-term – at least until the first half of 2023. Besides, rapidly increasing debt costs and risk-free rates have made price discovery challenging and has put further upward pressure on yields. Consequently, investors would likely adopt a cautious stance making them negotiate considerable price reductions or step back from transactions until pricing subsides. Interestingly, the market dislocation could afford attractive investment opportunities for non-bank lenders in the market.

As the demand for sustainable space that meets stipulated EPC ratings remains at the top of occupier requirements, the flight to quality will continue to remain a dominant theme for the forseeable future. This coupled with inflation-induced undersupply and a contracting development pipeline is expected to sustain the rental uplifts for best-in-class space. The disconnect between Grade A and Grade B office rents is expected to widen further. The real estate landlords and investors who can play their model to this theme will be well positioned to command strong rental income and capital value appreciation going ahead.