US Office Real Estate Report

Subscribe to our Insights Leave your email address to be the first to hear about insights.

Key Highlights

- The US office vacancy rate has reached historical highs due to significant decline in the usage of office space post-pandemic and as occupiers are bracing for an impending recession in the first half of 2023

- There is continued flight to quality which makes the demand for office space increasingly polarized, with demand moving towards Class-A buildings that are in prime locations and possess rich amenities

- With the significant layoffs in the US-based technology sector and a swift pullback in office job postings, the office market fundamentals are likely to remain challenged in the near-term

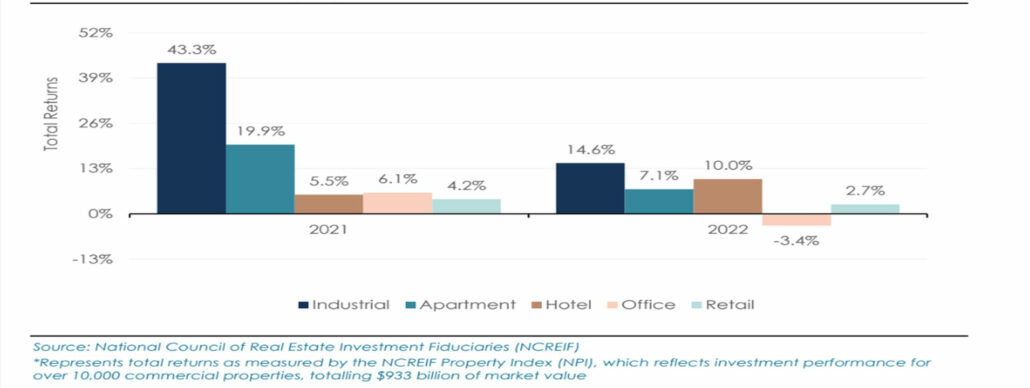

- Office properties delivered negative returns in 2022 underperforming other real estate sectors, reflecting significant decline in capital values during the year

The Covid-19 pandemic brought a structural shift in the demand for office space as hybrid and remote work became more prevalent. The beginning of 2022 saw the caseload from the Omicron variant spiking in the US. The subsequent months brought other challenges – Russia-Ukraine war, significant surge in interest. rates as the US Fed attempted to tame inflation, rising construction costs, and slowing economic growth. These dynamics affected demand for office space, translating into elevated vacancy rates, slower leasing activity and negative net absorption particularly during the second half of 2022.

National Vacancy Rate at Record Highs Since the Great Recession

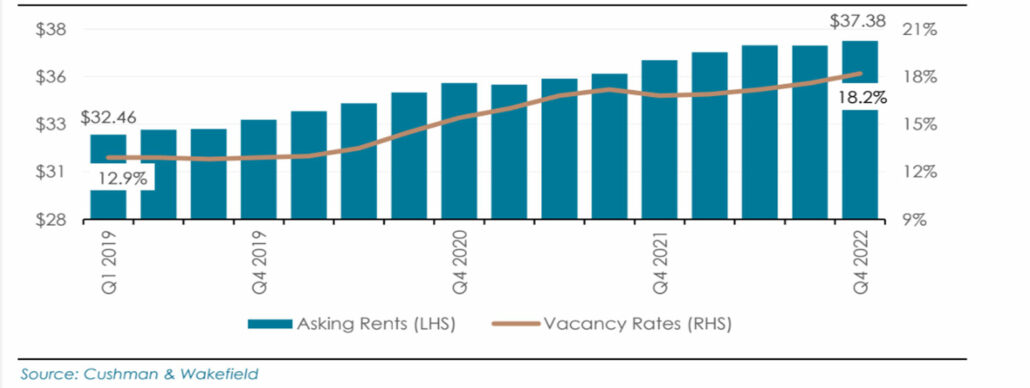

US office vacancy has risen for the past 13 quarters and surpassed 18% in Q4 2022 for the first time on record. The overall US office vacancy rate stood at 18.2% in Q4 2022, with about a third of US markets (27 out of 90 markets) running above 20%, according to Cushman & Wakefield. This represents a 140-bps increase over Q4 2021. The office demand, which appeared to be stabilizing in the first half of 2022, started declining again in the second half of 2022. Tenants continued to place significant space on the sublease market to lower costs, driving sublease inventory and vacancy. The confluence of factors – slowing demand, new sublease additions and sizeable new construction deliveries – have resulted in the increase in vacancy. Notably, 40% of new vacancy in 2022 was due to the sublease space available. The recent rise in layoffs in the US technology sector amid economic turmoil has been the largest contributor to the surge in sublease availability, generating 54% of the new additions in Q4, according to JLL. Interestingly, the US average asking rents have continued to rise driven by relative shortage of high-quality space, which has aided landlords to preserve rental rates. National effective asking rents (per Cushman & Wakefield) rose by 2.8% YoY in Q4 2022 to $37.38 per square feet (psf). However, the prevalence of concession packages such as tenant improvement (TI) allowances undermined the positive rent growth. TI allowances rose by 10% in 2022 and grew about 19% over the past three years, according to JLL.

Overall Vacancy Rate and Asking Rent (in $)

Investment Volumes Remained Subdued in 2022

The annual investment volume declined 25.3% YoY in 2022 to $101.1 billion as per JLL, mainly driven by diminished investor appetite for large scale transactions owing to higher financing costs. The rising debt costs have brought yields into greater focus, translating into a mismatch between seller and purchaser price expectations and making the price discovery elusive. The expectations for tapering by the US Fed in 2023 is expected to bode well for financing markets and would likely boost investment activity in the office. space.

Historical Sales Volume Transaction

US Office Real Estate vs Other US Property Types

Total returns for US core office real estate, as measured by the subindex of the NCREIF Property Index (NPI), slipped to -3.4% in 2022 from 6.1% in 2021. Notably, the returns turned negative in the third and fourth. quarter of 2022 delivering -0.66% and -4.80%, respectively. Across sectors, office market underperformed and was the only sector delivering negative returns in 2022, reflecting significant write-down of office properties during the year.

Total Returns of Various US Property Sectors

Surge in Addition of Space on the Sublease Market Drives Negative Net Absorption

As per Cushman & Wakefield, each quarter of 2022 registered negative net absorption, with Q4 marking the tenth negative quarter in the past eleven quarters. This has been mainly driven by significant additions of sublease space in the second half of the year, coupled with downsizing activity by major corporates.

Outlook

While the broader macroeconomic environment and the office market fundamentals remain challenged, certain segments are expected to outperform the market. High-quality office assets will continue to command healthy leasing activity and better rents led by prevailing trend of flight to quality that drives substantial demand for highly-amenitized buildings. Office demand generally moves in tandem with prospects of job creation, especially in office-using industries such as technology and financial services. The ongoing massive layoffs in the US tech sector further dampens the prospects for office demand considerably. Although the new office construction supply has moderated in recent quarters due to economic uncertainty, it still remains high enough to exceed the demand in the near to medium-term. As a result, the overall US office vacancy rate is expected to remain elevated in 2023. However, as employers increasingly consider return-to-office as a catalyst for. enhacing productivity and collaboration, the US office market is anticipated to do well over the long-term.