Global Private Debt: Attractive Risk-Adjusted Performance Thus Far, But Distress Could Increase Ahead

Subscribe to our Insights Leave your email address to be the first to hear about insights.

Key Insights

- Global Private Debt (PD) fundraising maintains a healthy pace, even in the face of macroeconomic challenges, with direct lending and mezzanine strategies emerging as the top choices.

- PD has demonstrated higher risk-adjusted returns over long periods and has shown relative resilience to market downturns versus other public debt market indices.

- Although defaults have been low and manageable thus far, they are anticipated to rise in 2024 due to higher interest rates and macroeconomic uncertainty.

- The growing utilization of PD deals for refinancing syndicated loans with near-term maturities and general corporate purposes (GCP) bodes well for the outlook of the asset class.

PD has increasingly emerged as a resilient and an attractive asset class within the private market and

institutional investors have been favouring PD over Private Equity (PE) in their allocations. With above $1.5 trillion in assets under management (AUM), PD has scaled to become the third-largest asset class within the alternatives space, followed by PE and real estate.

The fall in buyouts and M&A activity due to higher interest rates has created some slack in the PD market in 2023. However, this has been counterbalanced by tailwinds from shift in the uses of PD funds. Of late, the narrative in PD has been about increasing use of PD deals for refinancing large syndicated loans with near term maturities. Notably, PD deals for refinancing rose by 14% YoY in the first three quarters of 2023. Another tailwind in PD has come from signficant growth in use of deals for GCP category, which accounted for 25% share of PD deals by count in the first three quarters of 2023, up 28% YoY.

PD Fundraising Remains Buoyant Despite Macro Challenges

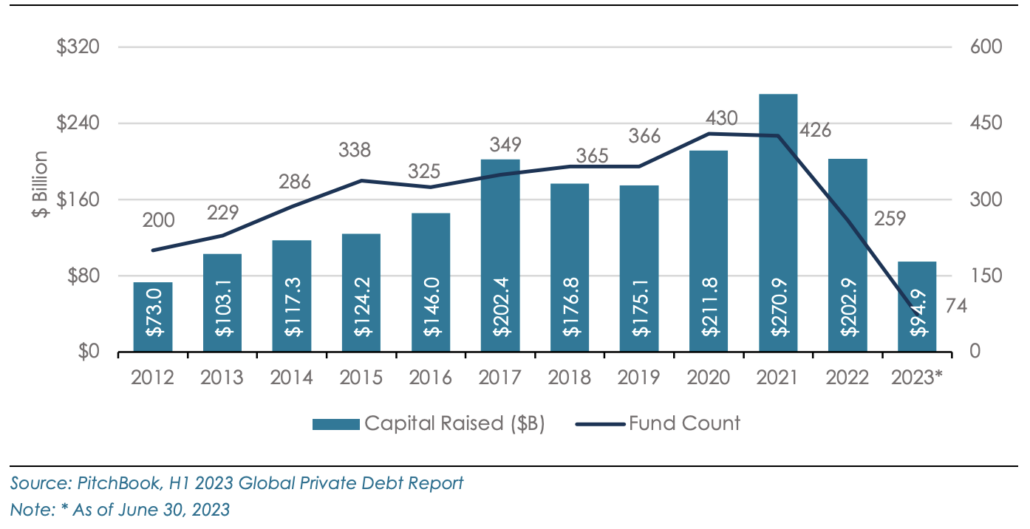

Global PD Fundraising Activity

PD fundraising continues to be strong with $94.9 billion raised through the H1 2023 (PitchBook), surpassing the $91.4 billion raised during the same period last year. PitchBook expects 2023 PD fundraising to likely exceed $200 billion for the fourth consecutive year, considering the stronger second-half seasonality. PD has now overtaken venture capital in terms of collective fundraising and now ranks second after PE within the private market. Direct lending remains the most preferred PD strategy, accounting for 32% of the total fundraising, while mezzanine funds secured the second position at around 28%, a notable surge compared to their five-year average of ~12%.

Strong Historical Returns and Resilience Compared to Public Debt Proxies

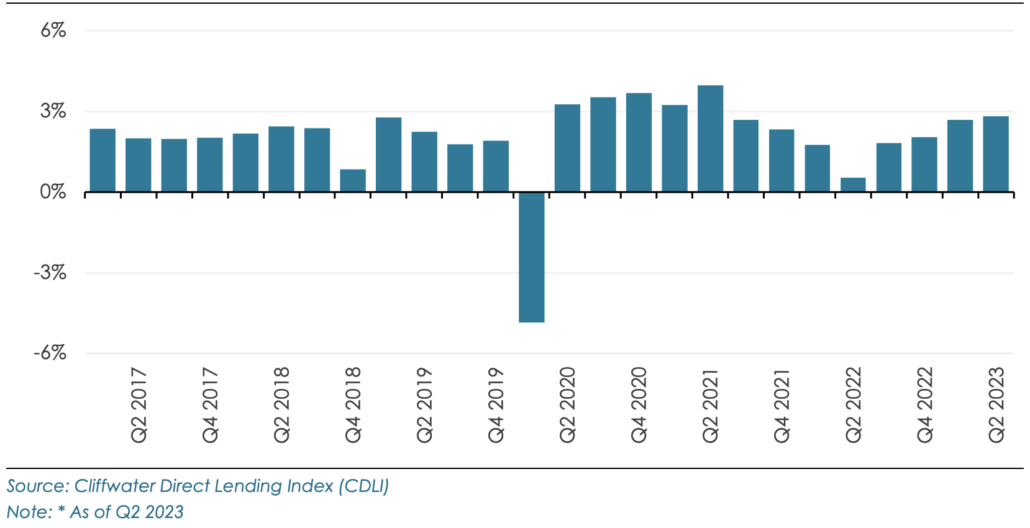

Quarterly Total Returns, 2017-2023*

The Cliffwater Direct Lending Index (CDLI), which measures the unlevered, gross-of-fee performance of US middle-market corporate loans, generated a total return of 2.81% in Q2 2023, a slight increase from the first quarter, bringing the trailing 1-year total return to 9.69%. Historically, quarterly CDLI returns have been mostly positive, showing modest downside except during severe (3 Sigma) events, making them favourable compared to most other public debt asset classes. Even during the recent COVID-19 drawdowns, private credit declined 4.6%, while high-yield bonds fell 17.7% (as per Key Wealth Institute). Notably, the CDLI has outperformed major public debt indices (viz. Bloomberg High Yield Bond Index, Morningstar LSTA US Leveraged Loan Index and Bloomberg Aggregate Bond Index) in 12 of the past 18 calendar years through 2022 and has demonstrated greater return consistency in calendar year performance.

Strong Performance by “Big-six” US-listed Alternative Asset Managers

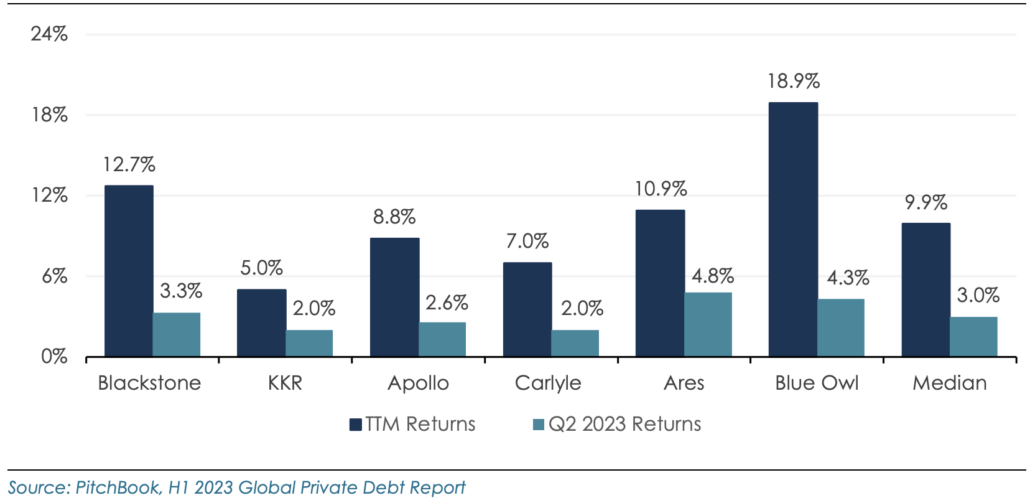

Gross PD Returns Reported by Alternative Asset Managers

The median quarterly gross return for PD funds managed by “big-six” firms (Blackstone, KKR, Apollo, Carlyle, Ares, and Blue Owl) stood at 3.0% as of Q2 2023, with a trailing twelve-month (TTM) return of 9.9%. Notably, PD outperformed PE funds (median TTM return of 9.0%) and the S&P 500 (12.0% TTM) while exhibiting lower volatility and dispersion in fund performance. These six managers have collectively raised over $150 billion for their private credit strategies over the last 12 months, constituting ~40% of their total fundraising across all private market strategies.

While Default Levels Remain Low, Distress Could Rise Going Ahead

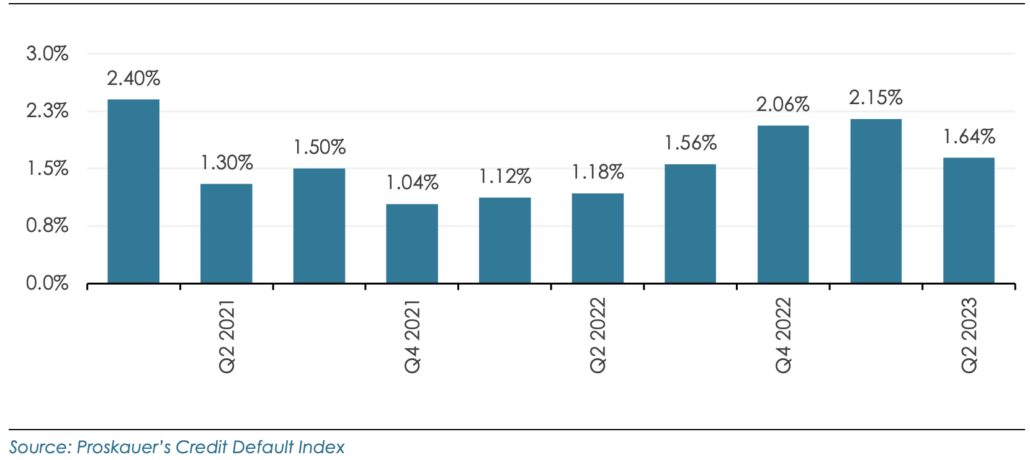

Quarterly Credit Default Rates

Proskauer’s Private Credit Default Index, which tracks senior-secured and unitranche loans in the US, reported a default rate of 1.64% in Q2 2023, marking a 50-bps decline from the previous quarter’s rate of 2.15%. Interestingly, the Proskauer’s index also revealed a decline in defaults for consumer goods/services industry for the first time since Q2 2022, ending at 5.3% in Q2 2023 (versus Q1 2023 default rate of 8.0%). Though default rates have remained manageable until now, they are likely expected to rise in 2024. Bank of America (BofA) expects private credit defaults to likely reach 5% in 2024 surpassing syndicated loan defaults (at 3%). The investment bank sees greater risk of default particularly in older vintage funds with highly levered deals.

Asia Pacific (APAC) PD Spotlight

Bright Prospects for Region’s PD Market

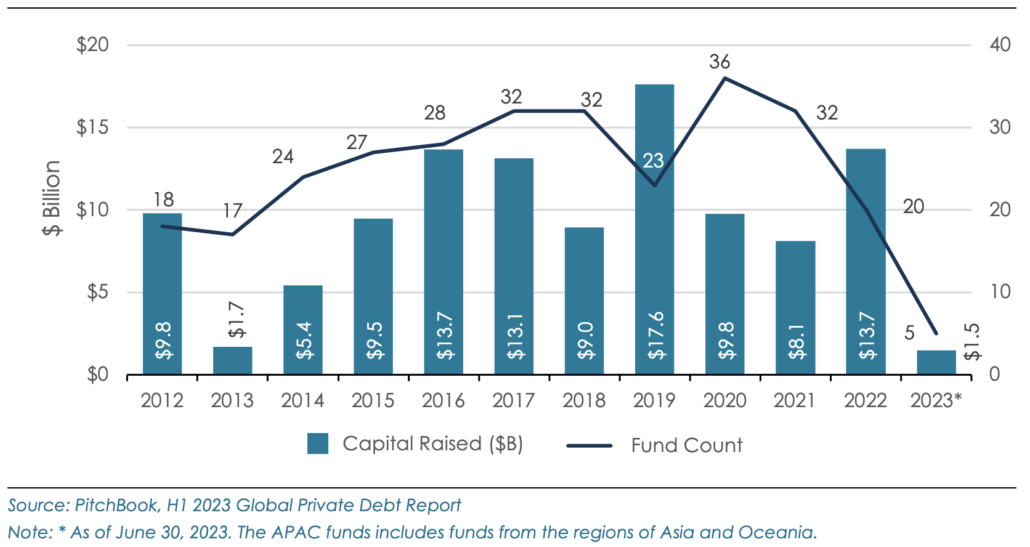

APAC PD Fundraising Activity

PD in APAC, even though a small proportion of the $1.5 trillion global market, has been steadily growing. SMEs are the mainstay of many Asian economies. Banks in the APAC region have become risk-averse and cautious in the wake of Basel II capital requirements, leading to stringent lending norms and greater scrutiny of borrowers. Hence PD continues to be the go-to source for many SMEs as PD lenders are less constrained by the regulatory requirements.

As of H1 2023, APAC PD fundraising amounted to $1.5 billion, which is broadly inline with fundraising in H1 2022 (as per PitchBook). Though PD has matured into a well-established asset class with normalized returns in the US, the APAC region has long trailed its Western counterpart and is now gradually catching up on the trend. Preqin expects significant growth potential for PD in APAC region as it currently holds only 6% of the total global assets in this segment. While direct lending is the top strategy employed in more developed PD markets especially the US, special situations and mezzanine funds predominate in APAC.

An increasing number of institutional investors have either entered or are actively pursuing investments within the region. Recently, Hillhouse, backed by Yale University’s endowment, announced the launch of a new Asia-focused PD fund which could potentially raise ~$1 billion in assets. Also, US-based Muzinich & Co. closed its first PD fund for APAC in July at $500 million with $200 million contributed by Singapore-based DBS Bank as its anchor limited partner (LP). Furthermore, Blackstone’s announcement last year to increase its APAC credit assets tenfold to $5 billion underscores the strong prospects of the asset class in the region.

Outlook

PD’s relative outperformance and superior loss protection, in contrast to other public debt markets, has led to a growing inclination among institutional investors to increase their allocation to PD. Furthermore, findings from recent surveys suggest increasing investor preference for raising allocation to PD. About two-thirds of insurance companies plan to raise their allocations to PD as per a recent survey by BlackRock.

The momentum behind PD is fueled by a slew of tailwinds, such as chance to take market share from public bank-led deals and the potential for continued deal flow resulting from add-on acquisitions made by existing portfolio companies of PE sponsors. Another promising opportunity stems from refinancing the imminent ‘maturity wall,’ where large companies that raised funds through high-yield bonds and syndicated leveraged loans are looking to secure funds from PD market. All this points to bright prospects for the PD market. However, any deterioration in the macroeconomic conditions, including the realization of a long predicted US recession, could significantly elevate default risks. Hence, investors need to tread with caution and exercise prudence by closely monitoring the earnings and free cash-flow generation of portfolio companies.