Global Private Debt: Positioned Quite Well Amid Volatility and Marco Uncertainty

Subscribe to our Insights Leave your email address to be the first to hear about insights.

- Global private debt (PD) fundraising activity remained relatively resilient in the first quarter of 2023 despite the macroeconomic backdrop, with North America leading the pack in fundraising.

- PD assets under management (AUM) have grown fourfold in the past decade reaching ~$1.5 trillion in 2022, with nearly half a trillion USD of dry powder (amount of committed, but unallocated capital).

- Empirical evidence shows that PD has outperformed various segments of public debt and has delivered better risk-adjusted returns.

- Given higher interest-rates and slowing economic growth, the credit default rates may rise going ahead.

- PD’s compelling attributes like its low correlation with public equities, enhanced call protection, and consistent cash distribution makes it an attractive all-weather asset class. As we approach mid 2023, the institutional investors are grappling with increased economic uncertainty stemming from global monetary tightening, persistent inflation, the possibility of further interest-rate hikes by

major central banks (notably US Fed and ECB), and fears of a potential recession. In this backdrop, many investors are increasing their allocations to PD for optimizing the portfolios to meet their return objectives and offer downside protection. Historical evidence suggests that PD serves as a good choice given it has exhibited relative resilience and outperformance versus traditional fixed income in an elevated interest rate environment.

PD Fundraising Remains Resilient Amid Macro Challenges

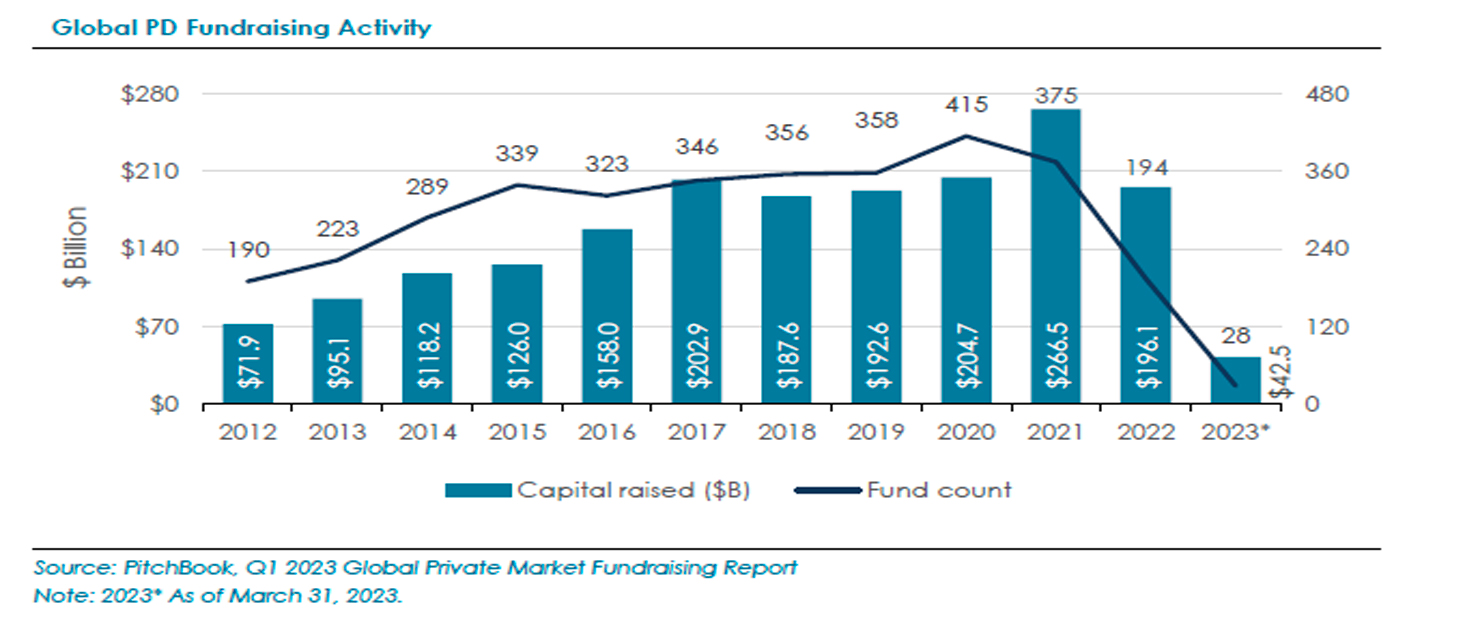

PD fundraising has largely witnessed a steady rise over the past decade. The Q1 2023 fundraising activity demonstrated resilience amid challenging macro environment, despite the fact that Q1 tends to be a seasonally weak quarter. The global PD fundraising amounted to $42.5 billion in Q1 2023, representing a slight decline compared to Q4 2022, but largely on par with the same quarter of prior year. North America accounted for 95% of the total fund value in Q1 2023 by region. Mezzanine strategy emerged as the most favored investment approach, raising $17.1 billion in Q1 2023 (~40% of total funds raised). This was followed by special situations and direct lending strategies, which contributed to 27% and 26% of the total global fundraising, respectively. PitchBook expects fundraising momentum to pick further in the remainder of 2023.

Fourfold Jump in AUM in the Past Decade

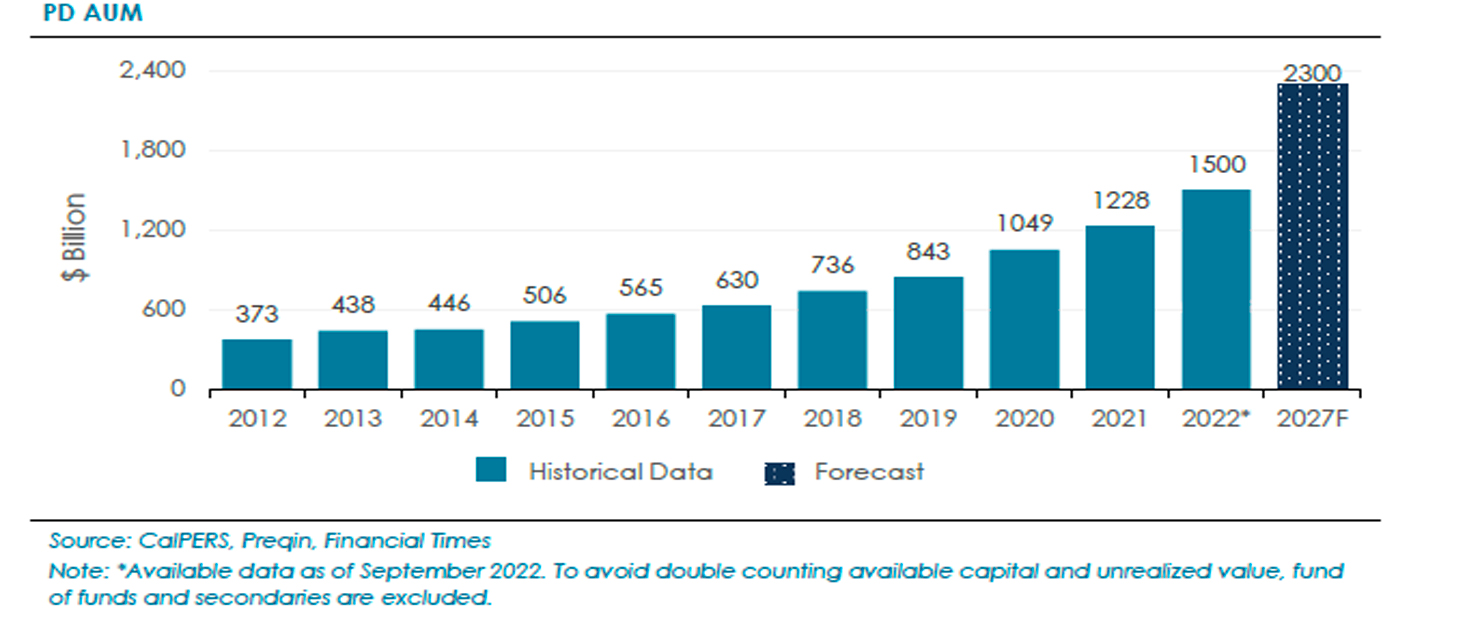

According to Preqin, AUM in PD have risen fourfold over the past decade, increasing from $373 billion in 2012 to nearly $1.5 trillion as of September 2022. Preqin forecasts PD AUM to grow at a CAGR of nearly 9% over next five years to reach $2.3 trillion by the end of 2027. Institutional investors have been raising their PD allocations and the industry is currently flush with significant dry powder estimated at $453 billion as of Q3 2022, according to PitchBook estimates. As bank credit has further tightened amid the recent banking stress, the significant PD dry powder could be swiftly deployed to facilitate deals at attractive terms for the lender.

PD has Delivered Consistent Returns in Volatile Market Conditions

PD has proven its mettle as an attractive asset class for investors, offering a reliable income stream even in volatile market environments.

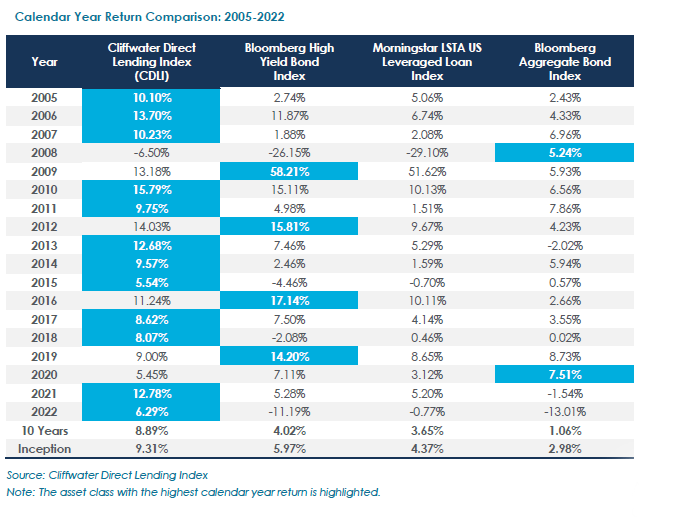

The Cliffwater Direct Lending Index (CDLI), which measures the unlevered, gross of fee performance of US middle market corporate loans, has generated a total return of 2.69% in Q1 2023, bringing the trailing four quarter total return to 7.26%. Over past periods, PD has clearly exhibited greater return consistency in calendar year performance. A historical comparison of CDLI returns to high yield bonds, syndicated loans, and investment grade bonds, demostrates CDLI’s outperformance over the three public debt indices in 12 out of the past 18 calendar years.

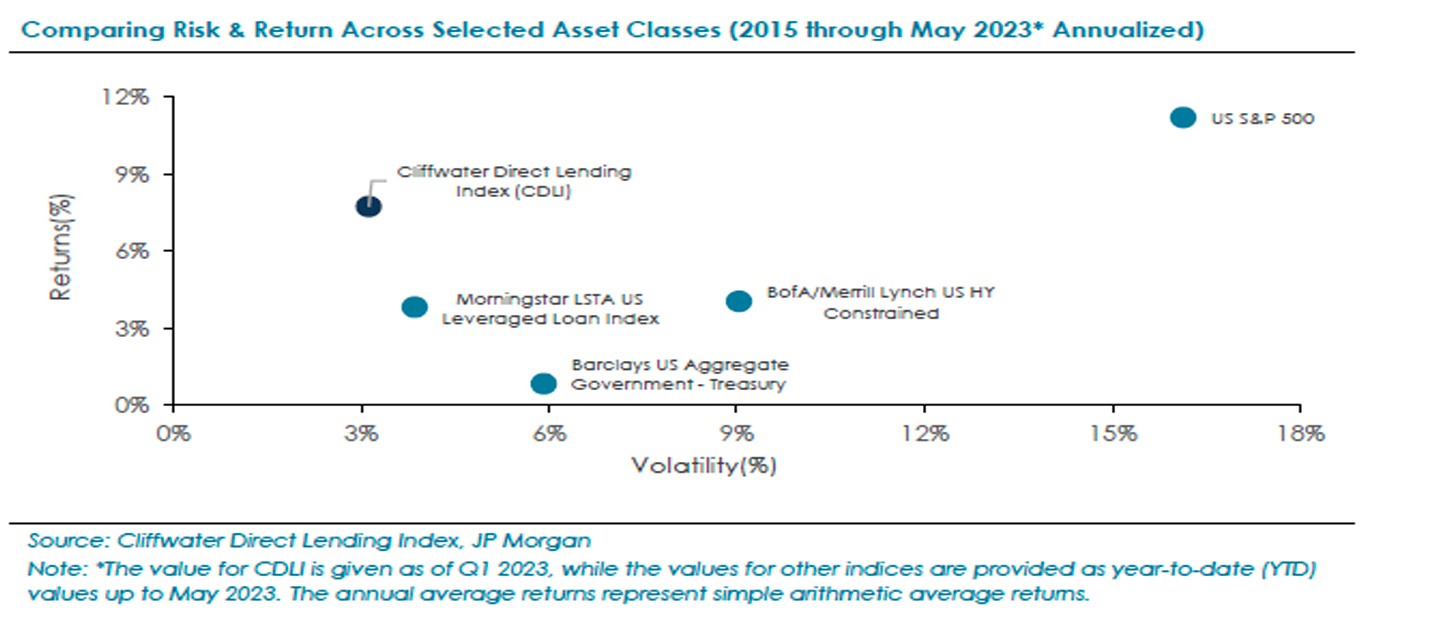

Provides Attractive Absolute Risk-adjusted Returns Over the Long Term

Historically, investors’ allocation to direct lending has helped to maximize return potential while minimizing volatility. Since 2015, the CDLI has produced average annual returns of 7.7% with a lower volatility of 3%. On a risk-adjusted basis, PD can be more attractive as compared to public equity and represents nearly 70% of the return of the US S&P 500 index while exhibiting less than one fifth of its volatility. From a perspective of credit losses too, the PD compares favorably to other public debt segments and leveraged loans. The average annual realized credit losses for middle market loans since inception of CDLI in 2005 stands at 1.03%, slightly higher compared to leveraged loans (0.92%) but well below credit losses for high yield bonds (1.49%) and bank commercial and industrial loans (2.30%).

APAC PD Spotlight

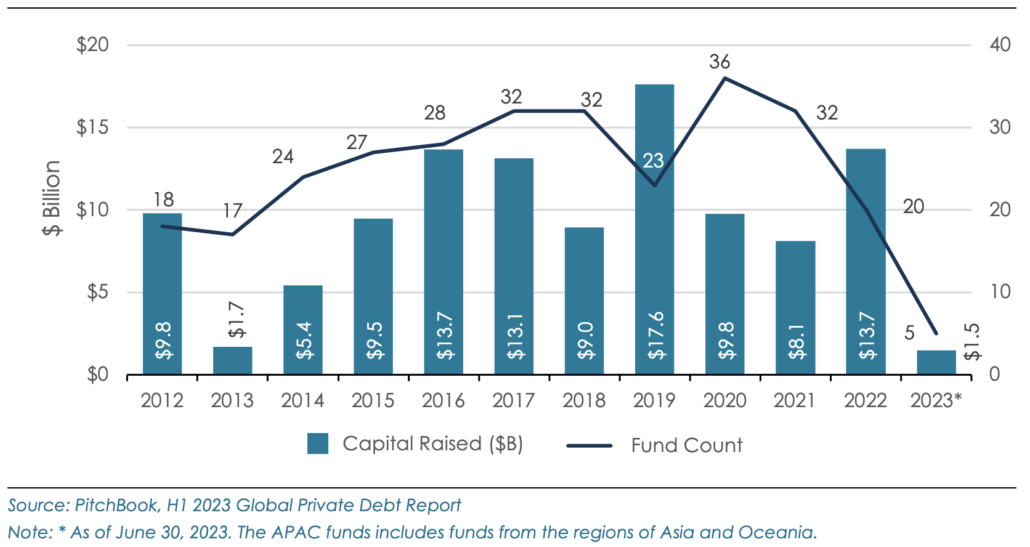

Though Fundraising Activity Has Moderated, is Expected to Jump Going Ahead

The Asia Pacific PD fundraising experienced growth, rising from $7.4 billion in 2021 to $9.2 billion in 2022, according to PitchBook. However, fundraising dropped to less than a billion in Q1 2023, mimicking the pattern of private equity. The average fund size in the region nearly doubled from $195 million in 2020 to $386 million in 2022.

In recent years, the Asian PD market has witnessed robust growth, with PD AUM surpassing $90 billion as of June 2022. Additionally, the dry powder value in the region stood at $25.2 billion in 2022, a rise of nearly 50% compared to $17 billion in 2020. A recent survey conducted by BlackRock reveals that 68% of APAC investors plan to increase their allocations to PD in 2023, surpassing the global average of 52%, indicating bright prospects for growth, as firms in the region increasingly look to diversify their credit financing away from bank loans.

Outlook

The market for PD continues to expand as traditional banks’ appetite for certain type of credits has weakened. As traditional sources of credit financing viz. public (bond) markets and banks continue to shrink, the demand for private capital alternatives remains strong. Besides, the private credit managers with capital to deploy in the current macro environment can call for more favorable terms (including higher premiums) on the loans they provide. In additon, the current situation provides avenues for deploying capital in strategies like distressed debt and special situtations.

Nevertheless, the current economic backdrop raises investors’ concerns around the direction and magnitude of credit defaults. According to the recent Proskauer Private Credit Survey 2023 (April), 76% of investors expect a surge in credit defaults within their portfolios over the next 12 months. Yet, it is evident that institutional investors remain keen on the asset class owing to its compelling attributes viz. low correlation with public equities, enhanced call protection, and consistency of cash distributions. A recent investor survey by Preqin reveals that more than 80% of investors expect to commit more or the same amount of capital to PD over the next 12 months, which underscores further growth of this asset class. The ability to deliver attractive risk-adjusted returns throughout the economic cycles has underscored the importance of PD as an all-weather investment solution.