The Electric Vehicles (EVs): Gearing Towards Mainstream Adoption

Subscribe to our Insights Leave your email address to be the first to hear about insights.

Key Insights

- The Electric Vehicle (EV) market has witnessed strong growth across all segments of road transport in recent years, with electric cars posting a record 10 million units sales in 2022.

- The sales share of electric cars in global car sales rose from 9% in 2021 to 14% in 2022, implying that one in seven cars sold globally is now an EV.

- Inadequate charging infrastructure, limited driving range, and high upfront costs are among the key buyer concerns that could deter widespread adoption of EVs.

- Original Equipment Manufacturers (OEMs) are continually raising their electrification targets and making substantial investments in EV production, technology advancements, and procurement of battery raw materials.

- The anticipated surge in sales of EVs in the future necessitates that entire EV ecosystem along with goverments’ work in tandem to remove any impediments to the sustained adoption of EVs

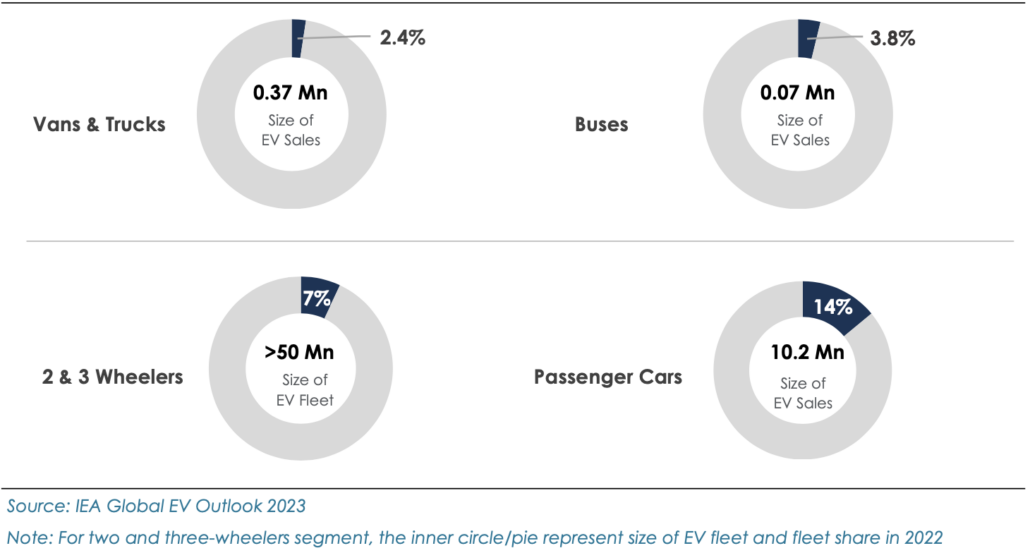

EVs’ Momentum Accelerating Across All Segments of Road Transport

In 2022, one in every seven cars purchased globally was an EV, marking a substantial increase from the 2017 figure of only one in 70 cars sold being an EV. The momentum towards decarbonizing the transportation sector is now accelerating like never before, fueled by a myriad of factors including robust policy support, advancements in battery technology, the expansion of charging infrastructure, and the introduction of captivating models by automakers. Furthermore, the reach of electrification is rapidly expanding to various other segments of road transport, encompassing two and three-wheelers, buses, and trucks.

The two and three-wheelers stands out as the most electrified market segment today, especially in emerging markets and developing economies, surpassing even cars. For instance, more than half of India’s three- wheeler registrations in 2022 were electric, underscoring their rapidly increasing popularity driven by government incentives and significantly lower lifecycle costs, particularly in the context of higher fuel prices. According to the International Energy Agency (IEA), the global sales of electric buses reached about 66,000 units in 2022, while the number of medium- and heavy-duty electric trucks sold totalling 60,000. China continues to maintain its lead position in the production and sales of electric buses and trucks.

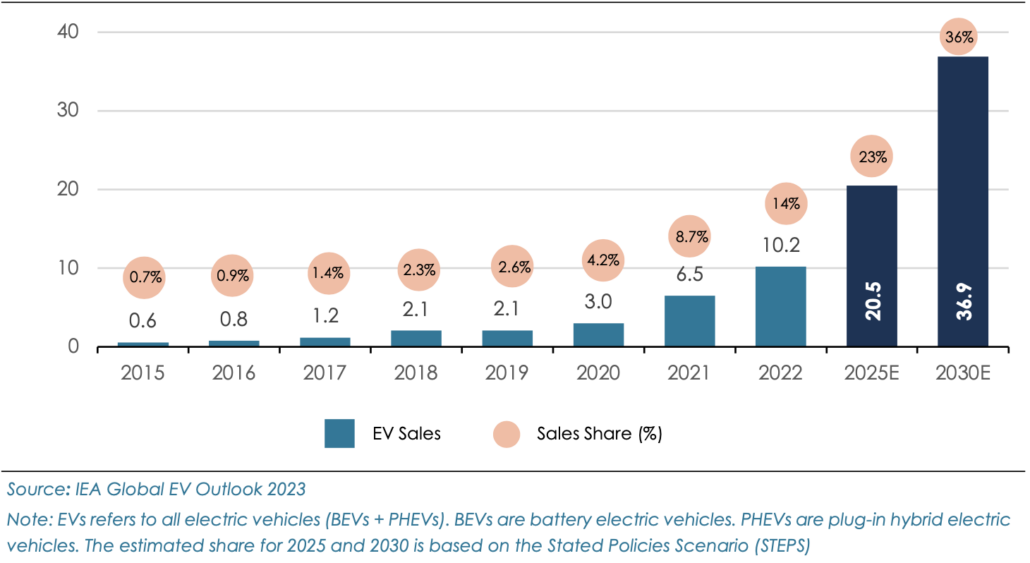

Electric Cars Witnessed Record Sales in 2022 Crossing 10 Million Mark

Global EV Car Sales (in millions) and Sales Share (%)

Global electric car sales surpassed 10 million units in 2022, showing a 55% year on year surge relative to 2021. Notably, China continued to be a frontrunner with sales jumping by 80% in 2022 and accounted for 60% of global growth. In Europe and the US, the second and third largest car markets, the annual electric car sales rose by 15% and 55% in 2022, respectively. The total EV fleet on the road in 2022 stood at 26 million, which is more than five times the number in 2018. Electric car sales experienced a rise against the backdrop of a flat global auto market. According to the International Energy Agency, over 2.3 million electric cars were sold in Q1 2023, an increase of ~25% YoY. The IEA expects electric car sales momentum to continue in 2023 to reach 14 million by the end of year, with sales share expected to rise to ~18%, up from 14% in 2022. By 2030, the IEA estimates the sales share of EV cars to reach 36% as per the Stated Policies Scenario (STEPS).

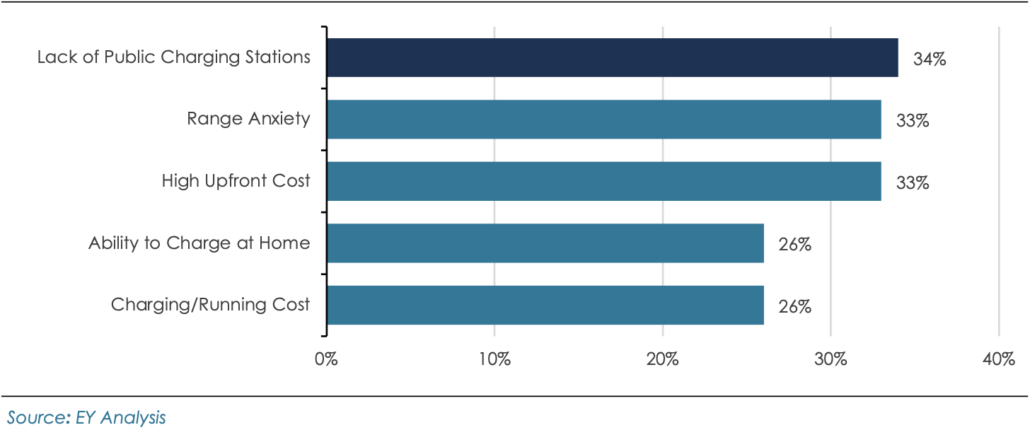

Some Consumer Concerns Could Deter Widespread EV Adoption

Consumers’ concerns about switching to EVs

The factors impeding individuals from transitioning to an EV encompass availability of charging infrastructure, limitations in driving range, battery longevity, and elevated upfront cost of purchasing an EV. According to the 2022 EY Mobility Consumer Index study, the availability of charging infrastructure remains a major concern for those considering an EV purchase, followed by range anxiety and high upfront costs. In 2022, the lack of adequate charging infrastructure hindered the purchase of an EV for 34% of consumers worldwide and the upfront cost of an EV is 30% higher compared to an equivalent ICE vehicle. EV makers are making rapid progress on each of these fronts; however, governments should continue to facilitate investments in the roll-out of charging infrastructure. In 2022, the number of public charging points available worldwide increased to 2.7 million from 1.8 million in 2021 (as per IEA). Consequently, the growing necessity for public charging points becomes crucial in enabling wider adoption of EVs.

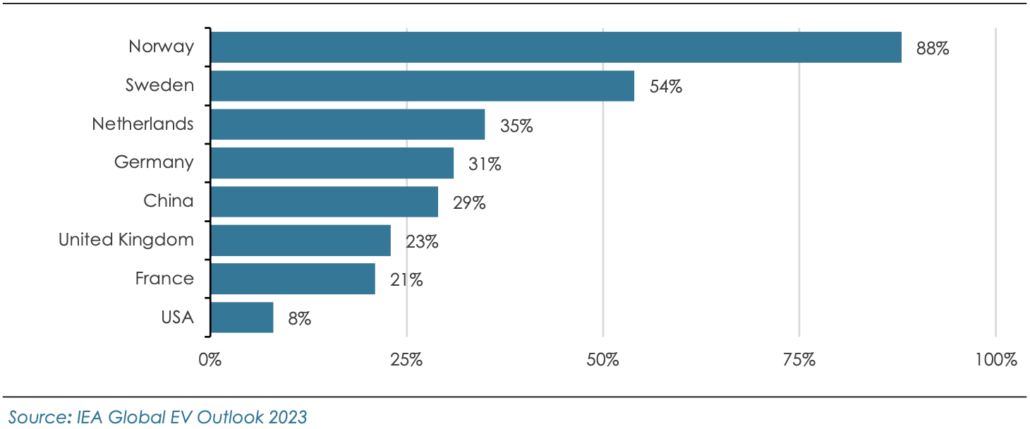

European Countries Continue to Rank Highly for the Sales Share of Electric Cars

Share of EV Car Sales in Total Car Sales (2022)

European countries lead the pack for the highest sales share of electric cars, led by Norway and Sweden. Notably, the sales share of EV cars in Germany has risen tenfold since pre-Covid, to grow as the biggest EV market in Europe. Outside Europe, China remains the largest adopter of EVs with ~30% share in total car sales, followed by the United States with a share of 8% in 2022.

An increasing number of countries have unveiled zero-emission vehicle targets, playing a crucial role in decarbonizing the mobility sector. The European Union has adopted new standards for CO2 emissions for new cars and vans as outlined in the ‘Fit for 55’ package. Similarly, in the United States, the Inflation Reduction Act (IRA), the adoption of California’s Advanced Clean Cars II rule by several states, and the enforcement of the recently proposed emissions standards by the US Environmental Protection Agency are all poised to further increase sales of EVs.

Impressive Electric Product Lineup Plans by Auto OEMs

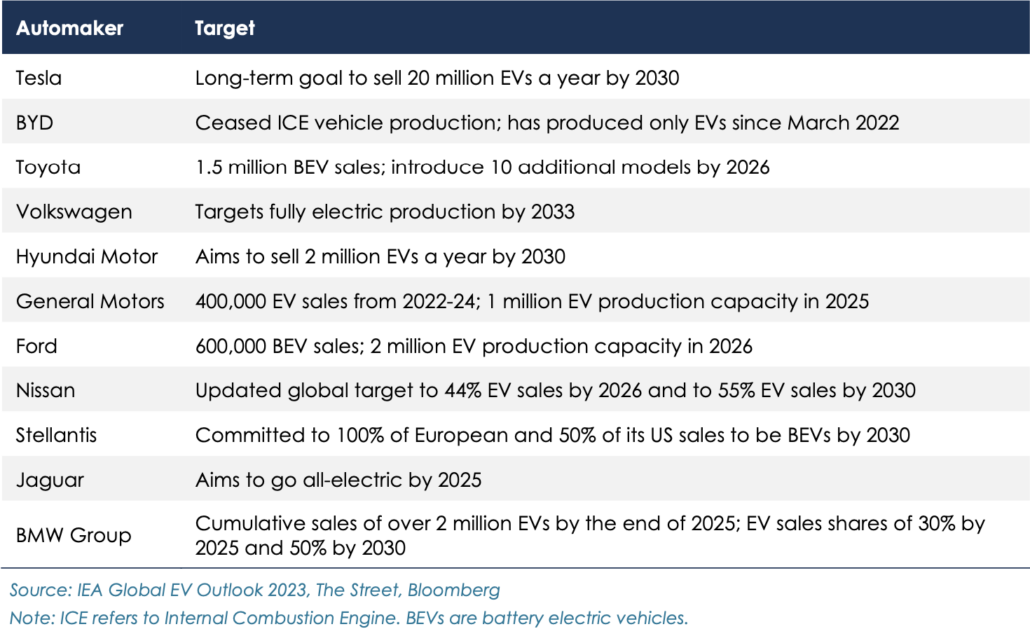

Automakers’ Ambitious Electrification Targets

There are more than 500 electric car models available today for the end-consumers, more than double the options available in 2018. The OEMs are consistently boosting their electrification targets and have committed an estimated ~$1.2 trillion in investments (per EY) through 2030 on EV production, technology, batteries, and raw materials. According to IEA, major global carmakers are committing up to 50-70% of their capital expenditure (CAPEX) and R&D budgets towards the advancement of EVs and digital technologies. Notably, just seven automakers, including Volkswagen and Ford, which collectively accounted for about half of the Light-Duty Vehicles (LDV) sales in 2022, have committed a remarkable CAPEX of more than $55 billion on emerging automotive technologies since 2019.

Furthermore, as carmakers strive to secure future battery supplies, they are strategising investments for increased vertical integration for in-house battery production. Besides, to secure adequate supply of critical minerals needed for batteries, such as lithium and nickel, auto OEMs are increasingly partnering with mining companies or even directly investing in mining operations. For instance, General Motors invested $650 million to build a lithium mine in Nevada, Ford partnered with Vale and Huayou, and Tesla broke ground on a metal refinery in Texas.

Outlook

As the EV ecosystem matures, the way the global auto industry makes profits will be transformed. According to Goldman Sachs estimates, the global car industry’s operating profits are expected to rise from $315 billion in 2020 to $418 billion in 2030, while the pool of profits for EVs is forecast to increase from $1 billion in 2020 to $110 billion in 2030. However, from the profitability standpoint, the EV sector has its share of challenges. For instance, prices of EV cars are declining due to intensified competition which could depress the margins for the industry. And the increased push for electrification has sparked ‘greenflation’ as rising demand for EV batteries pushes up prices for key raw materials used in making them (lithium, nickel, cobalt, etc.). Notably, battery makers hold disproportionate pricing power which gives them an edge in generating higher earnings. To rebalance their pricing power with battery makers, auto OEMs are increasingly seeking JVs with mining companies and investing in vertically integrated production for securing supplies to critical minerals.

About 52% of car buyers have expressed a preference for an EV as their next purchase (per the 2022 EY Mobility Consumer Index study). The IEA’s STEPS analysis pegs the total fleet of EVs (excluding two/three- wheelers) to rise from 30 million in 2022 to 240 million by 2030, exhibiting a CAGR of 30%. Undoubtedly, regulation remains a big lever in propelling EV penetration where the global market is transitioning from an incentive-driven dynamics to a self-sustaining model. Encouragingly, the expansion of initiatives such as Low-Emission Zones (LEZs) or similar policies holds immense potential for fostering increased EV adoption in the future. To ensure sustained EV proliferation, the governments and industry stakeholders must persevere in facilitating investments and remove barriers for the deployment of charging infrastructure. It is crucial for the entire ecosystem to go in tandem with rising EV sales, as any divergence may stutter the seamless adoption of EVs.

minerals needed for batteries, such as lithium and nickel, auto OEMs are increasingly partnering with mining companies or even directly investing in mining operations. For instance, General Motors invested $650 million to build a lithium mine in Nevada, Ford partnered with Vale and Huayou, and Tesla broke ground on a metal refinery in Texas.