Year of Cautious Optimism: Investment Opportunities in European Industrial Real Estate

Subscribe to our Insights Leave your email address to be the first to hear about insights.

EXECUTIVE SUMMARY

Industrial real estate in Europe emerges as a landscape ripe with potential, despite facing rising interest rates, political shifts, and climate-centric policies. Sectors like new energy infrastructure, data centers, and healthcare offer the hope of stability and consistent returns for investors.

The current scenario of high borrowing costs and stringent lending standards unveils a silver lining for sale and leaseback (SLB) investors. This environment presents a unique opportunity for strategic investment maneuvers and innovative financial solutions.

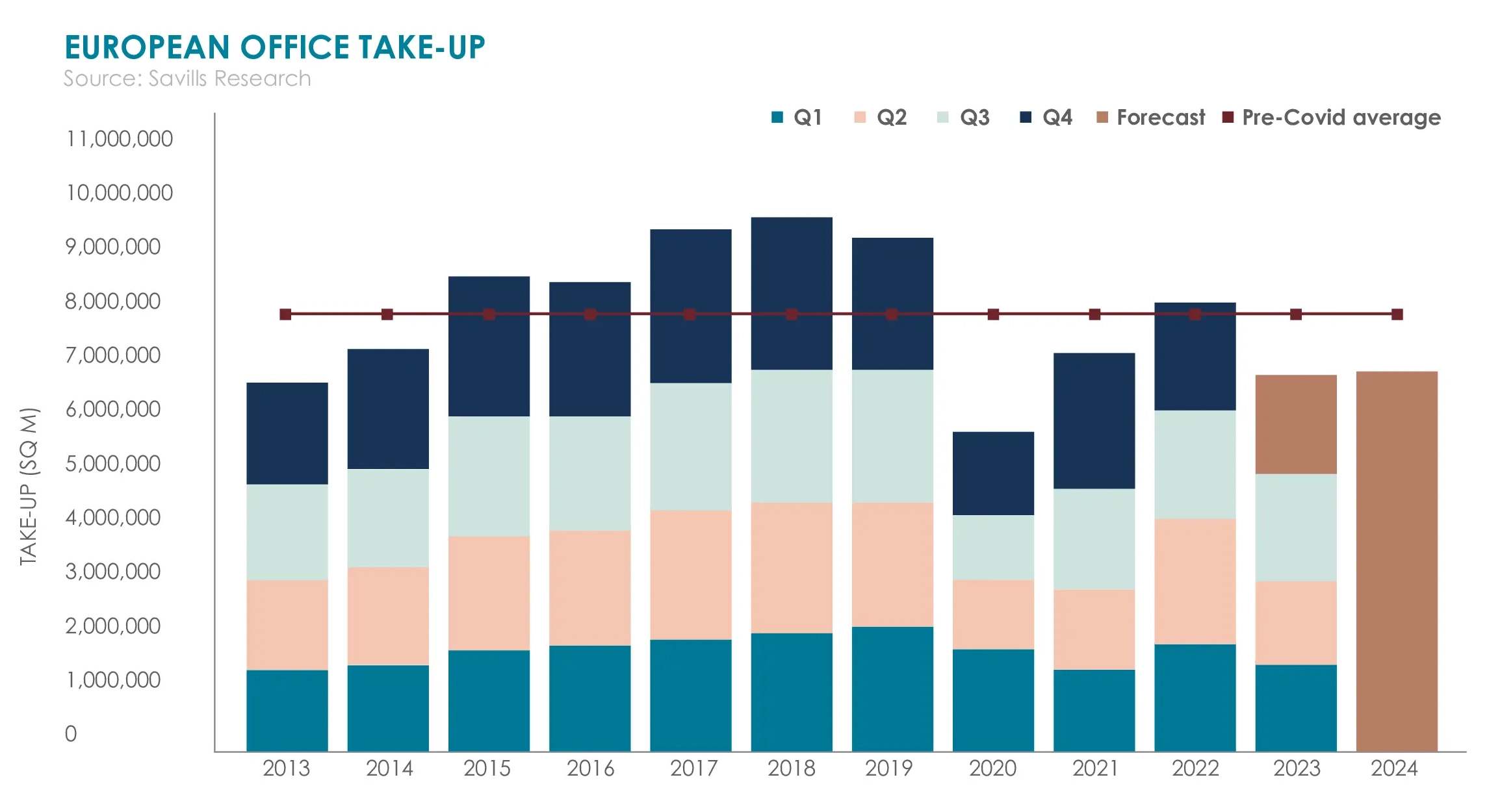

Office take-up outlook is uncertain in Europe, yet high-quality asset pricing is becoming attractive. Logistics pricing is likely to stabilize as investors anticipate rental growth. Retail to stay resilient, but the future hinges on consumer confidence and purchasing power.

GEOPOLITICAL AND MACROECONOMIC OVERVIEW

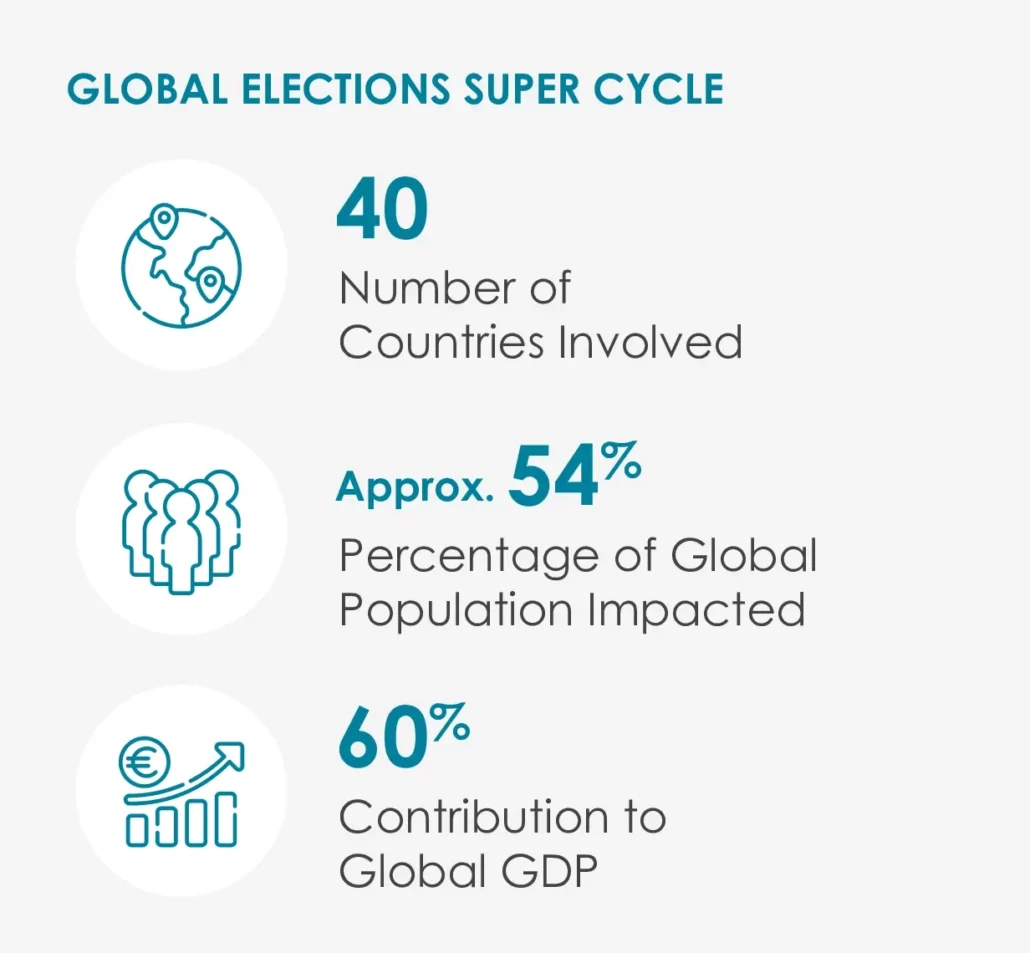

2024 is going to be the year of a global elections super cycle with forty countries including several major economies going to the polls. This election cycle is unprecedented in a single year. Among the most consequential will be the elections in the United States, European Union, and India. Some regulatory and policy uncertainty can be expected during this time.

Regional disparities in inflation rates and monetary policy will remain a central theme throughout 2024. Notably, certain central banks in emerging economies have initiated policy rate reductions at the onset of the year. Conversely, in other advanced economies, the commencement of easing cycles is anticipated to occur only from mid-2024 onwards, driven by persistent apprehensions regarding inflationary pressures. The resultant tightening of financial conditions may lead to the onset of technical recessions in select developed economies.

Considering the prevailing economic landscape, it is imperative to adopt a balanced perspective that encompasses optimistic prospects. The reduction in interest rates presents a significant counterweight, stimulating economic expansion and fostering a resurgence within capital markets. Despite prevailing inflation rates persisting above the 2 percent target across numerous European markets, there is a notable trajectory of rapid decline. Projections indicate that Euro Area headline CPI inflation is anticipated to ease to 1.8 percent by the fourth quarter of 2024. This decline in inflationary pressures holds the potential for a favorable outcome, particularly in the realm of real wage growth.

Geopolitical risks are poised to dominate, especially those stemming from the Israel-Hamas conflict in the Middle East. This ongoing conflict, alongside persisting tensions arising from the Russia-Ukraine war and the geopolitical dynamics between China and Taiwan, underscores significant risks to the global economic landscape in 2024. The potential disruptions to the world’s crucial trade corridors risk impacting an already fragile global supply chain. Such geopolitical instabilities warrant close monitoring as they pose considerable implications for economic stability and market performance.

COMMERCIAL REAL ESTATE IN EUROPE: ECONOMIC FORECASTS AND TRENDS

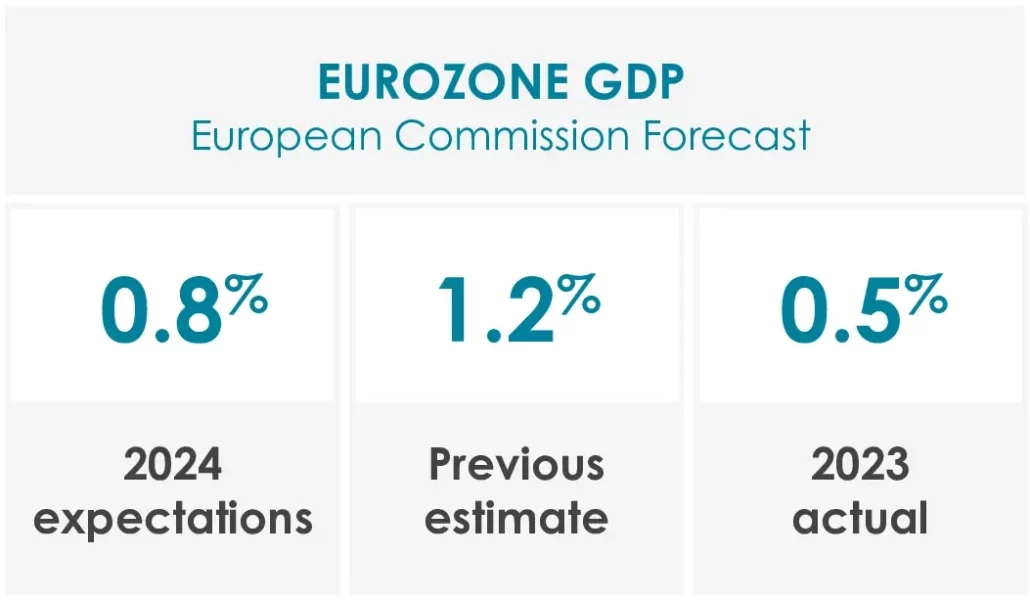

It is critical to look at commercial real estate forecasts, especially in the Euro area through this macroeconomic lens. The European Commission’s February 2024 forecast shows that GDP in the Eurozone will increase only 0.8% in 2024 rather than the 1.2% growth it expected last November, but it would still be up from a 0.5% rise in 2023.

In light of current assessments, commercial real estate leaders anticipate certain fundamentals, such as capital accessibility and vacancy rates, to face challenges. Nonetheless, there is an optimistic outlook regarding property valuations and rental rates, with expectations aligned for them to remain stable throughout the duration of 2024.

Addressing the potential economic volatility in 2024 and its impact on industrial real estate management, Sidra Capital says, “Our focus as always is on active asset management to protect and enhance the value of our assets while maintaining a strong income profile. We believe 2024 will present attractive investment opportunities for those with strong banking relationships and advanced asset management skills.”

COMMERCIAL REAL ESTATE IN EUROPE: ECONOMIC FORECASTS AND TRENDS

Looking beyond surface-level metrics, the data underscores a narrative of optimism and resilience within the European office sector. Utilization rates persist at 90% of pre-pandemic levels, signaling robust demand. Notably, newer high-quality assets consistently demonstrate strong performance, underlining the sector’s adaptability and appeal to tenants. Construction initiatives tailored to accommodate hybrid work strategies contribute to the absorption of previously unused areas, further enhancing the sector’s dynamism. CBRE’s 2024 European Real Estate Market Outlook highlights encouraging trends, indicating signs of stabilization in office vacancy rates. Markets such as Warsaw, Milan, and Madrid have demonstrated either stable or declining vacancy rates, reflecting positive momentum. Projections suggest that prominent metropolitan areas like London, Paris, and Munich are poised to follow suit, reinforcing the sector’s resilience and potential for sustained growth.

For the logistics sector, the CBRE report suggests that 2024 will continue to see the same challenges and opportunities as 2023. While the sector anticipates a moderation in uptake attributed to a deceleration in online retail expansion, there is a tempered optimism regarding the trajectory of vacancy rates. Forecasts suggest an initial uptick in vacancy rates during the first half of 2024, followed by a stabilization phase in the latter half of the year. Importantly, these projected vacancy rates are expected to settle at levels considerably below historical norms, indicating resilience and potential for sustained performance within the logistics sector.

COMMERCIAL REAL ESTATE IN EUROPE: ECONOMIC FORECASTS AND TRENDS

According to Knight Frank’s European Real Estate Outlook for 2024, investors from regions with robust currencies and hedging advantages, notably North America, are poised to maintain their active engagement within the European market. Furthermore, Japanese investors are anticipated to demonstrate a proactive stance, leveraging favorable debt costs and evolving yield dynamics to capitalize on investment opportunities throughout the upcoming year.

The report also underscores the continued interest of private capital and safe-haven investors, including sovereign wealth funds, in prime real estate assets. There is emphasis on maintaining focus on top-tier properties that offer stability and enduring value. Additionally, investors are expected to explore prospects within secondary and tertiary real estate segments, recognizing the potential for revaluation. This trend presents opportunities for enhancing sustainability standards and reimagining the utility of well-structured assets, underscoring a proactive approach towards portfolio optimization and value enhancement.

SECTOR PROSPECTS IN 2024:

THE NEED FOR RECESSION-PROOFING

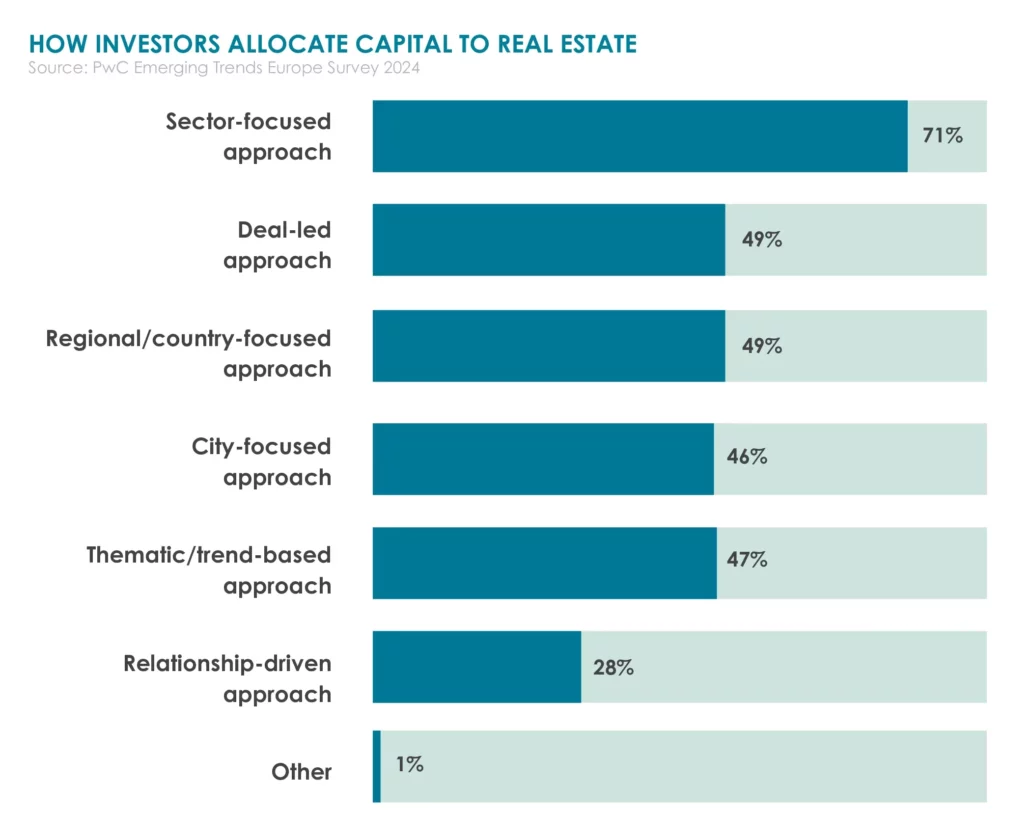

Investors in Europe still prefer taking a sector-based approach to real estate. Therefore, it is important to identify sectors that provide recession-proof income with growth potential especially in a high inflation environment. What will make sectors attractive are clear demand drivers that are not necessarily dependent on GDP. This is important because real estate’s relative appeal compared to other asset classes, and therefore its ability to attract capital, has been undermined by the closing yield gap with fixed-income assets. While cost of capital is escalating within real estate, fixed-income assets are demonstrating augmented returns, prompting a reevaluation of investment preferences. Bonds, in particular, are emerging as a compelling alternative to real estate, marking a departure from the prevailing investment trend observed over the past decade. Should prevailing interest rates persist at elevated levels, this trend of capital reallocation towards fixed-income instruments could endure for an extended period, thereby reshaping investment dynamics in the foreseeable future.

THE CALAIS PROJECT – A STRATEGIC INVESTMENT

Sidra Capital’s acquisition of the Eurocap Industrial and Trade Park in Calais, Northern France is an example of recession-proof investing. At acquisition, the Property is 88 percent leased to 60 tenants with a weighted average unexpired lease term (WAULT) of 3.6 years. Eurocap is situated close to the Eurotunnel rail terminus and the major French port, spanning 130 acres, featuring 800,000 square feet of space across 23 buildings with substantial open yard storage.

This diverse property offers occupiers a range of options including logistics, light industrial, storage, trade park facilities, and small business office spaces. The primary objective of the investment is to generate a resilient cash yield while enhancing the environmental sustainability and overall appeal of the existing structures to attract potential tenants. According to Sidra Capital,

“It is an income-generating property and the main idea behind the investment is to utilize the empty land in the surrounding area to build additional warehouses and then to lease and operate the property for income generation or transfer the property for capital gain.”

This strategic acquisition underscores Sidra Capital’s commitment to prudent and forward-thinking investment practices, positioning the firm favorably within the competitive real estate market landscape.

CONCLUSION

The industrial real estate landscape in Europe for 2024 presents a dynamic scenario shaped by unprecedented macroeconomic and geopolitical risks. However, anticipated challenges including rising interest rates and political instability, are likely to be counterbalanced by resilience observed in sectors such as offices, retail, new energy infrastructure, data centers, healthcare, and logistics.

Despite concerns about potential revenue declines, there are optimistic indicators, particularly in the demand-driven areas such as logistics. The surge in e-commerce, reshoring efforts, and increased consumer spending will continue to contribute to the robust demand for industrial sites. Notably, logistics facilities and industrial/warehouse spaces are poised to remain among the top-performing sectors with an expected double-digit growth in rentals.