US Commercial Real Estate Outlook: Tide to Shift in H2 2024

Subscribe to our Insights Leave your email address to be the first to hear about insights.

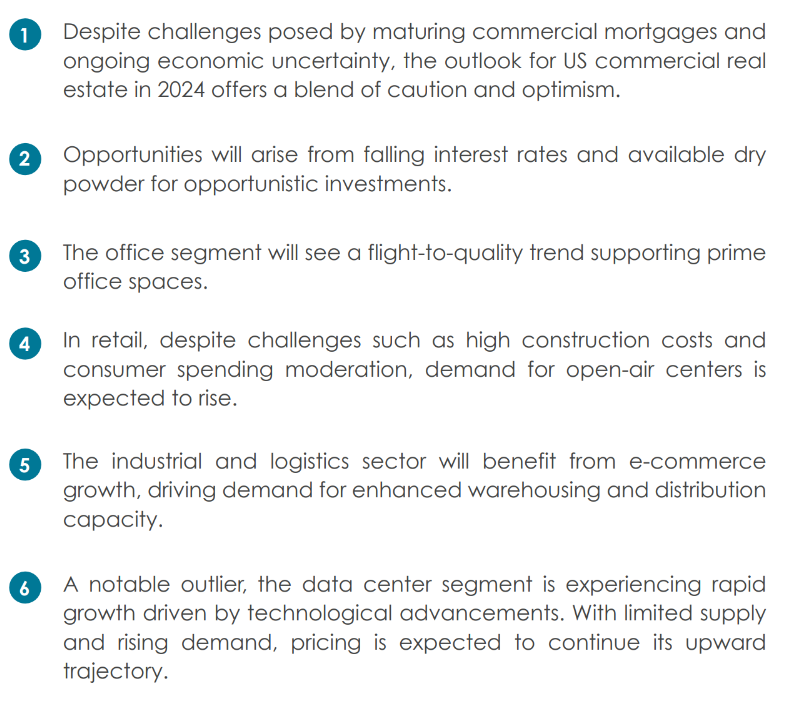

EXECUTIVE SUMMARY

U.S. COMMERCIAL REAL ESTATE: YEAR OF RECKONING OR DISGUISED OPPORTUNITY?

A broad overview of economic commentary during a downturn shows that positive forecasting is generally disincentivized by market participants. When bleak forecasts are proved incorrect, there is a sense of relief and consequently little to no backlash. However, when positive forecasts are proved incorrect, the backlash is often harsh. This compels forecasters to take a safe middle-of-the-road approach, at the cost of

accuracy. For the sake of accurate forecasting, it is critical to take a broad-based view that supplements economic forecasts with macroeconomic data and changes in policy. For U.S. commercial real estate, it is prudent to supplement the sectoral outlook with the Federal Reserve’s monetary policy roadmap and current macroeconomic data. This approach will provide investors an accurate assessment of the challenges and opportunities facing U.S. commercial real estate and a wider and more comprehensive view of the dynamics at play in the sector.

Applying this lens, we will look at the prospects for U.S. commercial real estate in 2024. We’ll delve into the outlook for various segments and assess their maintainability in light of shifts in interest rates and overall economic growth.

CRITICAL TRANSITION PHASE FOR U.S. COMMERCIAL REAL ESTATE

In 2023, commercial real estate in the U.S. faced challenges due to higher interest rates, rising inflation, and economic downturns, making it tough for buyers and sellers to agree on deals. Lender pipelines were slow, and landlords and tenants struggled with hybrid work policies post-pandemic. The biggest challenges, though, were limited credit availability and high cost of borrowing, which slowed down transactions.

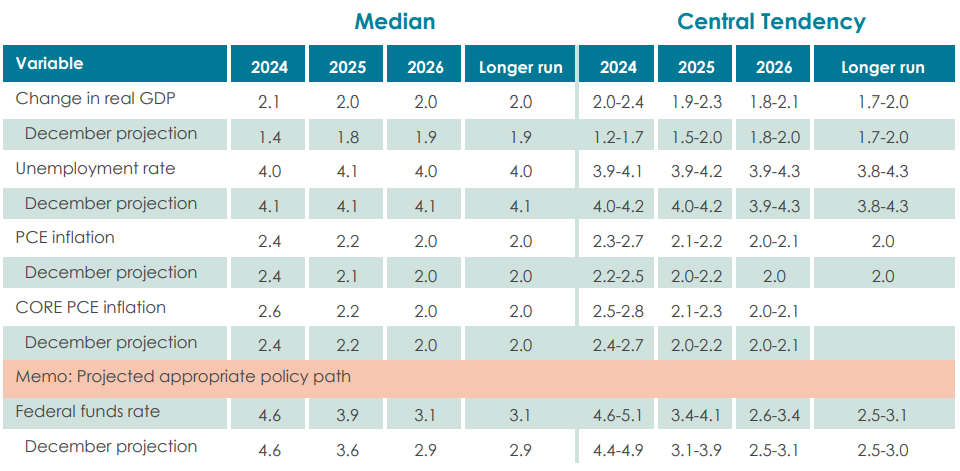

The outlook for 2024 is far more optimistic, with market participants expecting better deal flows in the second half of the year. Interest rates are also stabilizing. In fact, following the Federal Reserve’s latest policy meeting held earlier in March, Chairman Jerome Powell indicated that the Fed expects to cut rates three times in 2024. The Summary of Economic Projections by the Fed shows the central bank will likely reduce short-term interest rates from the current record highs of 5.25 to 5.50% to around 4.6% by

the end of 2024 and to 3.9% in 2025.

Federal Reserve: Economic Projections – March 2024

Sidra Capital notes, “Markets are bullish in their expectations for interest rate declines with some expecting as many as three to four cuts this year. On the other hand there are expectations for rates to be higher for longer.” In light of these dynamics, the alternative asset management firm is taking a pragmatic approach on fresh investments, prioritizing careful consideration of interest rate risks.

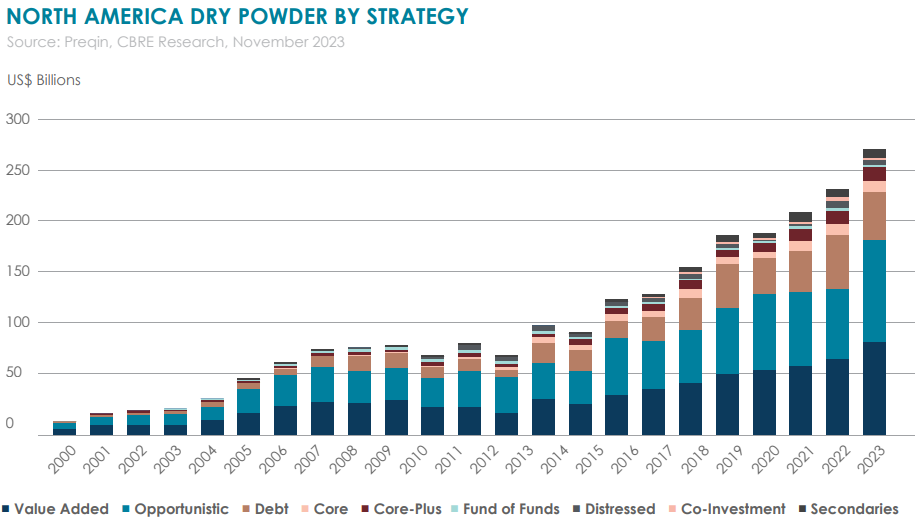

Falling interest rates combined with reasonably good real estate fundamentals should help to revive capital markets activity above current depressed levels. As a result, investment activity in commercial real estate should begin to pick up in the second half of 2024.

Nevertheless, significant challenges loom on the horizon this year, chiefly a phenomenon dubbed the ‘maturity wall.’ According to Goldman Sachs, an estimated $1.2 trillion worth of commercial mortgages are slated to mature within the current and subsequent years. This figure accounts for nearly a quarter of all outstanding commercial mortgages, marking the highest level recorded since 2008. With the backdrop of the Fed’s record-high interest rates, that means a lot of borrowers needing to refinance at potentially two to three times higher rates. This situation is likely to weigh on lender sentiment, and with concerns over small bank failures, appetite for lending to commercial real estate may be muted.

While that situation paints a gloomy picture, it also presents a significant buying opportunity. In recent comments that evidence a shift in sentiment, Goldman Sachs Asset Management has said it will resume actively investing in US commercial real estate this year due to a combination of factors. These are falling interest rates and a floor in prices being set by buyers in the market; suggesting that the market is bottoming out. Regarding bank failures, we have seen the Fed demonstrate that it has the hoses to put out the fires when required. Separately, a notable amount of dry powder remains available for value-add and opportunistic investing in 2024. CBRE pegs the amount of deployable equity capital at $81.4 billion for value-added investing and $95.9 billion for an opportunistic investing strategy.

Opportunities in U.S. Commercial Real Estate: Segmental Breakdown

While the normalization of hybrid work arrangements is expected to limit office demand, the trend towards flight-to-quality persists. This will support demand for prime office spaces equipped with superior amenities. Although overall office vacancy rates are projected to peak at 19.8%, absorption in newer post-2010 assets remains positive. Despite a decrease in new construction completions due to high interest rates and limited demand, average prime office rents are anticipated to increase modestly by up to 3%. However, the shrinking supply pipeline may improve office fundamentals and reduce vacancy risks. Meanwhile, consistent office utilization rates and a preference for smaller space requirements under 20,000 sq. ft. are expected to bolster the flexible office market, while submarkets offering walkable amenities and accessibility to public transportation are likely to see heightened demand.

As part of a real estate strategy that focuses on income-generating assets in mature markets, Sidra Capital has a diverse portfolio of commercial office assets across regions in the United States. A good example is Oakmont Point in Westmont, Illinois. It’s a three-story class-A property purchased in 2019 that offers a net leasable area of over 92,000 sq.ft. It is an income-generating asset that currently houses industry leaders JLL and Ryan Companies.

For the retail segment, fundamentals are expected to remain strong in 2024. A dearth of new construction owing to high construction costs will likely result in a drop in retail availability rates. CBRE expects availability at 4.6% by the end of the year. While rent growth is expected to dip below 2% in the first three quarters of the year, Q4 is likely to witness a rise in rent growth beyond 2%. Among retail formats, traditional mall-based

proprietors have been closing underperforming stores in favor of small-format open-air centers. Demand for these open-air retail centers is expected to increase rapidly. However, high interest rates and resumption of student debt payments will emerge as pain points and might cause a moderation in consumer spending adversely impacting retail sales.

The industrial and logistics sector is expected to see sustained growth, driven by the steady expansion of e-commerce. As a result, retailers and suppliers will be motivated to enhance warehousing and

distribution capacity to meet increasing demand. Additionally, there will be a heightened focus on energy efficiency, with a growing need for solar and wind energy solutions throughout the year.

The adoption of sustainable materials and installation of electric truck charging stations will further enhance the appeal of industrial spaces. Properties equipped with these features will experience heightened demand, particularly first-generation spaces.

In 2019, Sidra Capital initiated the Net Leased Industrial Portfolio. The investment program encompasses vital single-tenant industrial properties across 15 states in the U.S. It comprises 30 strategically located assets, held under long-term triple net leases, with a combined net leasable area exceeding 3.6 million square feet. These properties play pivotal roles for tenants, serving as manufacturing and distribution facilities for their operations.

A clear outlier in terms of growth is the data center segment. Rapid growth in technology is driving an urgent need to transform the sector, including innovations in power and cooling. Additionally, limited supply and strong demand means that pricing for data centers will continue to rise. Following a 16% annual increase in pricing for the 250 to 500 kilowatt segment in 2023, there is a 10 to 15% increase in pricing expected in 2024.

Optimistic Outlook: Bleak 2023 Will Make Way for Brighter 2024

In fact a bird’s eye view of commercial real estate in the U.S. reveals several pain points. According to Sidra Capital, “Real estate in the U.S. is facing challenges prompting us to adopt an asset management approach that is aimed at preserving the value of our recent investments. We are being selective in the acquisitions we make.”

However, fears of a recession have subsided. GDP rose 3.2% year-on-year in the fourth quarter of 2023, taking the annual growth rate to 2.5% versus 1.9% in 2022. Consumer spending, which accounts for 70% of economic activity in the US, grew at a 3% annual pace in the fourth quarter of 2023, while government spending for the same period rose by 5.4%. And while the Federal Reserve’s rate setting committee has remained conservative in March by not reducing rates, forward-looking commentary suggests 2024 could see a flush of liquidity with policy easing. Now is an opportune time for investors to get in the market, look for distressed deals and prepare for a refinance. This will enable taking advantage of compelling deals that may present themselves in the year ahead.

REFERENCES

CBRE: https://www.cbre.com/insights/books/european-real-estate-market-outlook-2024

PWC: https://www.pwc.com/gx/en/industries/financial-services/real-estate/emerging-trends-real-estate/europe-2024.html

Deloitte: https://www2.deloitte.com/us/en/insights/industry/financial-services/commercial-real-estate-outlook.html

Knight Frank: https://www.knightfrank.com/research/article/2023-11-30-european-real-estate-outlook-2024

PWC: https://www.pwc.com/gx/en/industries/financial-services/real-estate/emerging-trends-real-estate/europe-2024.html

Deloitte: https://www2.deloitte.com/us/en/insights/industry/financial-services/commercial-real-estate-outlook.html

Knight Frank: https://www.knightfrank.com/research/article/2023-11-30-european-real-estate-outlook-2024

DISCLAIMER

This document is strictly private, confidential, and personal to its recipients and should not be copied, distributed, or reproduced in whole or in part, nor passed to any third party. The information provided in this report is for general guidance and information purposes only. Under no circumstances should the information contained in the report be used or considered as formal financial or investment advice, or any other advice, or an offer or solicitation of an offer to buy or sell, or as a recommendation or endorsement of any security or other form of financial asset. The report is not to be considered as investment research or an objective or independent explanation of the matters contained herein.

The information in the report is obtained from various sources as of the date of the report. Sidra Capital has taken reasonable care to ensure that the material information contained herein is in accordance with the facts and contains no omission likely to affect its understanding. Sidra Capital makes no representations or warranties whatsoever as to the accuracy or completeness of this report and expressly disclaims any liability of whatever nature, whether direct or indirect, or responsibility for the accuracy of the information contained in the report. The information contained herein may be subject to changes without prior notice. Sidra Capital does not accept any form of liability, neither legally nor financially, for loss (direct or indirect) caused by the understanding and/or use of this report or its content. This report is only intended for the recipients and should not be copied or otherwise distributed, in whole or in part, to any other person without the prior written approval of Sidra Capital.