The UK Office: Market Dynamics Shaped by Bifurcation Between the Best and the Rest

Subscribe to our Insights Leave your email address to be the first to hear about insights.

Key Highlights

- Central London office take-up volume declined in the second quarter, as evidenced by an increase in the vacancy rate and the trend of occupiers opting for smaller and more flexible spaces.

- Prime rents have remained stable, while offices located in prime areas and top-notch spaces with rich amenities and strong ESG credentials have witnessed a rental premium of 25-35.

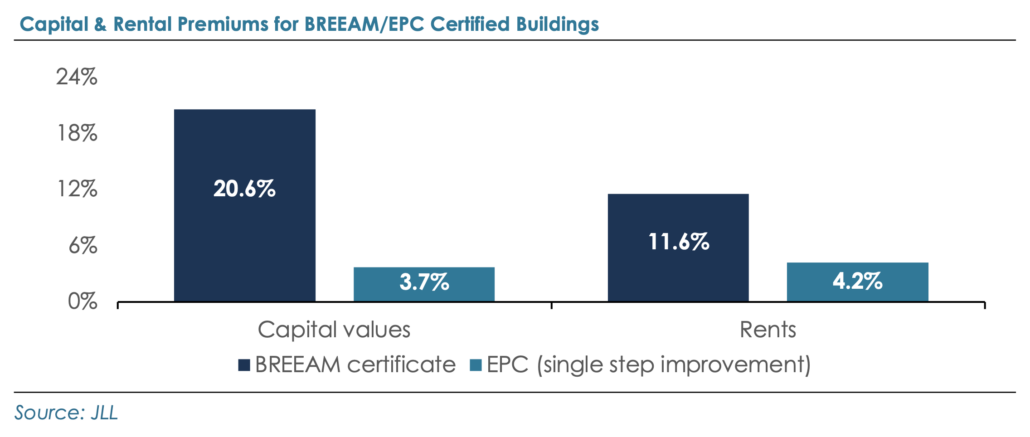

- The UK government’s stringent building standards and the flight-to-quality trend among occupiers suggest better prospects for rise in capital values and higher rental premiums for certified buildings.

- Though year-to-date leasing and vacancy data paint a weak picture for the UK office demand, the leasing momentum is expected to pick up in the second half of the year.

Office Leasing Remains Subdued Amid Challenging Macro Backdrop

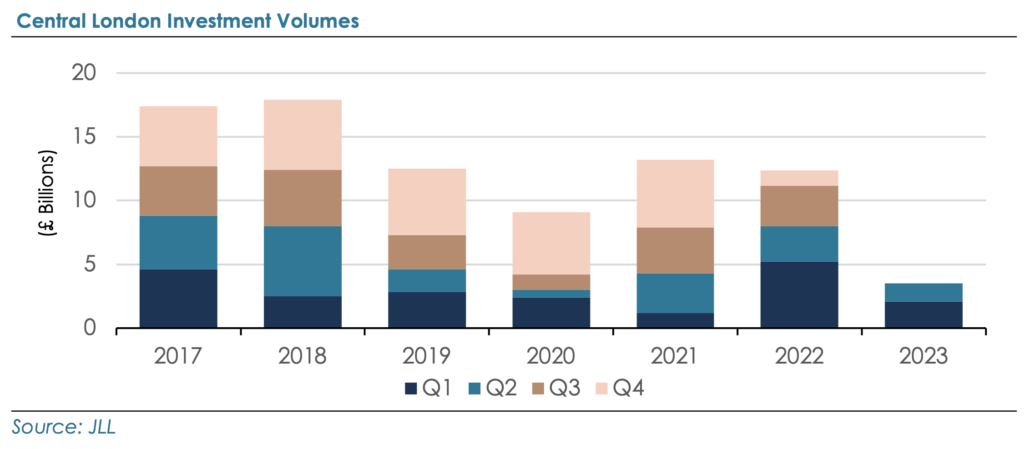

Renowned as one of the world’s most transparent and mature investment markets, London’s real estate sector has solidified its status as the premier target for international capital. The year-to-date investment volumes through the first half of the year in Central London office stood at £3.6 billion (per JLL) with about 90% of volumes driven by overseas investors. The office sector has experienced a paradigm shift since the pandemic’s onset, primarily driven by the advent of hybrid work model, resulting in a 35% decline in office attendance compared to pre-pandemic levels. This was further accentuated by unprecedented interest rate hikes aimed at curbing persistent inflation. Nonetheless, the prevailing demand gravitates toward top- tier spaces, with an emphasis on sustainability credentials, flexible and collaborative environments, and seamless transportation connectivity.

The Central London take-up softened in Q2 2023 with 2 million sq. ft transacted, representing a decline of 27% YoY. This marks a 20% fall from the long-term (10-year) Q2 average of 2.5 million sq. ft; however, it is in line with prior two quarters. The year-to-date take-up stands at 4 million sq. ft, representing a ~25% decline YoY and placing it below the long-term H1 average of 4.7 million sq. ft (as per JLL). Interestingly, the demand for best-in-class space continues to surge at the expense of poorer specified stock, as Grade A quality accounted for 77% of London office space leased in Q2 (per Colliers). In terms of size, the smaller end of the market evidenced a pronounced increase in Q2 2023 with deals sub-25,000 sq. ft taking a 54% market share. Notably, Q2 2023 recorded no deals exceeding 100,000 sq. ft across the market. Citing data from commercial property management software provider Re-Leased, a recent Financial Times article highlights the contraction of UK office lease lengths from four and a half years pre-pandemic to 2 years and 10 months in Q1 2023, signals a pronounced shift away from lengthy lease commitments.

Despite lower take-up volumes, the under-offer office space has steadily increased for two subsequent quarters, reaching 3.7 million sq. ft by the end of Q2 – its highest level since Q4 2019. Notably, pre-let, newly built, and refurbished spaces represented a significant portion of space under-offer (at 70%).

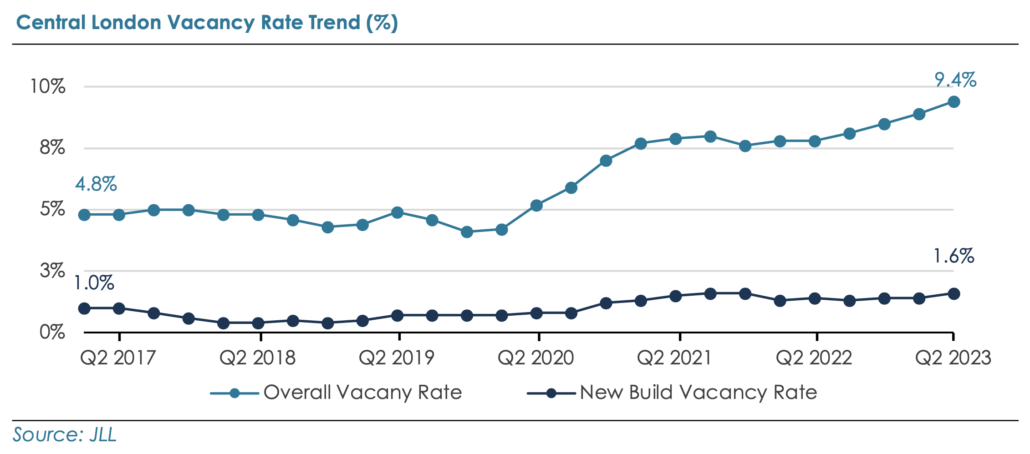

As of June, Central London’s office supply has surged by 23% YoY to ~24 million sq. ft, primarily boosted by a rise in newly built and refurbished office spaces. The overall quarterly vacancy rate has risen by 50-bps QoQ and by 160-bps YoY to 9.4% in Q2 2023, significantly higher than the long-term average of 5.5%. However, the vacancy rate for newly built office space stood at a mere 1.6%, which demonstrates the resilience of best-in-class assets. JLL expects further rise in vacancy during H2 2023 as 3.5 million sq. ft of speculative space is set to be completed by the year end.

Though Prime Rents Remain Stable, Certain Pockets Command Huge Rental Premium

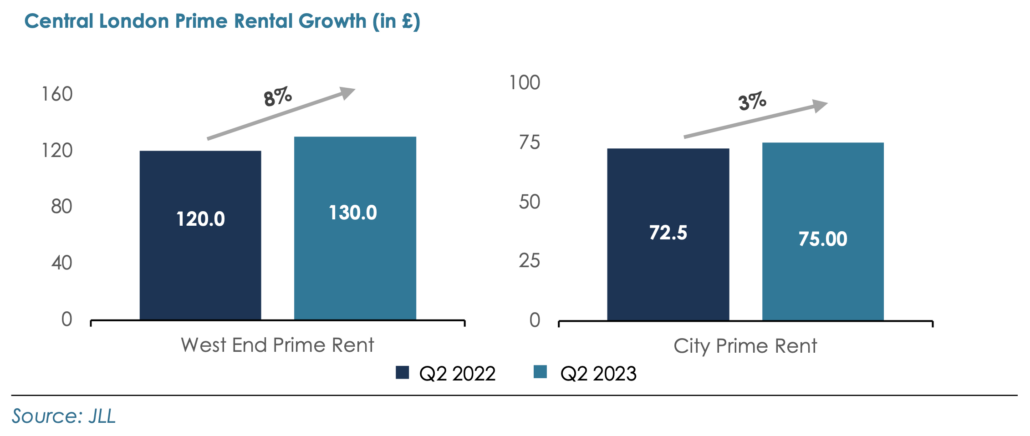

Throughout this quarter, prime rents have held steady in both the West End and the City at £130 and £75 per sq. ft, respectively (as per JLL). However, premiums are evident for top-tier assets, driven by demand for well-located properties boasting high amenity levels and strong ESG credentials. The ongoing evidence from recent transactions indicates super prime rents achieved in certain assets across London. For instance, the rental premium averaged about 25% in the City, while for West End the average rental premium stood at 35%.

Investment Volumes Moderated on Investor Caution Amid High Interest Rates

The high cost of debt has resulted in a significant drop in investment volumes, which decreased by one- third from the first quarter to approximately £1.4 billion in Q2 2023. This marks a 53% decline compared to the 10-year Q2 average of £3.1 billion. Notably, the West End market dominated transactions, contributing £892 million (62%), while the City accounted for £537 million (38%). The year-to-date investment total for 2023 has been more than halved to £3.6 billion, significantly below the £7.7 billion achieved in the first half of 2022 and 41% lower than the long-term H1 average of £6 billion. Optimism among overseas investors persists in London’s office market, commanding an 89% share during H1 2023. Notably, the Asia Pacific region takes the lead in investment activity, holding a significant 55% share.

Investment activity is expected to remain subdued this year, yet Central London office market hold alluring prospects for investors. Signs of falling inflation could lead to lower risk-free rates, enhancing real estate’s risk premium. The resilient prime rental growth and demand for Grade A space might expedite this shift, offering investors an enticing avenue for income growth at historically attractive yields.

The polarization of the market into ‘the best and the rest’ has negative implications for second-class assets requiring significant capital expenditure to upgrade to modern occupier and environmental office standards. As a result, many of these assets are currently being heavily discounted with buyers focussing on alternative uses. Recent CBRE research indicates that since the onset of 2022, investors have acquired a total of 2.1 million sq. ft of office space (including those under-offer) for £2 billion, with intention of repurposing the buildings for other uses. Notably, five out of the top ten deals this year have been procured with the intention of converting to alternative purposes (per Cushman & Wakefield).

Premium for Green Offices is Captivating for Investors

The UK government’s Minimum Energy Efficiency Standards (MEES) for buildings make it illegal to create new leases for properties with an Energy Performance Certificate (EPC) rating of F or G (the lowest two bands). The UK government is also in the process of raising the standards with a minimum requirement of EPC rating B by 2030. According to JLL research, properties with any form of BREEAM (Building Research Establishment Environmental Assessment Method) certification have generated an average capital premium of 20.6% and a rental premium of 11.6% (over the 2017-21 period), controlling for location, size, and age. Similarly, a single-step improvement in EPC generated a value premium of 3.7% and a rental premium of 4.2%. Offices with the highest BREEAM certifications experience shorter vacant periods, ranging from two to nine months, compared to lower-rated, unrated, and second-hand office spaces (per CoStar). This clearly implies a financial advantage for developers as well as investors when allocating capex for refurbishing office space to meet regulatory compliance on sustainability.

Outlook

The current economic backdrop dampens the outlook for office space demand. According to the Royal Institution of Chartered Surveyors (RICS), about two thirds of property surveyors think UK commercial property market is in a downturn as higher interest rates have adversely impacted credit conditions. Yet, the survey finds prime office segment to be robust. The office stock currently under-offer is well above the long-term average, which bodes well for leasing prospects ahead. Notably, both Savills and JLL expect office leasing to pick up momentum in the second half of the year. Moreover, as landlords increasingly repurpose office spaces for alternative uses, the available market supply of office stock is expected to diminish. This reduction is likely to curtail the vacancy rate and positively impact rental values.

While the chatter around flight to quality office assets has been there for some time, the recent data points to the prominence of this trend. The reduced supply of the best quality space has created a three-tier market comprised of premium assets, where rental values are rising at pace, prime supply, and the remainder of market encompassing secondary and tertiary stock. As UK government’s building standards continue to become more stringent on sustainability compliance, the certified green buildings certainly offer a real advantage to investors in the current risk-off environment driven by promising rental prospects, increased occupancy, enhanced exit values, and liquidity.