GCC Real Estate Outlook:2024 Marked by Optimism and Predictability

Subscribe to our Insights Leave your email address to be the first to hear about insights.

GCC REAL ESTATE ENVIRONMENT: STABILITY IN A TURBULENT GLOBAL ECONOMY

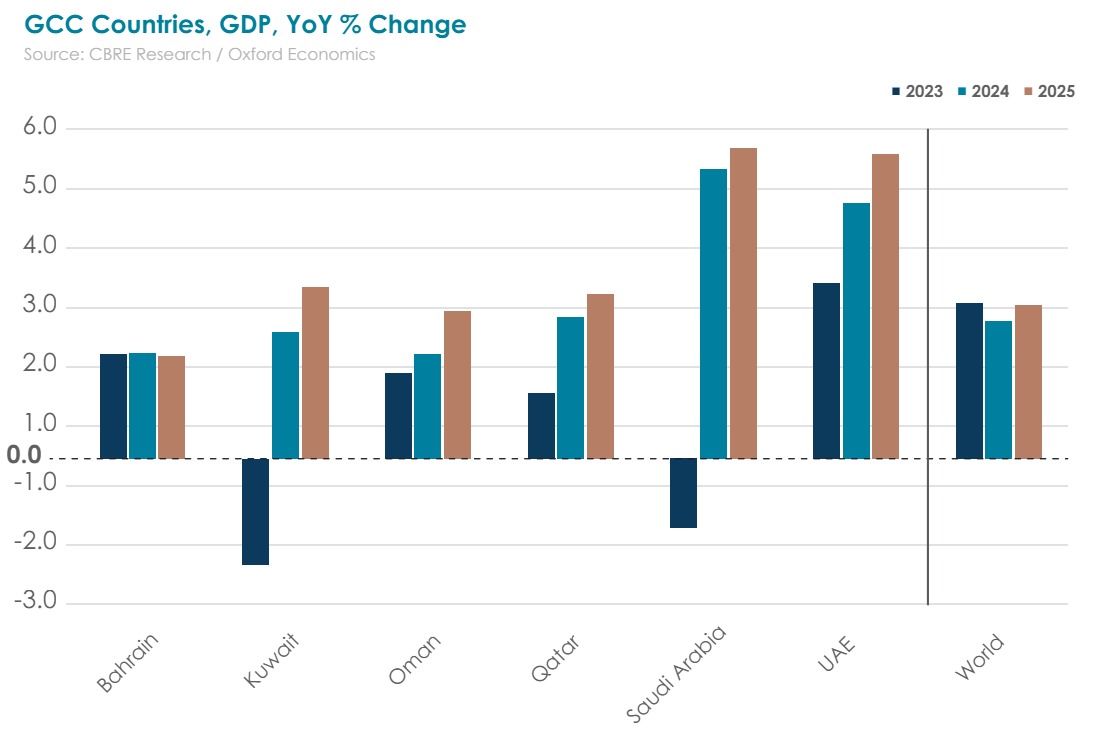

The global economy in 2023 experienced widespread turbulence, with the world’s leading developed nations grappling with stagnant growth and escalating inflation. Amid these challenging times, the economies of the GCC (Gulf Cooperation Council – Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and United Arab Emirates) stood out as an oasis of stability, providing predictability for investors in an otherwise uncertain environment. While the collective GDP growth of 0.8% across the six GCC nations in 2023 may appear modest by historical standards, it’s critical to recognize that during the same timeframe, major European economies slid into recession. Germany, for instance, saw its GDP shrink by the year’s end, and the UK entered a technical recession after experiencing GDP declines over two consecutive quarters ending in December 2023. Looking ahead to 2024, Oxford Economics forecasts 3% GDP growth for the GCC, with the Kingdom of Saudi Arabia (KSA) poised for a notable surge in growth, projected between 5.5-6%, and the UAE close behind with an anticipated growth rate of just under 5%. The forecast for 2025 suggests even more robust growth.

Let’s delve into the real estate sector within the region, examining the anticipated trajectory and what investors might expect in terms of investment yields as we move through 2024 into 2025.

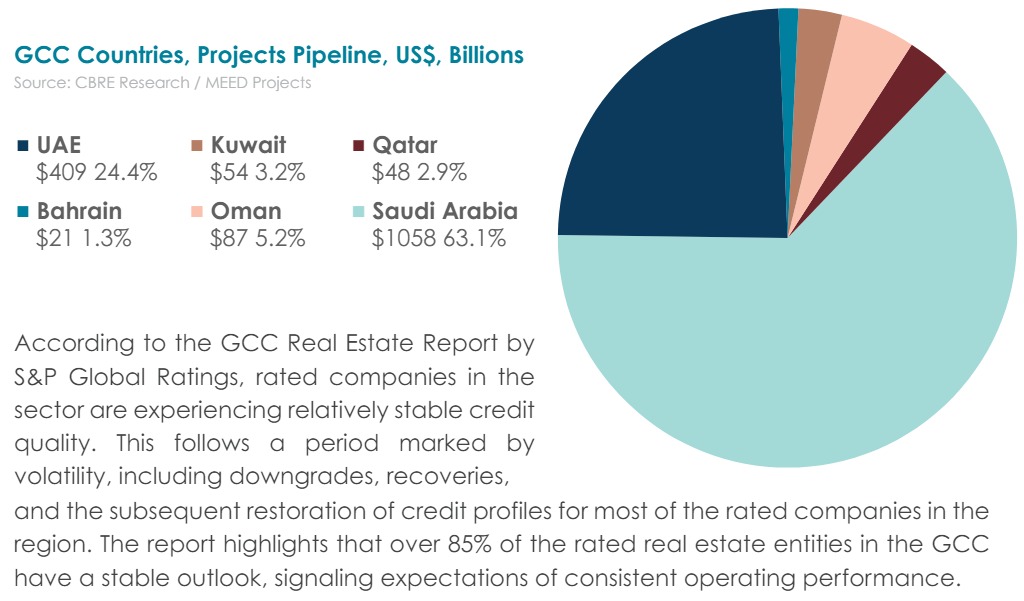

Real Estate: The Critical Non-Oil Growth Driver For GCC

Weak global growth during 2023 dampened oil demand, leading to several production cuts. However, while the oil sector in the region saw an average decline of 3.1%, non-oil sectors demonstrated resilience by growing at the same rate. Looking ahead to 2024, the oil sector is poised for recovery, with an expected growth of over 2%. During the same period, the non-oil sector is anticipated to outpace this, with a growth rate of nearly 3%. Within the non-oil sectors, the real estate market, in particular, is expected to remain buoyant across GCC countries. CBRE Research data indicates that, in 2024, the total value of planned or ongoing real estate projects in GCC economies will reach an estimated $1.68 trillion, a significant increase from $1.38 trillion the previous year. KSA, with its diversification strategy under Vision 2030, is leading this surge, accounting for 63.1% or approximately $1.06 trillion of this total. It is followed closely by the UAE at 24.4% or $409 billion. Bahrain, Kuwait, Oman, and Qatar are expected to contribute, with shares of 1.3%, 3.2%, 5.2%, and 2.9%, respectively.

GCC Sectoral Outlook: Positive Price Trend Despite Fragmented Performance

While market dynamics vary, S&P Global’s analysis matches the broader forecast for the GCC real estate sector, predicting increased investment across all areas.

Throughout 2023, the GCC’s residential market generally saw positive price performance, but with a notable divide in growth rates. In Saudi Arabia, the residential sector’s price trends have remained fragmented, differing by city and property type. Knight Frank reports that the average price of residential property sales fell by 16% in 2023. However, Riyadh stood out, with apartment prices increasing by 4.5% and villa prices by 0.5% compared to the previous year. Transaction volumes in Riyadh are also anticipated to stabilize in 2024, following two years of declines.

Saudi-based asset management firm Sidra Capital expects direction from the government on making local investment options accessible to foreign investors. The firm notes, “We are currently awaiting a regulatory decision that would permit foreigners to invest in local real estate in Saudi Arabia. The government has been discussing this matter, and it appears to be pending final approval. Once implemented, this policy change is expected to enhance Saudi Arabia’s appeal as an investment destination.”

This year, Sidra Capital has unveiled the Riyadh Opportunities Fund – a private, closed-ended fund with a capital of SAR 200 million, targeting the growing real estate market in Riyadh. This fund is strategically focused on spearheading a variety of real estate construction projects across the city. Its goal is to secure strategically positioned land plots for the development of a diverse portfolio of mixed-use real estate properties. This portfolio includes three residential projects and one office building, emphasizing the fund’s aim to leverage the lucrative real estate opportunities in Riyadh.

Sidra Capital has also partnered with Shahla Global Trading Company to create a series of residential units as part of the Sidra Capital-Sadeen Living Residential Development Fund. Situated in Jeddah, this initiative aligns with a major objective of Saudi Vision 2030: boosting home ownership among Saudi citizens. The project will include 12 buildings, housing a total of 148 residential units, in a bid to address the rising demand in the residential sector.

Let’s also examine the UAE, which stands out as the only market in 2023 to report growth in both prices and transaction volumes. In Abu Dhabi, the forecast indicates a continued increase in transaction volumes throughout 2024, driven by the introduction of new luxury and prime properties, which are expected to support a stronger average price growth. Conversely, older and less updated properties are likely to significantly underperform in comparison. In Dubai, transaction volumes are anticipated to experience a slight decline. Nevertheless, prices in both the apartment and villa sectors are projected to keep rising, even if at a slightly slower pace over the year.

In 2023, apartment rates in Bahrain saw an increase. This trend is expected to continue into 2024, fueled by the ongoing addition of high-quality properties and the attraction of regional investments. Meanwhile, villa sales prices, typically determined by plot size and driven primarily by local demand, are expected to remain fairly stable.

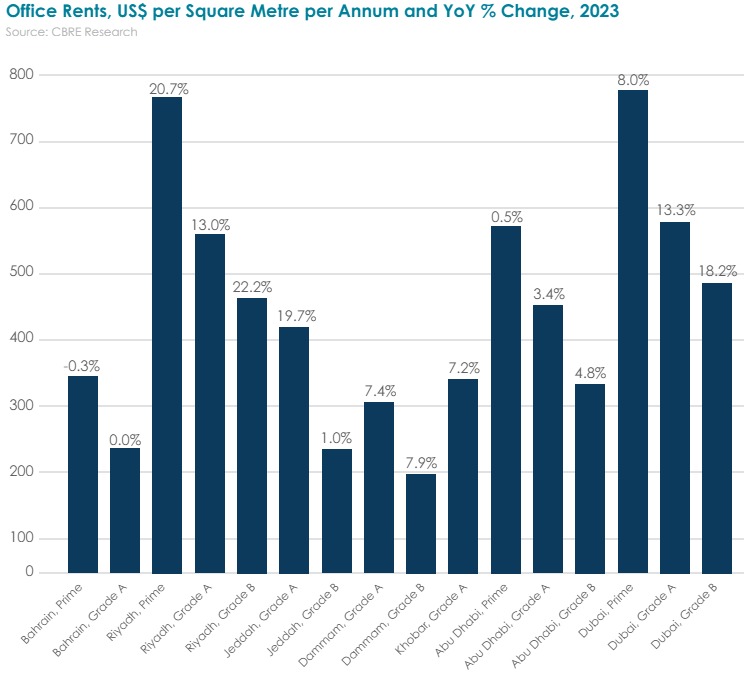

In the office segment, the focus in Saudi Arabia will remain on Riyadh, with occupancy rates maintained at the 98% observed in Q4 2023. High demand from both local and international tenants, coupled with a restricted supply, will propel rental values in Riyadh. However, in Jeddah and the Eastern Province, investors should anticipate a deceleration in rental growth. In the UAE, the market outlook remains positive for the upcoming year. Abu Dhabi’s office sector is expected to remain robust, with Prime and Grade A properties continuing to lead due to their limited availability and the growing demand for premium spaces. In Dubai, the scarcity of quality inventory along with high demand and a limited development pipeline, suggests rental prices will keep rising, albeit perhaps at a slower pace than the previous year.

Conclusion: Investment Yield Outlook for Investors in GCC

Investors eyeing the real estate market in the GCC region have numerous reasons to anticipate strong investment returns. In KSA, the demand is expected to remain strong, fueled by Vision 2030 investments. These investments aim to attract new global businesses and an additional expatriate workforce. According to Sidra Capital, “Saudi Arabia has implemented its Vision 2030 and we see potential growth in real estate in 2024 and for the next few years in the medium term. For Saudi investors the expectation of primary return from income-generating assets is a minimum of 7% on the leverage yield going up to 10%. A lot of the local investment is primarily development so you would be looking at a return on investment of 15%. Anything less than that becomes challenging to raise equity.” Additionally, a population growth rate of 2-3% will bolster the real estate sector, supported by GCC reforms that encompass new corporate-ownership rules and technology regulations. The potential for interest rate declines starting in the second half of 2024 is likely to make real estate even more affordable. While geopolitical tensions present a risk, they are expected to diminish as we move through 2024. CBRE Research indicates that the investment yield outlook in KSA and the UAE is stable. In KSA, residential properties are expected to yield between 7.50 to 7.75%. Prime offices may see yields ranging from 7.5 to 8%, and Grade A offices could have yields between 8.25 to 8.75%. The outlook for industrial and retail segments is also positive, with yields expected to range from 7.5 to 8.75%.

DISCLAIMER

This document is strictly private, confidential, and personal to its recipients and should not be copied, distributed, or reproduced in whole or in part, nor passed to any third party. The information provided in this report is for general guidance and information purposes only. Under no circumstances should the information contained in the report be used or considered as formal financial or investment advice, or any other advice, or an offer or solicitation of an offer to buy or sell, or as a recommendation or endorsement of any security or other form of financial asset. The report is not to be considered as investment research or an objective or independent explanation of the matters contained herein. The information in the report is obtained from various sources as of the date of the report. Sidra Capital has taken reasonable care to ensure that the material information contained herein is in accordance with the facts and contains no omission likely to affect its understanding. Sidra Capital makes no representations or warranties whatsoever as to the accuracy or completeness of this report and expressly disclaims any liability of whatever nature, whether direct or indirect, or responsibility for the accuracy of the information contained in the report. The information contained herein may be subject to changes without prior notice. Sidra Capital does not accept any form of liability, neither legally nor financially, for loss (direct or indirect) caused by the understanding and/or use of this report or its content. This report is only intended for the recipients and should not be copied or otherwise distributed, in whole or in part, to any other person without the prior written approval of Sidra Capital.