Sovereign Wealth Funds In The Aftermath Of The COVID-19 Crisis

Subscribe to our Insights Leave your email address to be the first to hear about insights.

Key Highlights

- With economies suffering from the coronavirus pandemic, sovereign wealth funds (SWFs) have emerged as critical reconstruction tools.

- SWFs are refocusing on domestic economies, rescuing local businesses, and replenishing government coffers.

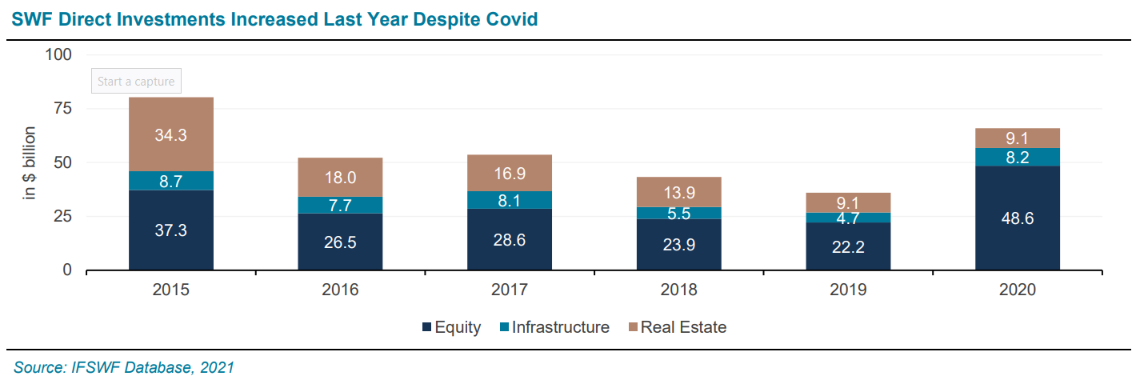

- Despite the COVID-19 pandemic, SWF’s direct investments increased in 2020 compared to 2019.

- SWFs are factoring climate change into their investment decisions and focusing on green energy initiatives.

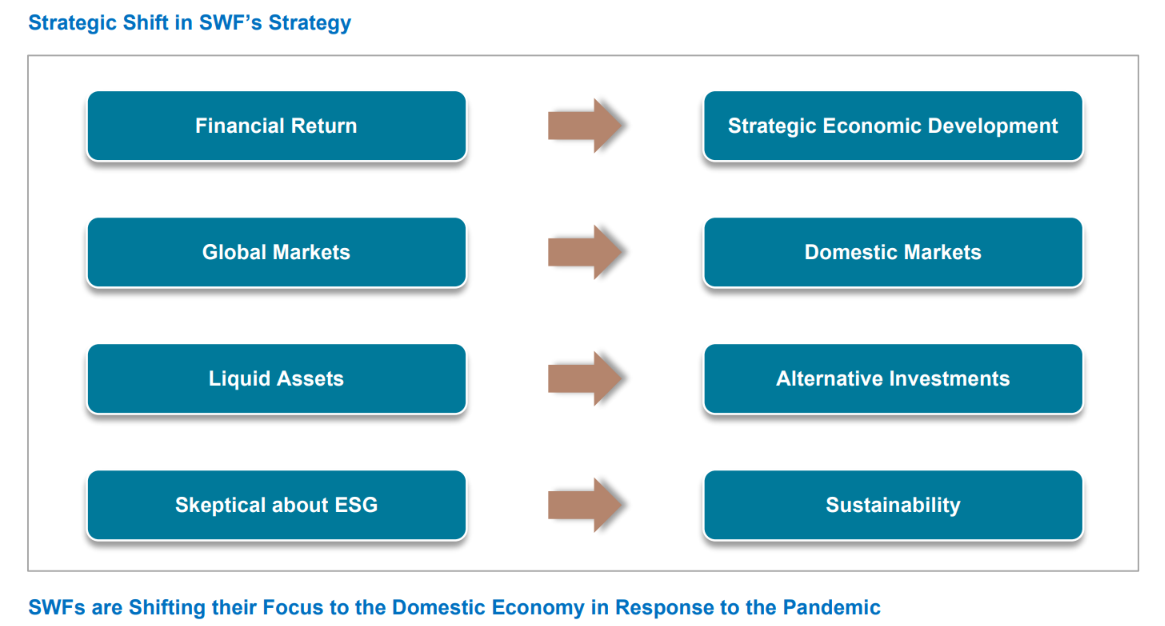

- A greater emphasis is being placed on domestic economies, sustainability, alternatives, and economic development, and these trends are expected to accelerate further post-COVID.

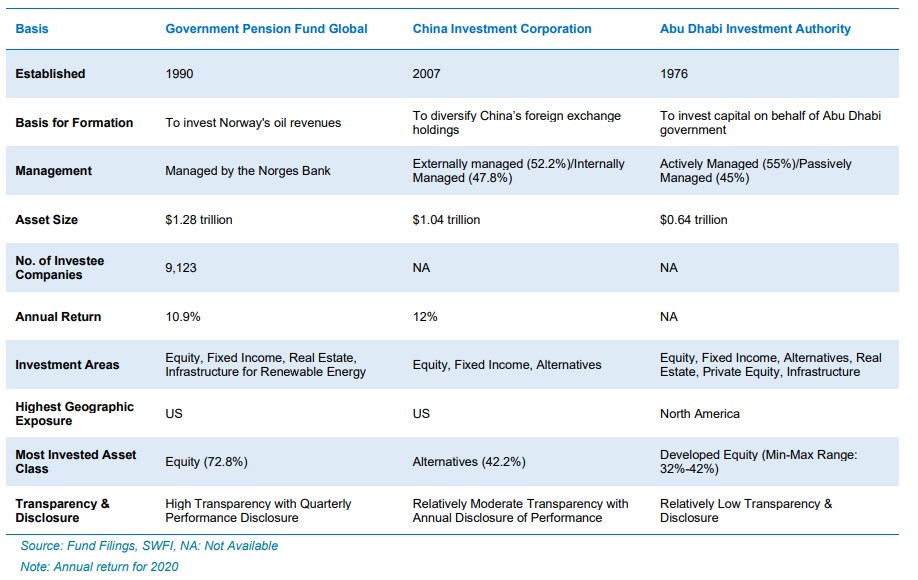

The coronavirus pandemic has created significant uncertainty in the global economy and investment landscape, particularly for institutional investors such as state-owned sovereign wealth funds (SWFs), which manage more than $8 trillion in assets under management (AUM). As a result, the roles of SWFs has shifted in recent years in response to the global economic and geopolitical dynamics. According to the Sovereign Wealth Fund Institute (SWFI), Norway’s Government Pension Fund Global is the largest SWF in the world followed by China Investment Corporation (CIC) and Abu Dhabi Investment Authority (ADIA).

Comparison of Top 3 SWFs

In this brief report, we have highlighted the shift in global SWFs strategies and their role in the post-COVID environment.

The market disruptions caused by COVID-19 pandemic in 2020 provided a plethora of investment opportunities for SWFs. As the SWFs entered the pandemic with large cash reserves, they were better positioned to support their domestic economies while also taking advantage of attractive opportunities in global markets.

There has been a flurry of domestic deals for SWFs in the aftermath of the pandemic. Some SWFs provided help to their respective governments to deal with the economic impact of the coronavirus by providing necessary support to domestic businesses. For instance, Turkey’s wealth fund injected about $3 billion in three state banks1, and Singapore’s SWF, Temasek Holdings, rescued the country’s flagship airline, Singapore Airlines, with a $13 billion financial package2, and backed Sembcorp Marine’s $1.5 billion rights issue. Meanwhile, in August 2020, Chile’s Finance Ministry withdrew $1.1 billion from the Economic and Social Stabilization Fund to help finance maturing external debt4. Similarly, Norway’s SWF, Government Pension Fund Global, made the largest contribution to the state government, after its Ministry of Finance, drew about $37 billion from its wealth fund to protect the economy from the dual shocks of the COVID-19 pandemic and lower crude oil prices.

Furthermore, some SWFs established for strategic purposes have also become more involved in their government’s policy response and economic support. For example, Ireland’s SWF, known as Ireland Strategic Investment Fund, committed up to €2 billion to the Pandemic Stabilization and Recovery Fund in May 2020 to assist medium and large businesses affected by the viral outbreak.

Despite COVID-19 pandemic, 2020 has been a bumper year for SWFs in terms of direct investments. According to the International Forum of Sovereign Wealth Funds (IFSWF), direct investments by SWFs totaled $65.9 billion in 2020, up from $35.9 billion in 2019, with a sizeable portion invested in domestic markets to cushion the impact of the coronavirus pandemic on their respective economies.

Last year, SWFs invested $48.6 billion in direct equity, more than double the $22.2 billion invested in 2019, with a particular emphasis on sectors including renewable energy, food production, e-commerce, and logistics. These figures indicate that SWFs maintained their exposure to risky assets by acquiring stakes in high-quality stocks during the COVID-19 crisis in order to benefit from lower market valuations and thus rebalance their portfolios for the long term. As a result, SWFs invested 22% of total capital indirect investments in their home markets in 2020, up from about 13% on average over the last five years.

According to the SWFI’s recent data, SWFs have invested over $3.39 trillion in stocks, with listed equities accounting for about 41% of total SWF assets. Major SWFs making investments in listed equities include Abu Dhabi Investment Authority (ADIA), Norway’s Government Pension Fund Global, China Investment Corporation (CIC), Kuwait Investment Authority (KIA), and Singapore’s GIC Private Limited. Meanwhile, Saudi Arabia’s SWF, Public Investment Fund (PIF) went on an investment spree in overseas markets by investing about $8 billion in the various US and European giants during the market turmoil in March 2020. In addition, Saudi central bank, Saudi Arabian Monetary Authority (SAMA), transferred $40 billion to the PIF to provide more firepower and strengthen the investment capacity of the wealth fund.

SWFs have Increased their Commitment to Environmentally Friendly and Sustainable Solutions, as well as the Development of COVID-19 Vaccines

According to reports, SWFs invested more than $2 billion in climate change-related sectors such as agritech, forestry, and renewable energy in 2020, representing a four-fold increase over 2016. Abu-Dhabi’s SWF, Mubadala Investment Company, expanded the scope and scale of its partnerships, including collaborations with Schneider Electric in sustainability-related areas and with Italy’s Snam to promote hydrogen development in the UAE.

Additionally, SWFs have been at the forefront of developing COVID-19 vaccines and supporting healthcare systems that have been under severe pressure due to the unprecedented crisis. Singapore’s sovereign fund, Temasek Holdings, was one of the investors who helped German biotech firm BioNTech raise $250 million in a private placement in 2020. Reports indicate that Temasek recently made an investment in China’s Clover Biopharmaceuticals, which is also a developer of COVID-19 vaccines. The Russian Direct Investment Fund (RDIF) is another SWF making huge strides in vaccine development, having funded the research and development of the world’s first registered coronavirus vaccine, Sputnik V, which was released last year. Separately, Mubadala Investment Company formed a strategic partnership with Honeywell to establish the first N95 respirator manufacturing line in the GCC region. Moreover, Abu Dhabi’s SWF signed a long-term agreement with the UK government to invest £800 million in UK life sciences.

Change in SWF Investment Patterns in the Post-Covid Era

Coronavirus pandemic has increased the sophistication of SWFs looking for diversification and resilience in their portfolios, prompting them to seek out other asset classes, sectors, and industries. Some SWFs are adapting to global economic changes by altering not only their investment allocations but also the way they invest. The pandemic has brought many changes in global markets, creating new opportunities for institutional investors, including SWFs. SWFs are expected to take advantage of these opportunities to boost returns on their investment portfolios while also supporting economic development and the long-term growth of local economies.

DISCLAIMER

This document is strictly private, confidential, and personal to its recipients and should not be copied, distributed or reproduced in whole or in part, nor passed to any third party.

The information provided in this report is for general guidance and information purposes only. Under no circumstances the information contained in the report is to be used or considered as formal financial, investment advice, or any other advice, or an offer or solicitation of an offer to buy or sell, or as recommendation or endorsement of any security or other form of a financial asset. The report is not to be considered as investment research or an objective or independent explanation of the matters contained herein.

The information in the report is obtained from various sources per dating of the report. Sidra Capital have taken reasonable care to ensure that the material information contained herein is in accordance with the facts and contains no omission likely to affect its understanding.

Sidra Capital makes no representations or warranties whatsoever, as to the accuracy or completeness of this report, and Sidra Capital expressly disclaims any liability of whatever nature whether (direct or indirect), or responsibility for the accuracy of the information contained in the report.

The information contained herein may be subject to changes without prior notice. Sidra Capital does not accept any form of liability, neither legally nor financially, for loss (direct or indirect) caused by the understanding and/or use of this report or its content. This report is only intended for the recipients, and should not be copied or otherwise distributed, in whole or in part, to any other person without the prior written approval of Sidra Capital