US Industrial Real Estate: Record Momentum May Ease; But Secular Tailwinds Remain Intact

Subscribe to our Insights Leave your email address to be the first to hear about insights.

Key Highlights

- The steady increase in e-commerce sales created a massive demand for warehouse space in the past decade, which only accelerated further during Covid-19 pandemic

- Current market data shows some moderation in the pace of the record growth seen until the first half of 2022

- Strong industrial property fundamentals are reflected in significant outperformance, especially in terms of the total returns over other core property sectors

- While an economic slowdown will certainly slow the pace of demand for space, and reset income-growth expectations, the long-term outlook for the sector remains stable

Strong Fundamentals Amid Economic Uncertainty

Traditionally, investing in office and retail real estate was considered more attractive than industrial real estate. The proliferation of e-commerce over the past decade changed that dynamic, fueling record demand for warehouses. Consequently, the sector has witnessed consistent positive rent growth and appreciation of industrial assets since 2011, with considerably lower vacancy rates. The onset of the Covid-19 pandemic further amplified e-commerce sales and the role of third-party logistics providers (3PLs). The demand tailwinds increased the attractiveness of the sector, making it an asset class of choice for investors.

The average asking rents are now at all time high, and the vacancy rates near record lows. However, the current economic backdrop of rising interest rates and economic slowdown has resulted in some deceleration in the record growth trajectory. Notably, the Q3 2022 industrial vacancy rose for the first time in last two years. Net absorption declined by 18% quarter on quarter, even though Q3 was the eighth consecutive quarter to cross the 100 million Sq. ft. mark. Although the pace of growth trajectory may be moderate going forward, the market fundamentals remain strong to weather adverse scenarios.

Best Performing Commercial Real Estate Sector

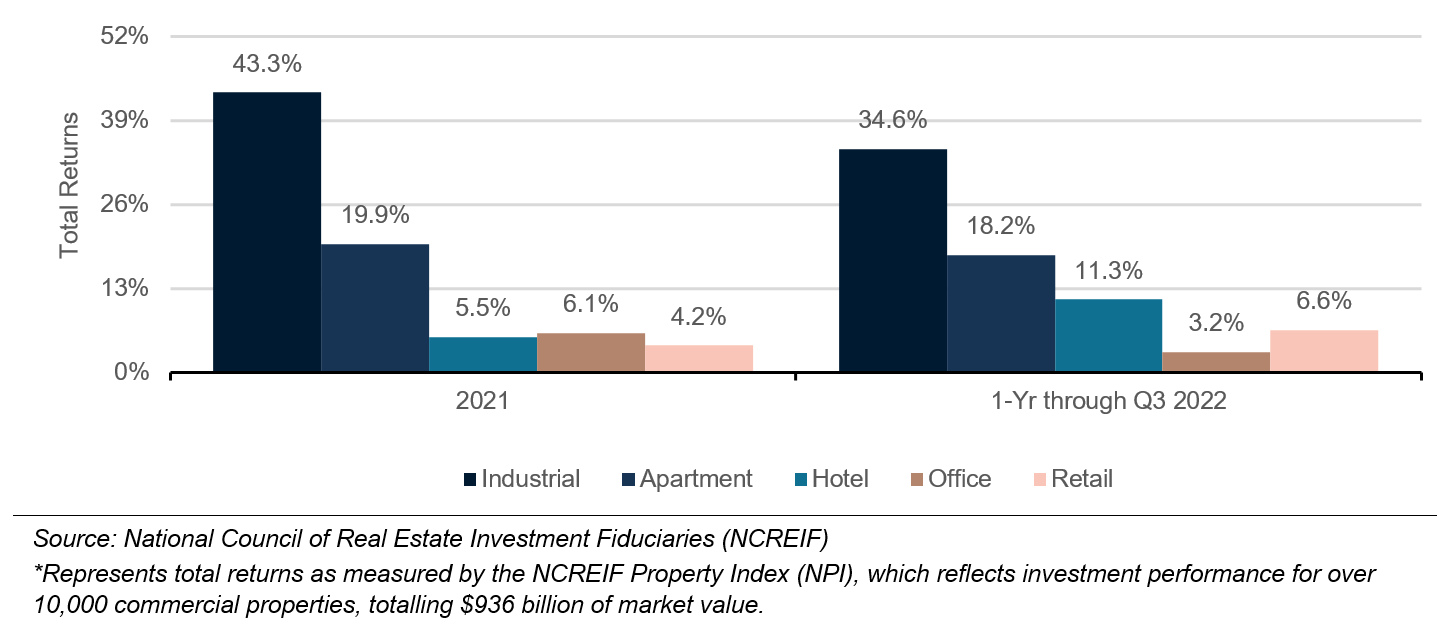

Amidst historically robust demand and landlords’ ability to increase rents, the NCREIF Property Index (NPI) industrial subindex has outperformed other property sectors by a wide margin.

Total Returns of Various Property Sectors*

Tailwinds from Further Boom in E-commerce Sales

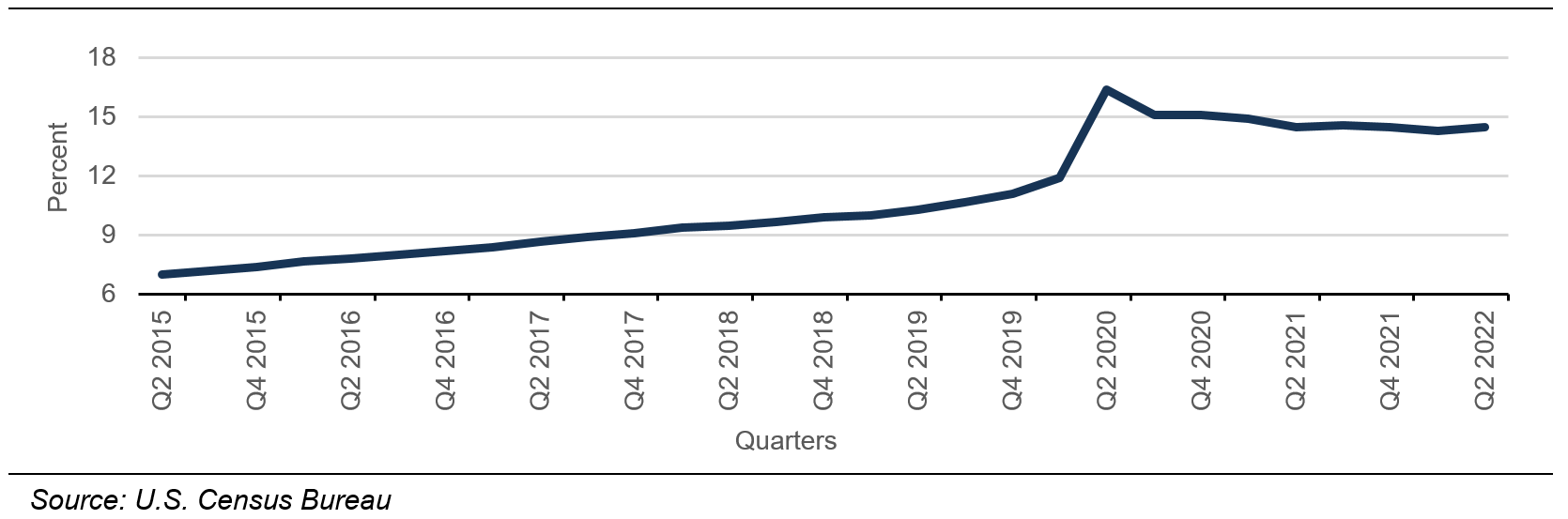

Share of e-commerce sales in total retail sales has more than doubled in the past 7-8 years – from about 7% in 2015 to 14.5% as of Q2 2022. The trend of online shopping further skyrocketed with the onset of pandemic. Forecasts suggest that e-commerce sales as a percent of total core retail sales (excluding spending on automobiles, gasoline, building materials, and food services) is set to grow to about 30% in the US by 2030 from about 20% in 2021, suggesting solid prospects for continued firm demand for warehouse space

E-Commerce Sales as a Percent of Total Retail Sales

Logistics and Third-party Logistics (3PLs) to Push Warehousing Absorption

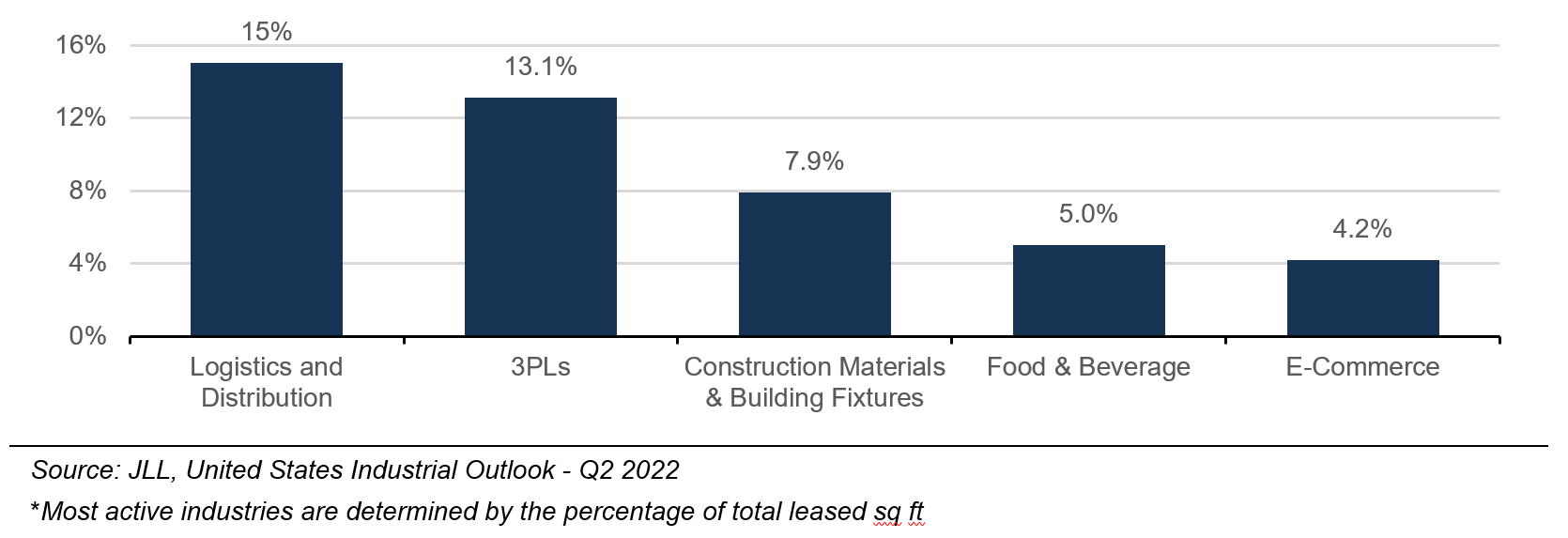

Firms striving to ensure profitability and efficiency amidst global inflationS and supply chain disruptions, have increasingly resorted to reshoring and stockpiling. To avert inventory shortages, the business approach has transitioned from ‘just-in-time’ to ‘just-in-case’ inventory management, which has raised the demand for fulfillment centres. To limit the impact of rise in rents, labour costs, transportation costs, and space crunch, firms now increasingly utilize the services of 3PLs.

Most Active Industries by Demand Based on Quarter-over-Quarter Growth in Q2 2022*

Outlook

So far in 2022, the rent growth has remained robust due to strong demand-supply dynamics. With record volume of new space expected to hit the market in coming months, the industrial sector may see a supply glut. This comes at a time when the sector is bracing for slowing demand amid fears of recession. This will certainly put a brake on the stellar rent growth witnessed since the onset of the pandemic. Consequently, property buyers are expected to exercise caution and tone down their income-growth expectations, further impacting leasing activity.

Nevertheless, the likelihood of an extremely negative scenario occurring in the industrial space remains low as the dynamics that shaped the sector’s growth are still intact. Going forward, the demand will benefit from the prospects of rising e-commerce sales and efforts by businesses to build supply chain resiliency.

DISCLAIMER

This document is strictly private, confidential and personal to its recipients and should not be copied, distributed or reproduced in whole or in part, nor passed to any third party.

The information provided in this report is for general guidance and information purposes only. Under no circumstances the information contained in the report is to be used or considered as a formal financial, investment advice or any other advice, or an offer or solicitation of an offer to buy or sell, or as recommendation or endorsement of any security or other form of financial asset. The report is not to be considered as investment research or an objective or independent explanation of the matters contained herein.

The information in the report is obtained from various sources per dating of the report. Sidra Capital have taken reasonable care to ensure that the material information contained herein is in accordance with the facts and contains no omission likely to affect its understanding.

Sidra Capital makes no representations or warranties whatsoever, as to the accuracy or completeness of this report and Sidra Capital expressly disclaims any liability of whatever nature whether (direct or indirect), or responsibility for the accuracy of the information contained in the report.

The information contained herein may be subject to changes without prior notice. Sidra Capital does not accept any form of liability, neither legally nor financially, for loss (direct or indirect) caused by the understanding and/or use of this report or its content. This report is only intended for the recipients, and should not be copied or otherwise distributed, in whole or in part, to any other person without the prior written approval of Sidra Capital.